Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

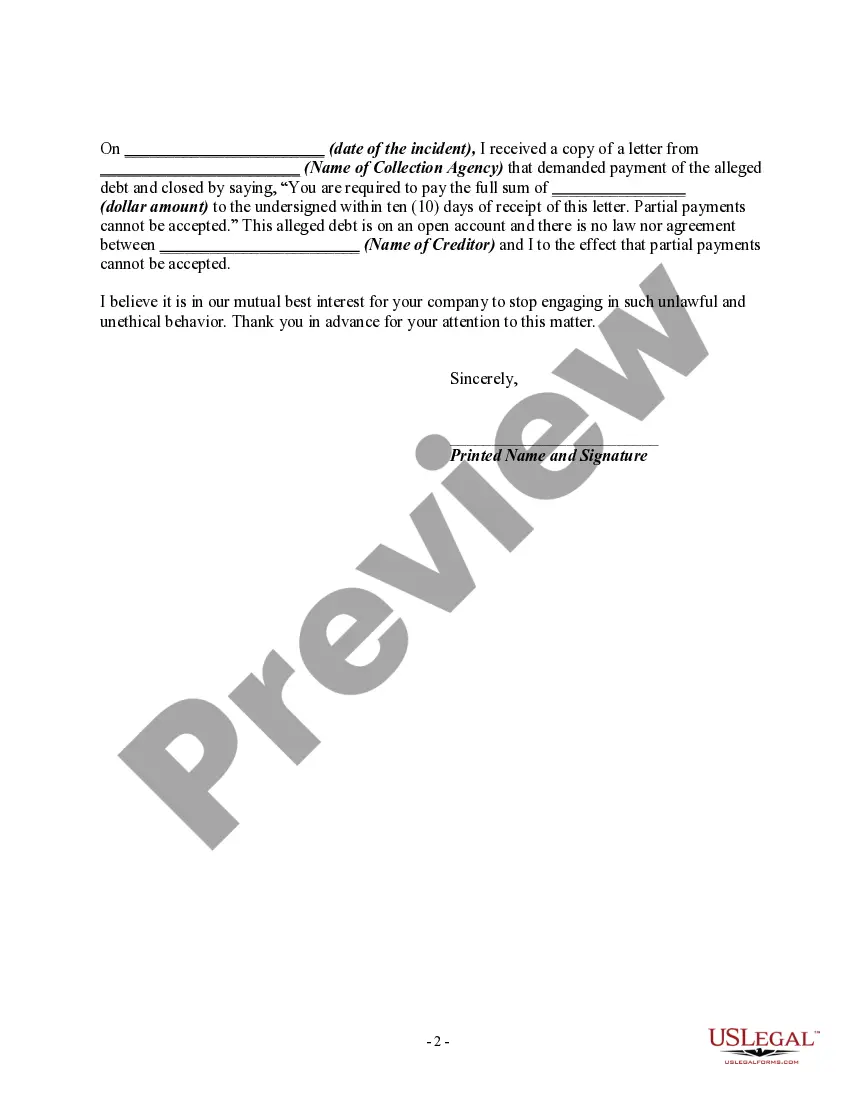

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Debt Collector's Name] [Debt Collection Agency's Name] [Address] [City, State, ZIP Code] Subject: Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt — Asserting that the Debt Collector Cannot Accept Partial Payments When They Can Dear [Debt Collector's Name], I am writing to inform you of the false or misleading representations made by your debt collection agency in relation to my outstanding debt. Despite my genuine willingness to settle this debt, I have been informed, on multiple occasions, that your agency cannot accept partial payments towards the debt. However, upon conducting my own research and reviewing applicable laws, I have found that your assertion is unfounded and misleading. It has come to my attention that your agency has been engaging in the use of false representation or deceptive means to collect a debt, specifically by asserting that you cannot accept partial payments when, in fact, you are legally allowed to do so. This false or misleading representation has created unnecessary confusion and frustration for both parties involved. Under the Fair Debt Collection Practices Act (FD CPA), it is prohibited for debt collectors to engage in any form of false, deceptive, or misleading representation in connection with the collection of any debt. Additionally, the Consumer Financial Protection Bureau (CFPB) has published specific guidelines regarding debt collection practices, emphasizing that debt collectors must provide accurate and truthful information to consumers. As a consumer, I have the right to be treated fairly and to have accurate representation in all debt collection activities. I expect your agency to comply with the applicable laws and cease any false or misleading representations regarding your acceptance of partial payments. Failure to do so would be a breach of the FD CPA and could result in legal action being taken against your agency. To ensure clarity and resolution, I request that you provide written confirmation within [15 days from receipt of this letter] acknowledging receipt of this letter, and an explicit statement confirming your agency's agreement to accept partial payments towards my outstanding debt. Please understand that I am fully committed to resolving my debt responsibly and in a timely manner. I trust that we can rectify this situation amicably and without further complications. Thank you for your prompt attention to this matter. I look forward to receiving your timely response. Sincerely, [Your Name]