Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

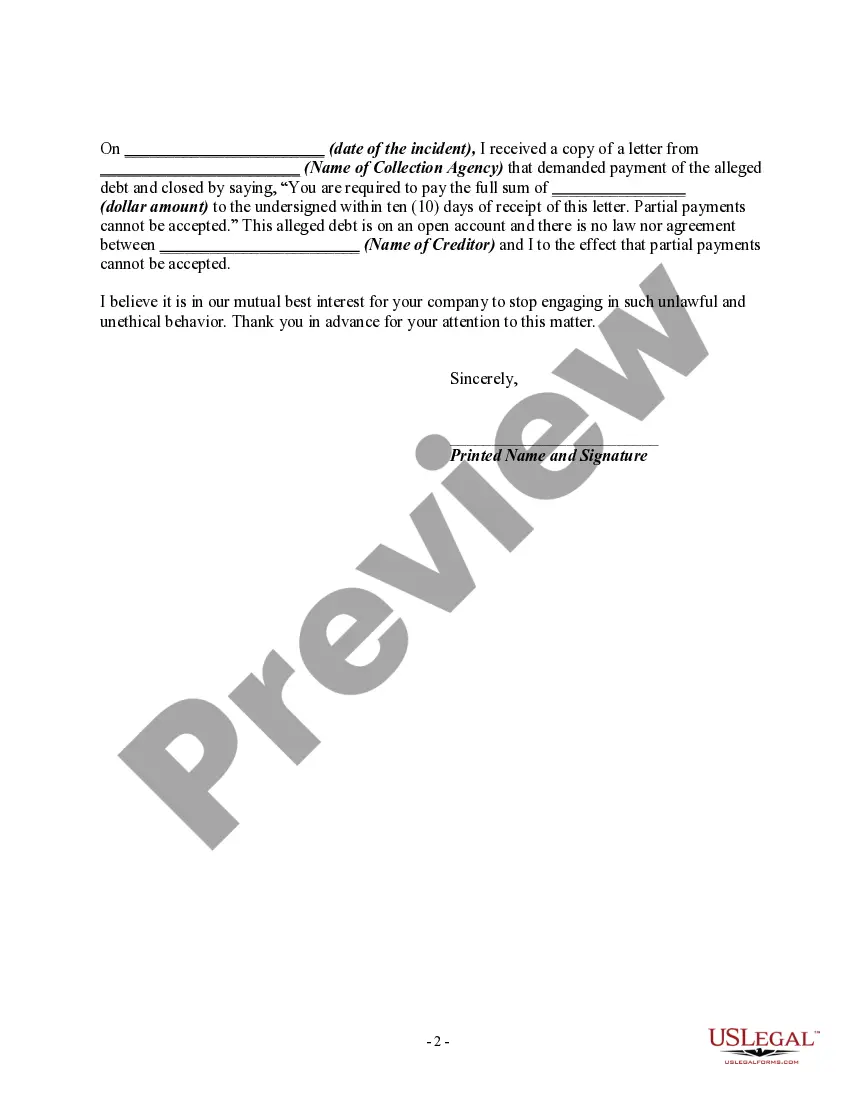

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

Title: San Antonio Texas Letter Exposing False Representations and Misleading Collection Practices — Asserting the Debt Collector's Acceptance of Partial Payments Introduction: In San Antonio, Texas, it is crucial to be aware of our rights as consumers when dealing with debt collectors. This letter serves as a formal communication to address false or misleading misrepresentations employed by debt collectors, specifically those who wrongfully assert an inability to accept partial payments. By understanding our rights and confronting deceptive collection practices, we can protect ourselves from potential harassment and unlawful tactics. This informative letter aims to enlighten debt collectors about their obligations and challenge their misleading approach, using relevant keywords to address different aspects of this issue. Main body: 1. Understanding False Representations in Collection Activities: Dear [Debt Collector's Name], I am writing this letter to address the false representation and deceptive means that I have observed during our recent communications regarding the debt owed. As a resident of San Antonio, Texas, I am well aware of my rights under the Fair Debt Collection Practices Act (FD CPA) and the Texas Debt Collection Act (TCA). It has come to my attention that your collection activities may have violated both of these acts. 2. Asserting the Debt Collector's Acceptance of Partial Payments: One particular issue that concerns me is your repeated statement that you are unable to accept partial payments towards the debt in question. According to the relevant laws and regulations, it is explicitly stated that debt collectors have the authority to accept partial payments, even if the debtor is financially unable to pay the full amount owed at once. 3. Documenting Misleading Collection Efforts: I should note that I have documented each interaction we have had and retained any relevant correspondence that supports my claims. This includes recordings, call logs, copies of letters, and any other evidence that highlights the false representation or deceptive means employed in your collection activities. 4. Demand for Immediate Cease in Misleading Tactics: I hereby demand an immediate cessation of all actions that involve false representation or deceptive means. Continuing such conduct would be a violation of the FD CPA and TCA, which could result in legal consequences for your company. In addition to discontinuing these misleading tactics, I request written confirmation from you that you will now accept partial payments towards the debt. Conclusion: In conclusion, as a resident of San Antonio, Texas, I am dedicated to ensuring that my rights as a debtor are fully respected, as outlined in the FD CPA and TCA. It is imperative that you correct your false or misleading representations and acknowledge that partial payments towards the debt can and should be accepted. Failure to comply with these demands may result in further legal actions to protect my rights as a consumer. Please consider this letter as my formal notice to rectify the deceptive and misleading practices. I anticipate your prompt response to address this matter satisfactorily. Sincerely, [Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address] Keywords: San Antonio, Texas, debt collector, false representation, misleading misrepresentations, deceptive means, collection activities, partial payments, acceptance of partial payments, consumer rights, Fair Debt Collection Practices Act (FD CPA), Texas Debt Collection Act (TCA), harassment, unlawful tactics, formal notice, legal actions.