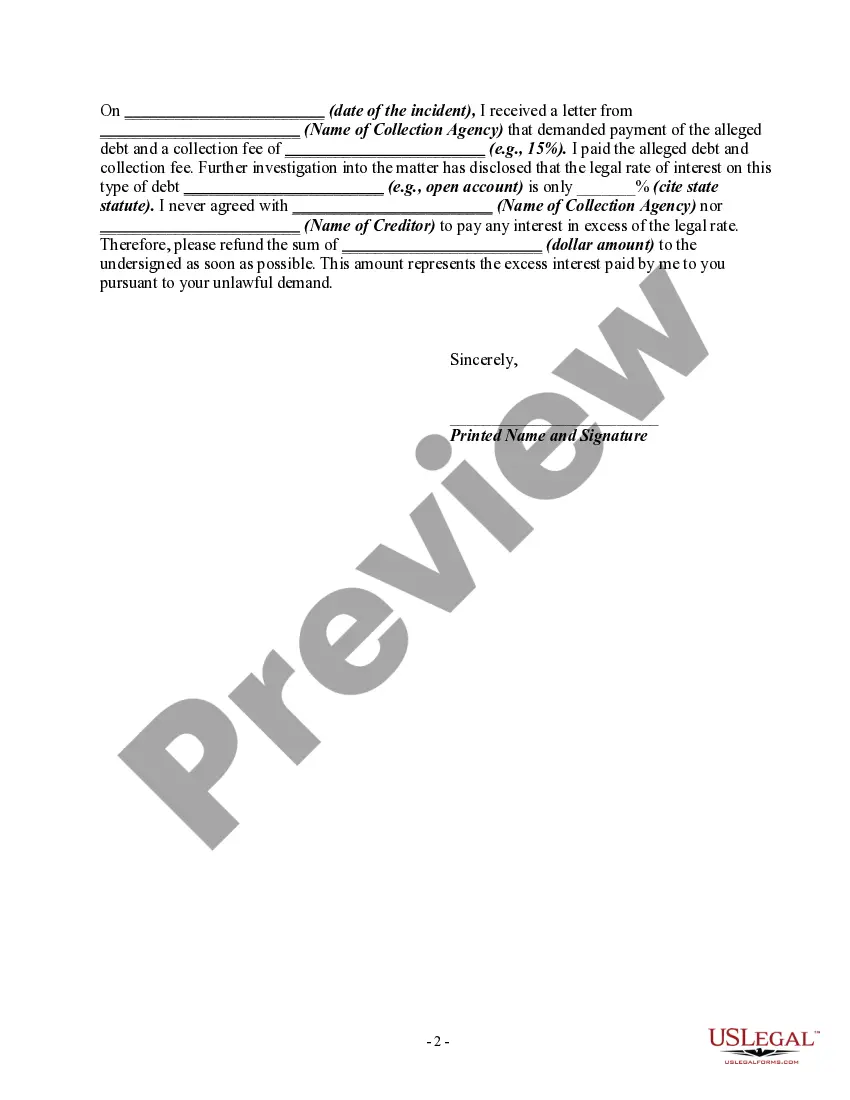

Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

Title: Allegheny Pennsylvania Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Introduction: In Allegheny, Pennsylvania, consumers have rights and protections against unfair and deceptive debt collection practices. If you find yourself subjected to a debt collector's actions that involve collecting an amount not authorized by the agreement creating the debt or by law, it is important to take action. This detailed description aims to provide insights into the process of writing a letter to inform the debt collector of their unfair practices and assert your rights in accordance with relevant laws. Key Keywords: — AlleghenPennsylvaniani— - Debt collector — Unfair practi—es - Collection activities — Amount not authorize— - Agreement creating the debt — Unauthorizecollectionio— - Violation of law — Consumer rig—ts - Debt collection rights — Debt collection laws Types of Allegheny Pennsylvania Letters Informing Debt Collector of Unfair Practices in Collection Activities: 1. Allegheny Pennsylvania Letter Informing Debt Collector of Unauthorized Collection Activities: This type of letter is specific to cases where the debt collector is attempting to collect an amount not authorized by the agreement creating the debt. It highlights the violation of the agreement and the debtor's rights, demanding immediate cessation of such practices. 2. Allegheny Pennsylvania Letter Asserting Consumer Rights in Debt Collection: This type of letter emphasizes the debtor's rights under Allegheny, Pennsylvania, and federal laws, particularly those protecting consumers from unfair and deceptive debt collection practices. The letter addresses the unauthorized collection activities and seeks remedies for the violation of these rights. 3. Allegheny Pennsylvania Letter Alleging Violation of Debt Collection Laws: This letter focuses on outlining the specific debt collection laws and regulations that the debt collector is breaching by collecting an unauthorized amount. It seeks acknowledgement and remediation for the illegal actions taken by the debt collector. 4. Allegheny Pennsylvania Letter Requesting Validation of Debt Collection: In cases where the debtor doubts the validity of the debt or believes that the amount being collected is incorrect, this letter seeks proper validation of the debt. It highlights the unauthorized collection practices and demands the debt collector provide documentation supporting their claims. 5. Allegheny Pennsylvania Letter Threatening Legal Action against Unfair Debt Collection: This assertive letter serves as a warning to the debt collector that continued unfair collection practices will result in legal action. It emphasizes the debtor's rights, the violation committed, and their determination to seek legal remedies if necessary. Overall, the specific type of letter you choose to write depends on the nature of the unfair practices you have experienced from the debt collector. Make sure to understand your rights under Allegheny, Pennsylvania, and federal laws to effectively assert your position and protect yourself from such activities.