Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

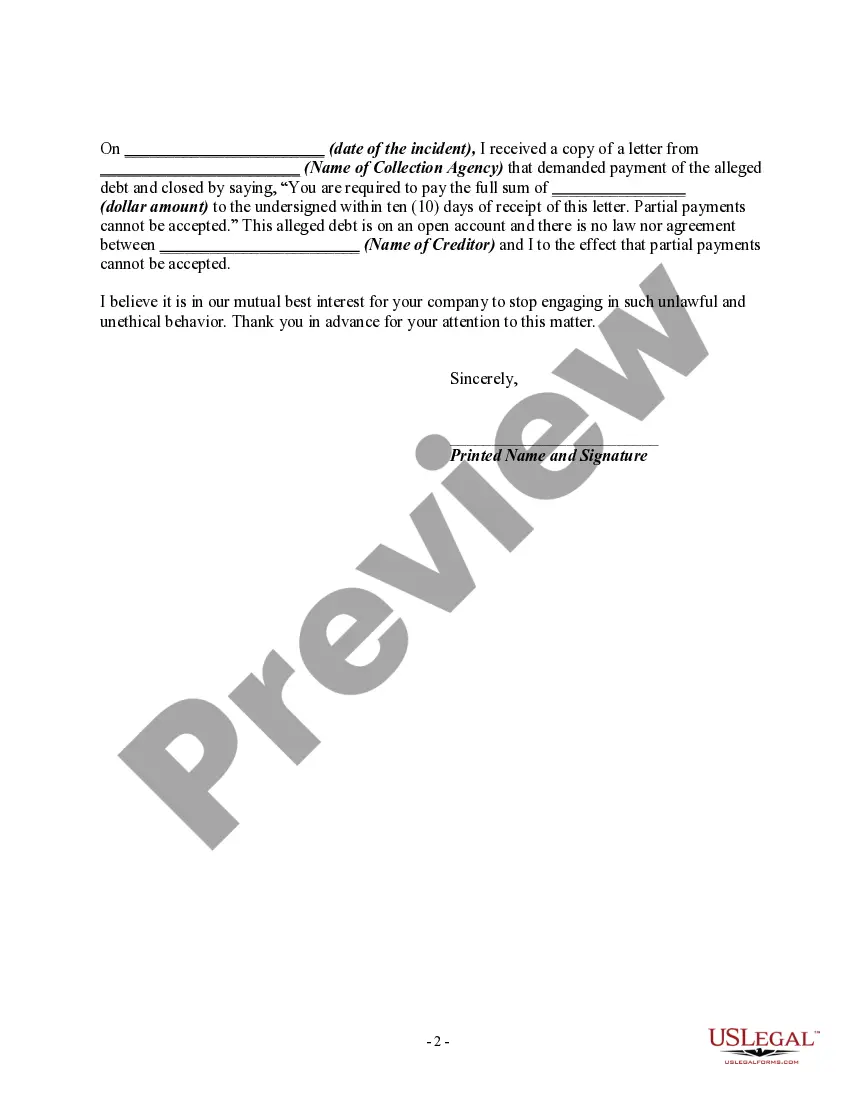

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

A Cuyahoga Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities is a written communication that addresses instances where a debt collector utilizes false representation or deceptive means to collect a debt and falsely asserts that they cannot accept partial payments even though they have the capability to do so. This letter aims to inform the debt collector of these misleading practices and assert the debtor's rights. The content of this letter should be detailed and concise, highlighting the specific instances of false representation or deceptive tactics used by the debt collector. It is crucial to include relevant keywords to capture the essence of the issue. These keywords might include "deceptive debt collection practices," "false representation," "misleading claims," "partial payments," and "Cuyahoga Ohio debt collection regulations." By utilizing these keywords, the letter can effectively convey the nature of the problem. The types of Cuyahoga Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt — Asserting that the Debt Collector Cannot Accept Partial Payments When They Can vary depending on the circumstances. Some possible types could be: 1. Type 1: False assertions of inability to accept partial payments: This type involves instances when a debt collector falsely claims that they cannot accept partial payments when, in reality, they possess the capability to do so. The letter will assert that such misrepresentations are deceptive and demand a correction of these claims. 2. Type 2: Misleading claims in collection communication: This type revolves around instances where the debt collector uses misleading language or misrepresents the debtor's options regarding partial payments. The letter will point out the specific misleading statements made and request accurate information be provided in future communications. 3. Type 3: False threats or intimidation tactics: This type pertains to situations where the debt collector employs false threats or intimidation to coerce the debtor into paying the full amount without considering partial payment options. The letter will address these tactics, assert the debtor's rights, and demand transparency in interactions. Regardless of the specific type, it is essential for the letter to clearly outline the false or misleading misrepresentations made and cite any relevant laws or regulations applicable in Cuyahoga Ohio. Additionally, the letter should request an immediate rectification of the misleading practices and emphasize the debtor's right to explore partial payment options.A Cuyahoga Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities is a written communication that addresses instances where a debt collector utilizes false representation or deceptive means to collect a debt and falsely asserts that they cannot accept partial payments even though they have the capability to do so. This letter aims to inform the debt collector of these misleading practices and assert the debtor's rights. The content of this letter should be detailed and concise, highlighting the specific instances of false representation or deceptive tactics used by the debt collector. It is crucial to include relevant keywords to capture the essence of the issue. These keywords might include "deceptive debt collection practices," "false representation," "misleading claims," "partial payments," and "Cuyahoga Ohio debt collection regulations." By utilizing these keywords, the letter can effectively convey the nature of the problem. The types of Cuyahoga Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt — Asserting that the Debt Collector Cannot Accept Partial Payments When They Can vary depending on the circumstances. Some possible types could be: 1. Type 1: False assertions of inability to accept partial payments: This type involves instances when a debt collector falsely claims that they cannot accept partial payments when, in reality, they possess the capability to do so. The letter will assert that such misrepresentations are deceptive and demand a correction of these claims. 2. Type 2: Misleading claims in collection communication: This type revolves around instances where the debt collector uses misleading language or misrepresents the debtor's options regarding partial payments. The letter will point out the specific misleading statements made and request accurate information be provided in future communications. 3. Type 3: False threats or intimidation tactics: This type pertains to situations where the debt collector employs false threats or intimidation to coerce the debtor into paying the full amount without considering partial payment options. The letter will address these tactics, assert the debtor's rights, and demand transparency in interactions. Regardless of the specific type, it is essential for the letter to clearly outline the false or misleading misrepresentations made and cite any relevant laws or regulations applicable in Cuyahoga Ohio. Additionally, the letter should request an immediate rectification of the misleading practices and emphasize the debtor's right to explore partial payment options.