Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

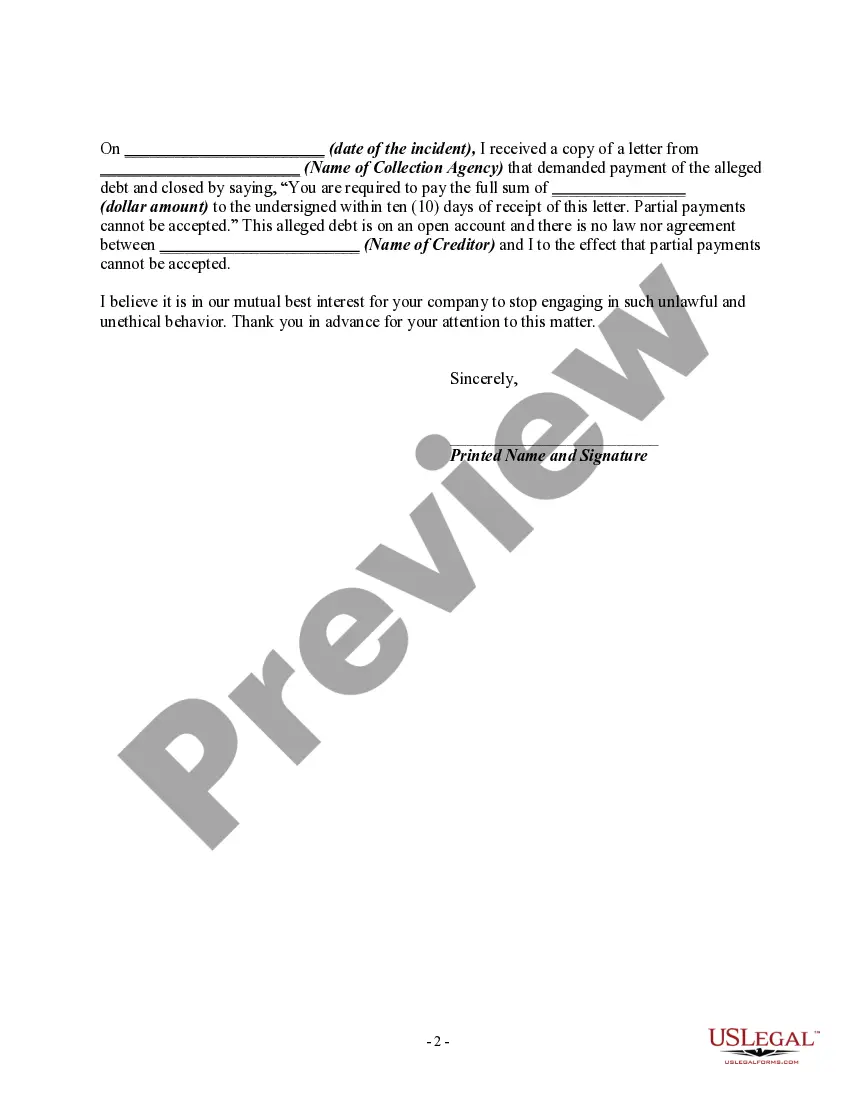

Title: Harris Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt — Asserting that the Debt Collector Cannot Accept Partial Payments When They Can Introduction: In the state of Texas, individuals are protected by specific regulations and laws governing debt collection practices. The Harris Texas Letter is a powerful tool to inform debt collectors about their false or misleading misrepresentations during collection activities. This article aims to provide a detailed description of the purpose, content, and significance of the Harris Texas Letter and shed light on instances where debt collectors assert their inability to accept partial payments when they are actually permitted by law to do so. I. Understanding the Harris Texas Letter: 1. Purpose: The Harris Texas Letter is a formal communication sent by an individual to a debt collector to address false or misleading misrepresentations made during debt collection activities. It aims to hold debt collectors accountable for their deceptive practices and educate them on Texas state laws regarding debt collection. 2. Legal Significance: The Harris Texas Letter serves as a documentation tool, ensuring that the debtor's response is registered with the debt collector. Sending a formal letter is crucial if legal action becomes necessary in the future. Moreover, it assures the debtor that their rights are protected under Texas law. II. False Representation or Deceptive Means to Collect a Debt: 1. Definition: False representation or deceptive means refer to tactics employed by debt collectors to coerce or mislead debtors into making payment arrangements or paying a debt that may not be legally valid or accurate. 2. Examples: a. Misrepresenting the amount owed by inflating the total debt with unauthorized fees or penalties. b. Falsely asserting the debtor's legal obligations and penalties if they fail to repay the debt immediately. c. Threatening legal action, including arrest or imprisonment, despite lacking the lawful authority to do so. III. Asserting that the Debt Collector Cannot Accept Partial Payments When They Can: 1. Legal Allowance for Partial Payments: Under Texas law, debt collectors are generally permitted to accept partial payments from debtors. However, some collectors may claim otherwise, leading to confusion or possibly exploiting debtors into making full payments. 2. Purpose of Informing: The Harris Texas Letter is utilized to correct the misinformation provided by debt collectors. By detailing the debtor's awareness of the debt collector's ability to accept partial payments, the letter ensures the collector does not continue to make false claims and potentially induce financial strain on the debtor. Conclusion: The Harris Texas Letter acts as an essential tool for debtors to combat false or misleading misrepresentations during debt collection activities. By asserting that debt collectors cannot accept partial payments when, in fact, they can, debtors reaffirm their rights and protect themselves against deception. Understanding the purpose, content, and significance of the Harris Texas Letter empowers debtors to take appropriate action and seek resolution in case of unfair or deceitful collection practices.Title: Harris Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt — Asserting that the Debt Collector Cannot Accept Partial Payments When They Can Introduction: In the state of Texas, individuals are protected by specific regulations and laws governing debt collection practices. The Harris Texas Letter is a powerful tool to inform debt collectors about their false or misleading misrepresentations during collection activities. This article aims to provide a detailed description of the purpose, content, and significance of the Harris Texas Letter and shed light on instances where debt collectors assert their inability to accept partial payments when they are actually permitted by law to do so. I. Understanding the Harris Texas Letter: 1. Purpose: The Harris Texas Letter is a formal communication sent by an individual to a debt collector to address false or misleading misrepresentations made during debt collection activities. It aims to hold debt collectors accountable for their deceptive practices and educate them on Texas state laws regarding debt collection. 2. Legal Significance: The Harris Texas Letter serves as a documentation tool, ensuring that the debtor's response is registered with the debt collector. Sending a formal letter is crucial if legal action becomes necessary in the future. Moreover, it assures the debtor that their rights are protected under Texas law. II. False Representation or Deceptive Means to Collect a Debt: 1. Definition: False representation or deceptive means refer to tactics employed by debt collectors to coerce or mislead debtors into making payment arrangements or paying a debt that may not be legally valid or accurate. 2. Examples: a. Misrepresenting the amount owed by inflating the total debt with unauthorized fees or penalties. b. Falsely asserting the debtor's legal obligations and penalties if they fail to repay the debt immediately. c. Threatening legal action, including arrest or imprisonment, despite lacking the lawful authority to do so. III. Asserting that the Debt Collector Cannot Accept Partial Payments When They Can: 1. Legal Allowance for Partial Payments: Under Texas law, debt collectors are generally permitted to accept partial payments from debtors. However, some collectors may claim otherwise, leading to confusion or possibly exploiting debtors into making full payments. 2. Purpose of Informing: The Harris Texas Letter is utilized to correct the misinformation provided by debt collectors. By detailing the debtor's awareness of the debt collector's ability to accept partial payments, the letter ensures the collector does not continue to make false claims and potentially induce financial strain on the debtor. Conclusion: The Harris Texas Letter acts as an essential tool for debtors to combat false or misleading misrepresentations during debt collection activities. By asserting that debt collectors cannot accept partial payments when, in fact, they can, debtors reaffirm their rights and protect themselves against deception. Understanding the purpose, content, and significance of the Harris Texas Letter empowers debtors to take appropriate action and seek resolution in case of unfair or deceitful collection practices.