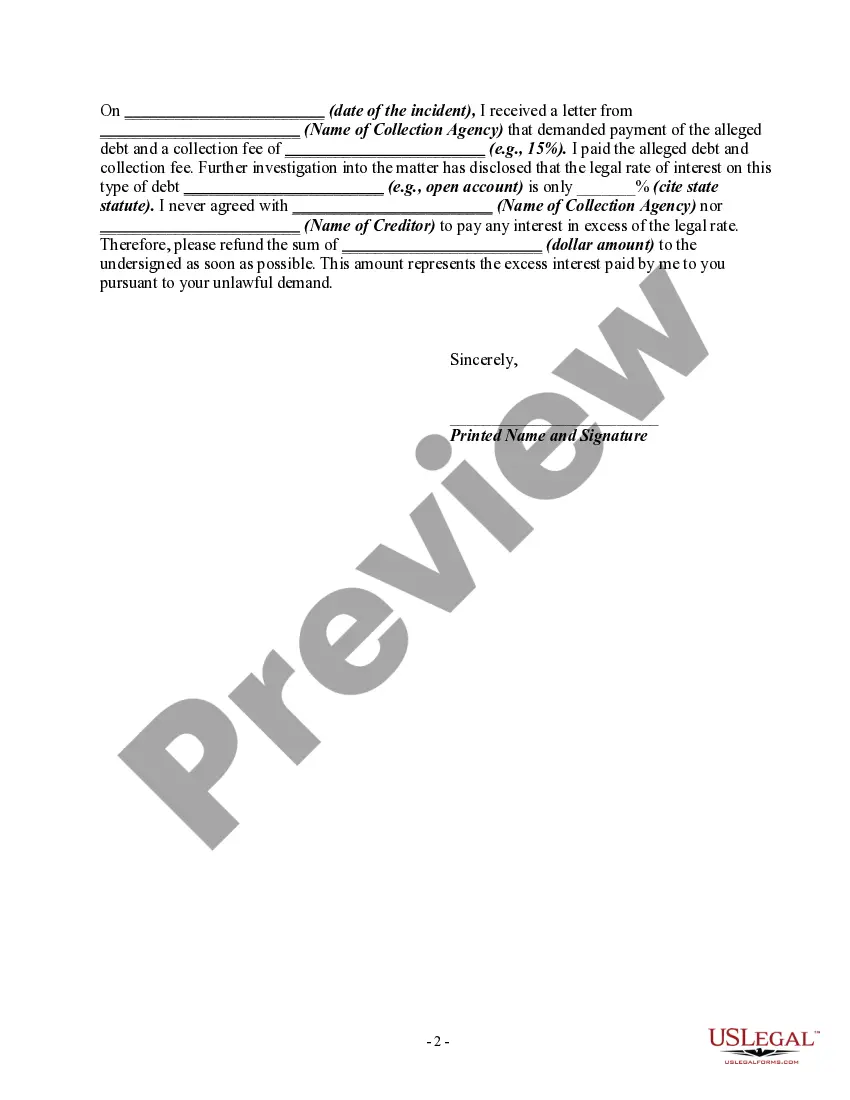

Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

Title: Fairfax Virginia Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Introduction: In Fairfax, Virginia, individuals have the right to protect themselves from debt collectors engaging in unfair practices. This article will guide you on writing a comprehensive letter to inform a debt collector of their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law. By addressing this issue, you can assert your rights and possibly resolve the matter amicably. Below are the essential components and relevant keyword phrases to consider when drafting this letter. 1. Your Contact Information: Clearly state your full name, current address, email address, and phone number at the beginning of the letter. This information is essential for the debt collector to identify your account accurately and respond to your concerns. Key phrases: Fairfax Virginia, contact information, full name, current address, email address, phone number 2. Debt Collector's Information: Include the debt collector's full name, business name, address, and any relevant identification numbers, such as their license or registration number, if available. This will help ensure that your letter reaches the intended recipient and is properly documented. Key phrases: debt collector's information, business name, address, identification numbers 3. Description of Unfair Collection Activity: Clearly explain the specific unfair collection activity you are addressing. Focus on the debt collector collecting an amount not authorized by the agreement creating the debt or by law. Include relevant details, such as dates, amounts, payment history, and any other supporting evidence if available. Key phrases: unfair collection activity, amount not authorized, agreement creating the debt, amounts collected, payment history, supporting evidence 4. Reference to Legal Protection: Highlight the statutory rights protecting consumers against unfair debt collection practices. Refer to relevant laws or acts that enforce these protections, such as the Fair Debt Collection Practices Act (FD CPA), Virginia Consumer Protection Act (CPA), or any applicable state law. Key phrases: legal protection, consumer rights, Fair Debt Collection Practices Act, FD CPA, Virginia Consumer Protection Act, CPA, state laws 5. Demand for Corrective Actions: Clearly state your expectation for the debt collector to rectify the unfair collection activity. This may involve ceasing the collection of unauthorized amounts, revising the agreement, providing an accurate account statement, or any other necessary action to resolve the issue. Key phrases: corrective actions, ceasing collection, revising agreement, accurate account statement, issue resolution 6. Deadline for Response: Specify a reasonable deadline for the debt collector to respond to your letter. This allows for prompt action and demonstrates that you are serious about addressing the matter effectively. Key phrases: response deadline, prompt action Conclusion: By crafting a comprehensive letter informing a debt collector of their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law, you may assert your rights as a consumer. Ensure that your letter is respectful, factual, and firmly conveys your concerns. Remember to keep copies of all correspondence for your records.Title: Fairfax Virginia Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Introduction: In Fairfax, Virginia, individuals have the right to protect themselves from debt collectors engaging in unfair practices. This article will guide you on writing a comprehensive letter to inform a debt collector of their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law. By addressing this issue, you can assert your rights and possibly resolve the matter amicably. Below are the essential components and relevant keyword phrases to consider when drafting this letter. 1. Your Contact Information: Clearly state your full name, current address, email address, and phone number at the beginning of the letter. This information is essential for the debt collector to identify your account accurately and respond to your concerns. Key phrases: Fairfax Virginia, contact information, full name, current address, email address, phone number 2. Debt Collector's Information: Include the debt collector's full name, business name, address, and any relevant identification numbers, such as their license or registration number, if available. This will help ensure that your letter reaches the intended recipient and is properly documented. Key phrases: debt collector's information, business name, address, identification numbers 3. Description of Unfair Collection Activity: Clearly explain the specific unfair collection activity you are addressing. Focus on the debt collector collecting an amount not authorized by the agreement creating the debt or by law. Include relevant details, such as dates, amounts, payment history, and any other supporting evidence if available. Key phrases: unfair collection activity, amount not authorized, agreement creating the debt, amounts collected, payment history, supporting evidence 4. Reference to Legal Protection: Highlight the statutory rights protecting consumers against unfair debt collection practices. Refer to relevant laws or acts that enforce these protections, such as the Fair Debt Collection Practices Act (FD CPA), Virginia Consumer Protection Act (CPA), or any applicable state law. Key phrases: legal protection, consumer rights, Fair Debt Collection Practices Act, FD CPA, Virginia Consumer Protection Act, CPA, state laws 5. Demand for Corrective Actions: Clearly state your expectation for the debt collector to rectify the unfair collection activity. This may involve ceasing the collection of unauthorized amounts, revising the agreement, providing an accurate account statement, or any other necessary action to resolve the issue. Key phrases: corrective actions, ceasing collection, revising agreement, accurate account statement, issue resolution 6. Deadline for Response: Specify a reasonable deadline for the debt collector to respond to your letter. This allows for prompt action and demonstrates that you are serious about addressing the matter effectively. Key phrases: response deadline, prompt action Conclusion: By crafting a comprehensive letter informing a debt collector of their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law, you may assert your rights as a consumer. Ensure that your letter is respectful, factual, and firmly conveys your concerns. Remember to keep copies of all correspondence for your records.