Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

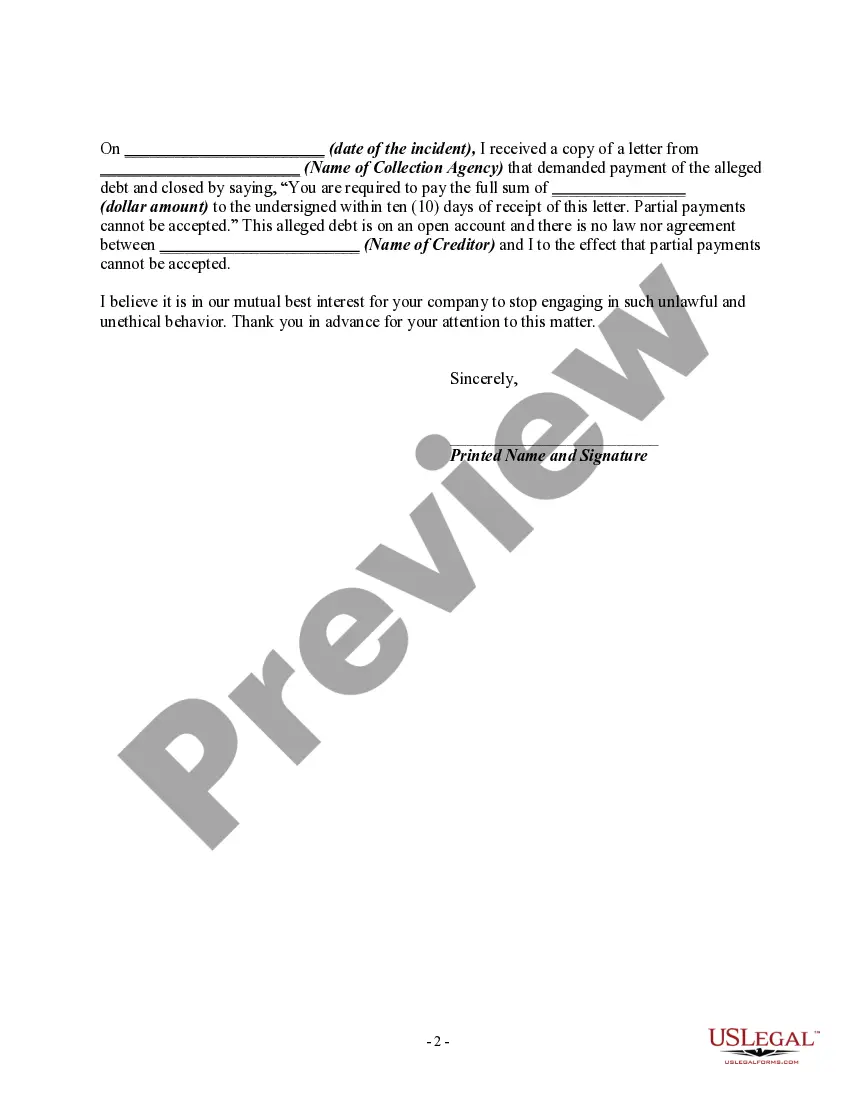

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

Maricopa, Arizona is a vibrant city located in Pinal County. Known for its strong sense of community and rich cultural heritage, Maricopa offers a diverse range of attractions and activities for residents and visitors alike. From its stunning desert landscapes to its modern amenities, the city has something for everyone. Now, let's turn our attention to the topic of writing a detailed letter informing a debt collector of false or misleading misrepresentations in their collection activities. If you find yourself dealing with a debt collector who is using false representation or deceptive means to collect a debt, such as asserting that they cannot accept partial payments when they actually can, it's important to take action and assert your rights. When drafting your Maricopa, Arizona letter, make sure to include the following relevant keywords to ensure clarity and specificity: 1. False representation: Clearly state that you have identified false representation or misleading misrepresentations in the debt collector's collection activities. Explain the specific instances or examples where they have misrepresented their policies regarding partial payments. 2. Deceptive means: Highlight any tactics or methods employed by the debt collector that you consider to be deceptive. Provide specific details or evidence to support your claims. 3. Asserting inability to accept partial payments: Clearly state that the debt collector has wrongfully asserted their inability to accept partial payments. Cite any relevant laws, regulations, or guidelines that support your position and emphasize that their actions are in violation of those rules. 4. Debt collector's obligation: Explicitly mention that as a debt collector, they have an obligation to provide accurate and truthful information to debtors. Emphasize that any misrepresentation, false claims, or deceptive means used in attempts to collect a debt are not only unethical but also potentially illegal. 5. Legal repercussions: Mention in your letter that you are aware of your rights as a consumer and that you will not hesitate to take further action if the debt collector does not cease their misleading practices. Explain that you may report their actions to relevant regulatory agencies, such as the Consumer Financial Protection Bureau or the Federal Trade Commission, if necessary. It's important to address the letter to the specific debt collector involved and provide accurate contact information for them to respond. If there are different variations or instances of false or misleading misrepresentations in collection activities related to the inability to accept partial payments, consider providing separate letters for each occurrence to maintain clarity and organization. Remember to keep copies of your correspondence and any supporting documents for future reference. Seeking legal advice or consulting a consumer rights organization in Maricopa, Arizona, may also be helpful in ensuring you navigate this process effectively. Overall, writing a detailed and well-structured letter notifying a debt collector of false or misleading misrepresentations is crucial to protect your rights as a consumer. By clearly asserting your position and providing specific examples, you increase the likelihood of rectifying the situation and holding the debt collector accountable for their actions.Maricopa, Arizona is a vibrant city located in Pinal County. Known for its strong sense of community and rich cultural heritage, Maricopa offers a diverse range of attractions and activities for residents and visitors alike. From its stunning desert landscapes to its modern amenities, the city has something for everyone. Now, let's turn our attention to the topic of writing a detailed letter informing a debt collector of false or misleading misrepresentations in their collection activities. If you find yourself dealing with a debt collector who is using false representation or deceptive means to collect a debt, such as asserting that they cannot accept partial payments when they actually can, it's important to take action and assert your rights. When drafting your Maricopa, Arizona letter, make sure to include the following relevant keywords to ensure clarity and specificity: 1. False representation: Clearly state that you have identified false representation or misleading misrepresentations in the debt collector's collection activities. Explain the specific instances or examples where they have misrepresented their policies regarding partial payments. 2. Deceptive means: Highlight any tactics or methods employed by the debt collector that you consider to be deceptive. Provide specific details or evidence to support your claims. 3. Asserting inability to accept partial payments: Clearly state that the debt collector has wrongfully asserted their inability to accept partial payments. Cite any relevant laws, regulations, or guidelines that support your position and emphasize that their actions are in violation of those rules. 4. Debt collector's obligation: Explicitly mention that as a debt collector, they have an obligation to provide accurate and truthful information to debtors. Emphasize that any misrepresentation, false claims, or deceptive means used in attempts to collect a debt are not only unethical but also potentially illegal. 5. Legal repercussions: Mention in your letter that you are aware of your rights as a consumer and that you will not hesitate to take further action if the debt collector does not cease their misleading practices. Explain that you may report their actions to relevant regulatory agencies, such as the Consumer Financial Protection Bureau or the Federal Trade Commission, if necessary. It's important to address the letter to the specific debt collector involved and provide accurate contact information for them to respond. If there are different variations or instances of false or misleading misrepresentations in collection activities related to the inability to accept partial payments, consider providing separate letters for each occurrence to maintain clarity and organization. Remember to keep copies of your correspondence and any supporting documents for future reference. Seeking legal advice or consulting a consumer rights organization in Maricopa, Arizona, may also be helpful in ensuring you navigate this process effectively. Overall, writing a detailed and well-structured letter notifying a debt collector of false or misleading misrepresentations is crucial to protect your rights as a consumer. By clearly asserting your position and providing specific examples, you increase the likelihood of rectifying the situation and holding the debt collector accountable for their actions.