Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

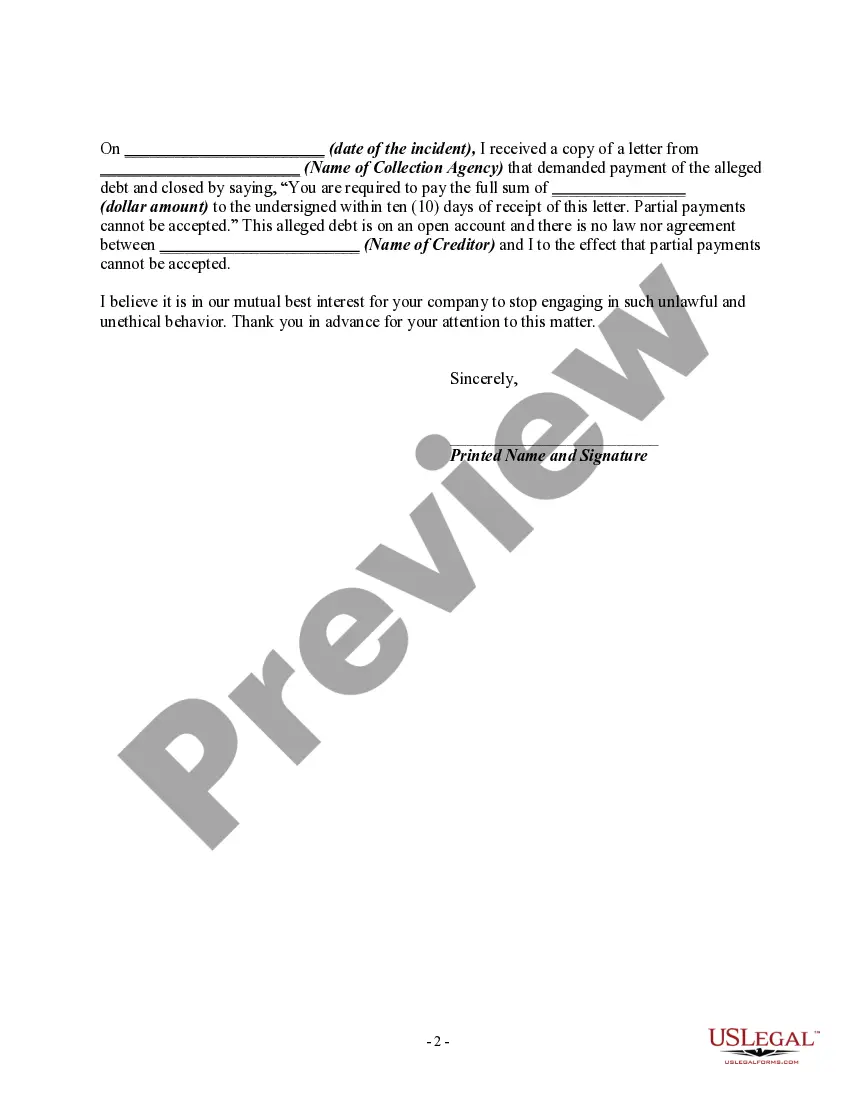

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

Title: Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt — Asserting that the Debt Collector Cannot Accept Partial Payments When They Can Keywords: Wake North Carolina, debt collector, false representation, misleading misrepresentations, collection activities, deceptive means, partial payments Description: In Wake North Carolina, individuals who find themselves dealing with debt collectors engaging in false representation or using deceptive means to collect debts have the right to protect themselves by sending a letter to these collectors. One specific scenario that individuals might face is when debt collectors assert that they cannot accept partial payments, even though they are legally obligated to do so. This Wake North Carolina letter serves as a powerful tool for individuals seeking to inform debt collectors of their misleading or false practices and asserting their rights. By using relevant keywords and addressing the specific issue of debt collectors refusing partial payments, this letter aims to rectify the situation and ensure fair treatment. Types of Wake North Carolina Letters Informing Debt Collector of False or Misleading Misrepresentations: 1. Wake North Carolina Letters Informing Debt Collector of False Representation: This type of letter highlights instances where false information has been provided by the debt collector, presenting the facts and requesting immediate resolution. 2. Wake North Carolina Letters Informing Debt Collector of Misleading Misrepresentations: In this letter, individuals address instances where the debt collector has intentionally misrepresented facts, thereby misleading the debtor. This letter clarifies the misleading information and seeks appropriate action. 3. Wake North Carolina Letters Informing Debt Collector of Deceptive Means: This type of letter focuses on situations where the debt collector has used deceptive means to collect debts. It highlights these deceptive practices, demanding that they cease immediately. 4. Wake North Carolina Letters Asserting Debt Collector's Obligation to Accept Partial Payments: This specific letter category addresses instances where the debt collector falsely claims their inability to accept partial payments. It reminds the collector of their legal obligation and emphasizes the debtor's right to make partial payments towards the outstanding balance. By utilizing one of these Wake North Carolina letters, individuals can effectively communicate their grievances regarding false or misleading practices undertaken by debt collectors. These letters work as an important step towards protecting one's rights and ensuring fair debt collection procedures.