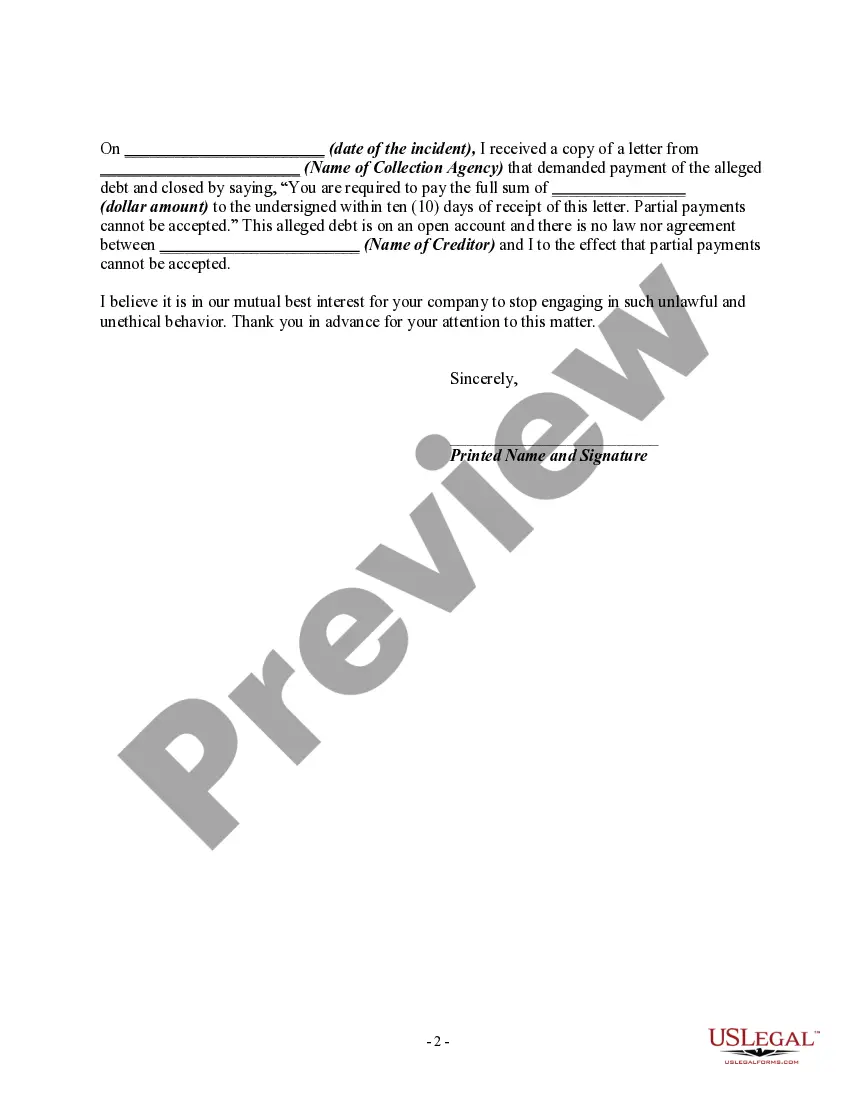

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

Title: Hennepin Minnesota Letter Exposing False or Misleading Debt Collection Practices Introduction: In Hennepin, Minnesota, it is crucial for consumers to be aware of their rights when dealing with debt collectors. This article aims to detail the contents of a letter informing debt collectors of their false or misleading misrepresentations in collection activities. Specifically, we will focus on situations where debt collectors use false representation or deceptive means to collect a debt and falsely claim that they cannot accept partial payments. Section 1: Understanding the Issue — Importance of Consumer Rights: Debt collectors must adhere to strict guidelines imposed by the Fair Debt Collection Practices Act (FD CPA) to protect consumers from unfair debt collection practices. — False or Misleading Misrepresentations: Debt collectors may resort to deceptive tactics, including falsely claiming they cannot accept partial payments. Section 2: Crafting the Hennepin Minnesota Letter — Identification of the Debtor: Clearly state the debtor's name, address, and account number to ensure accurate identification. — Recap the Communication: Briefly summarize the previous interactions with the debt collector, highlighting the instances where false or misleading statements were made. ReferencedFD CPAPA: Cite relevant sections of the FD CPA that protect against false representation or deceptive means in debt collection. — False Assertion of Inability to Accept Partial Payments: Address the specific issue of the debt collector claiming they cannot accept partial payments, despite being legally obligated to do so. — Request for Immediate Action: Demand that the debt collector cease their false representations and provide accurate information regarding partial payment acceptance. — Threat of Legal Actions: Warn the debt collector of potential legal consequences if they persist in their misleading practices. — Request for Written Confirmation: Request written confirmation from the debt collector acknowledging their receipt of the letter and their commitment to stop false or misleading misrepresentations. Section 3: Additional Types of Hennepin Minnesota Letters 1. Hennepin Minnesota Letter Alleging Threats or Harassment: Specifically addresses cases where debt collectors use threatening or harassing language, aiming to create fear or coerce debtors into immediate payment. 2. Hennepin Minnesota Letter Challenging Unverifiable Debt: Focuses on situations where debt collectors fail to provide sufficient or proper documentation to validate the debt's existence. 3. Hennepin Minnesota Letter Asserting Unauthorized Contact or Disclosure: Informs debt collectors of violations regarding contacting unauthorized individuals or disclosing debtor information without consent. Conclusion: Writing a Hennepin Minnesota letter to inform debt collectors of false or misleading misrepresentations is a vital step in protecting one's consumer rights. By addressing issues such as false representation or deceptive practices in debt collection, particularly regarding partial payment acceptance, consumers can assert their rights, ensuring fair treatment within the legal framework of Hennepin, Minnesota.Title: Hennepin Minnesota Letter Exposing False or Misleading Debt Collection Practices Introduction: In Hennepin, Minnesota, it is crucial for consumers to be aware of their rights when dealing with debt collectors. This article aims to detail the contents of a letter informing debt collectors of their false or misleading misrepresentations in collection activities. Specifically, we will focus on situations where debt collectors use false representation or deceptive means to collect a debt and falsely claim that they cannot accept partial payments. Section 1: Understanding the Issue — Importance of Consumer Rights: Debt collectors must adhere to strict guidelines imposed by the Fair Debt Collection Practices Act (FD CPA) to protect consumers from unfair debt collection practices. — False or Misleading Misrepresentations: Debt collectors may resort to deceptive tactics, including falsely claiming they cannot accept partial payments. Section 2: Crafting the Hennepin Minnesota Letter — Identification of the Debtor: Clearly state the debtor's name, address, and account number to ensure accurate identification. — Recap the Communication: Briefly summarize the previous interactions with the debt collector, highlighting the instances where false or misleading statements were made. ReferencedFD CPAPA: Cite relevant sections of the FD CPA that protect against false representation or deceptive means in debt collection. — False Assertion of Inability to Accept Partial Payments: Address the specific issue of the debt collector claiming they cannot accept partial payments, despite being legally obligated to do so. — Request for Immediate Action: Demand that the debt collector cease their false representations and provide accurate information regarding partial payment acceptance. — Threat of Legal Actions: Warn the debt collector of potential legal consequences if they persist in their misleading practices. — Request for Written Confirmation: Request written confirmation from the debt collector acknowledging their receipt of the letter and their commitment to stop false or misleading misrepresentations. Section 3: Additional Types of Hennepin Minnesota Letters 1. Hennepin Minnesota Letter Alleging Threats or Harassment: Specifically addresses cases where debt collectors use threatening or harassing language, aiming to create fear or coerce debtors into immediate payment. 2. Hennepin Minnesota Letter Challenging Unverifiable Debt: Focuses on situations where debt collectors fail to provide sufficient or proper documentation to validate the debt's existence. 3. Hennepin Minnesota Letter Asserting Unauthorized Contact or Disclosure: Informs debt collectors of violations regarding contacting unauthorized individuals or disclosing debtor information without consent. Conclusion: Writing a Hennepin Minnesota letter to inform debt collectors of false or misleading misrepresentations is a vital step in protecting one's consumer rights. By addressing issues such as false representation or deceptive practices in debt collection, particularly regarding partial payment acceptance, consumers can assert their rights, ensuring fair treatment within the legal framework of Hennepin, Minnesota.