Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose, and the failure to disclose in subsequent communications that the communication is from a debt collector . . . ."

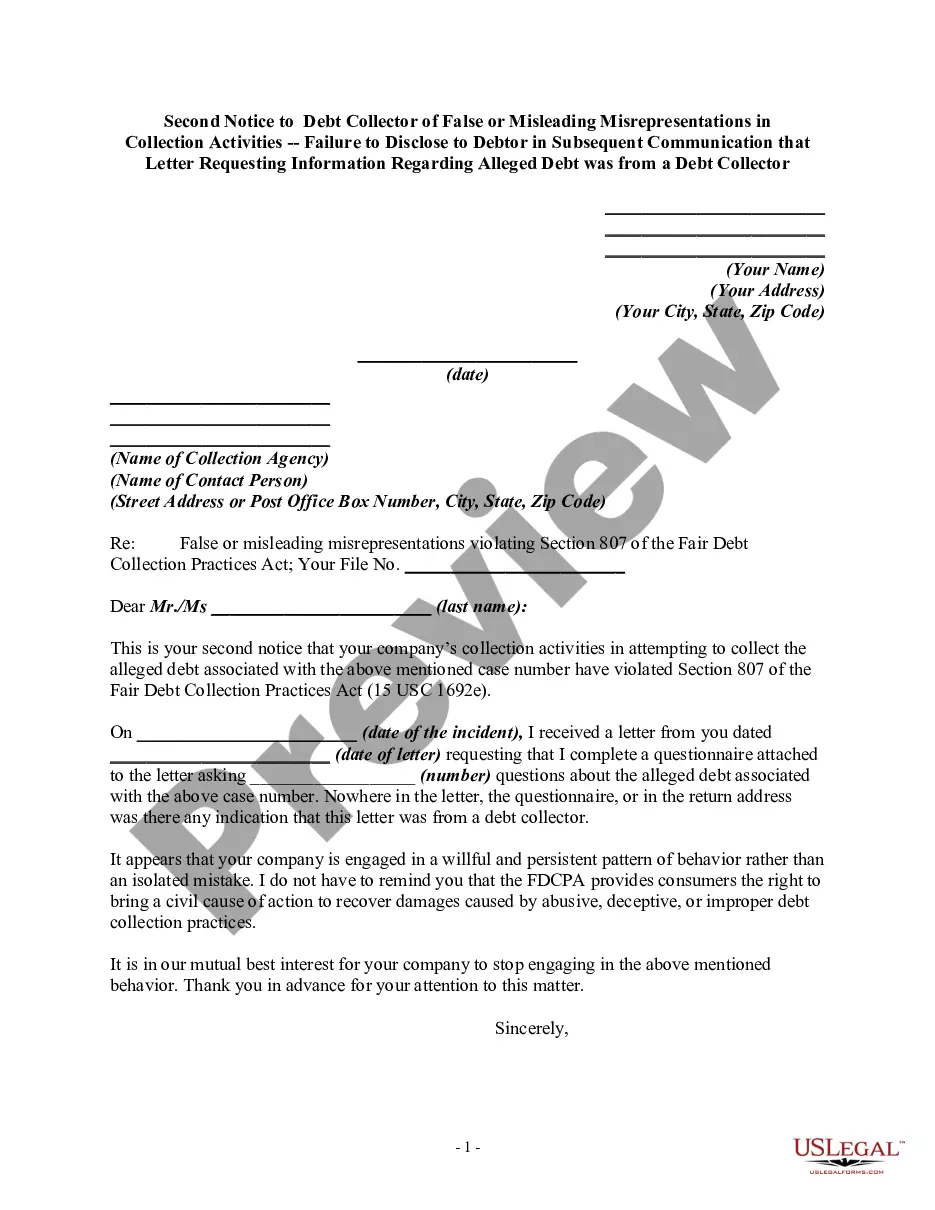

Title: King Washington Second Notice to Debt Collector: Exposing Deceptive Collection Practices — Failure to Disclose Origin of Information Request Keywords: King Washington, Second Notice, Debt Collector, False Misrepresentations, Misleading Misrepresentations, Collection Activities, Failure to Disclose, Subsequent Communication, Debt, Alleged Debt, Information Request Introduction: In this detailed description, we will explore the King Washington Second Notice to Debt Collector, specifically targeting situations where the debt collector fails to disclose to the debtor that the initial information request regarding an alleged debt was indeed sent by a debt collector. By shedding light on such deceptive collection activities, King Washington aims to protect consumers and ensure fair and transparent communication in debt collection practices. Types of King Washington Second Notice to Debt Collector: 1. Failure to Disclose Debt Collector Status: Under this type, the debt collector fails to explicitly inform the debtor, in subsequent communication, that the initial letter requesting information regarding the alleged debt was from a debt collector. This failure to disclose the debt collector's identity aims to give the impression that the subsequent communication is from an unrelated entity, potentially misleading and confusing the debtor. 2. False or Misleading Representations: This type of Second Notice addresses instances where the debt collector engages in false or misleading misrepresentations during collection activities. These misrepresentations may include exaggerated claims, misleading statements about the debtor's rights, fabricated debt amounts, or misrepresented consequences of non-payment. King Washington seeks to bring awareness to such deceptive practices to empower debtors to challenge illegitimate claims. 3. Lack of Clarity in Collection Activities: In this category, King Washington focuses on cases wherein the debt collector fails to provide clear and accurate information about the alleged debt and the collection process in their subsequent communication to the debtor. This lack of clarity may result in confusion, making it difficult for the debtor to understand their rights and options, creating an unfair advantage for the collector. Conclusion: The King Washington Second Notice serves as a vital tool in exposing and challenging deceitful collection activities by debt collectors. By highlighting instances of failure to disclose the debt collector's identity, false/misleading representations, and lack of clarity in subsequent communications, King Washington aims to protect debtors from unfair practices and facilitate a more transparent and equitable debt collection environment.Title: King Washington Second Notice to Debt Collector: Exposing Deceptive Collection Practices — Failure to Disclose Origin of Information Request Keywords: King Washington, Second Notice, Debt Collector, False Misrepresentations, Misleading Misrepresentations, Collection Activities, Failure to Disclose, Subsequent Communication, Debt, Alleged Debt, Information Request Introduction: In this detailed description, we will explore the King Washington Second Notice to Debt Collector, specifically targeting situations where the debt collector fails to disclose to the debtor that the initial information request regarding an alleged debt was indeed sent by a debt collector. By shedding light on such deceptive collection activities, King Washington aims to protect consumers and ensure fair and transparent communication in debt collection practices. Types of King Washington Second Notice to Debt Collector: 1. Failure to Disclose Debt Collector Status: Under this type, the debt collector fails to explicitly inform the debtor, in subsequent communication, that the initial letter requesting information regarding the alleged debt was from a debt collector. This failure to disclose the debt collector's identity aims to give the impression that the subsequent communication is from an unrelated entity, potentially misleading and confusing the debtor. 2. False or Misleading Representations: This type of Second Notice addresses instances where the debt collector engages in false or misleading misrepresentations during collection activities. These misrepresentations may include exaggerated claims, misleading statements about the debtor's rights, fabricated debt amounts, or misrepresented consequences of non-payment. King Washington seeks to bring awareness to such deceptive practices to empower debtors to challenge illegitimate claims. 3. Lack of Clarity in Collection Activities: In this category, King Washington focuses on cases wherein the debt collector fails to provide clear and accurate information about the alleged debt and the collection process in their subsequent communication to the debtor. This lack of clarity may result in confusion, making it difficult for the debtor to understand their rights and options, creating an unfair advantage for the collector. Conclusion: The King Washington Second Notice serves as a vital tool in exposing and challenging deceitful collection activities by debt collectors. By highlighting instances of failure to disclose the debt collector's identity, false/misleading representations, and lack of clarity in subsequent communications, King Washington aims to protect debtors from unfair practices and facilitate a more transparent and equitable debt collection environment.