Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

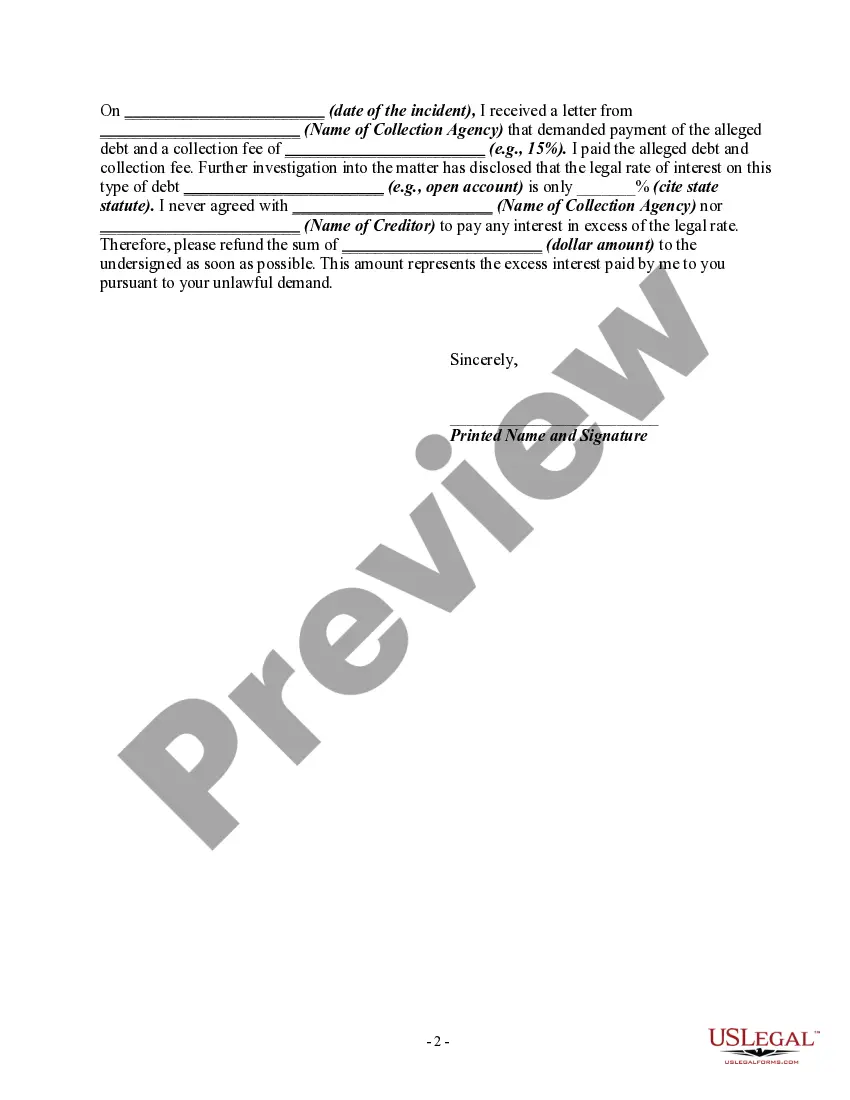

Title: Harris Texas Letter Informing Debt Collector of Unfair Practices — Unauthorized Collection Activities in Violation of Agreement or Law Introduction: In Harris County, Texas, individuals facing unfair debt collection practices have the right to protect themselves from unauthorized collection activities. This letter serves as a means to inform and address debt collectors who unlawfully collect amounts that exceed the debt agreement or violate applicable laws. By challenging these practices, individuals can safeguard their rights and seek fair resolutions. Content: 1. Opening Statement: Begin the letter by addressing the debt collector or collection agency by name and providing the contact information (address, phone number, and email if available). Clearly state that the purpose of the letter is to dispute and formally inform them of their unfair debt collection practices. 2. Personal Information: Include your full name, address, phone number, and any other relevant identification details. This information will help the debt collector to identify your account and begin the necessary investigations. 3. Debt Information: State the specific debt in question, such as the original creditor's name, the account number, and the alleged outstanding amount. Emphasize that you are aware of your rights and that the collector's actions are in violation of the agreement or applicable laws. 4. Violation Explanation: Describe in detail how the debt collector is engaging in unfair practices. Focus primarily on the fact that they are collecting amounts not authorized by the agreement creating the debt or sanctioned by law. These unfair practices may include charging excessive fees, interest, or other penalties not outlined in the original agreement. 5. Supporting Evidence: Attach any relevant documents as evidence that prove the debt collector's unfair practices. These can include copies of the original debt agreement, payment receipts, billing statements, or any correspondence exchanged between you and the collector. Clearly mark and reference each document to ensure ease of comprehension. 6. Legal Consequences: Highlight the potential legal consequences the debt collector may face if they continue their unfair practices. Mention that their actions may violate federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA), and that you are prepared to take legal action if necessary. 7. Request for Action: Politely but firmly demand that the debt collector immediately cease their unfair practices and rectify the situation by adjusting the amount owed in accordance with the agreement or relevant laws. Specify that you expect a response within a reasonable timeframe, typically 30 days, indicating their intention to resolve the matter. 8. Closing Statement: Conclude the letter by thanking the recipient for their attention and urging them to take immediate action to resolve the issue. State that you will be monitoring the situation closely and leave your contact information for further correspondence. Types of Harris Texas Letters Informing Debt Collector of Unfair Practices: — Harris Texas Letter Informing Debt Collector of Unjust Collection Fees — Harris Texas Letter Informing Debt Collector of Excessive Interest Charges — Harris Texas Letter Informing Debt Collector of Unauthorized Penalties — Harris Texas Letter Informing Debt Collector of Violation of Fair Debt Collection Practices Act (FD CPA) — Harris Texas Letter Informing Debt Collector of Unlawful Debt Collection Techniques.Title: Harris Texas Letter Informing Debt Collector of Unfair Practices — Unauthorized Collection Activities in Violation of Agreement or Law Introduction: In Harris County, Texas, individuals facing unfair debt collection practices have the right to protect themselves from unauthorized collection activities. This letter serves as a means to inform and address debt collectors who unlawfully collect amounts that exceed the debt agreement or violate applicable laws. By challenging these practices, individuals can safeguard their rights and seek fair resolutions. Content: 1. Opening Statement: Begin the letter by addressing the debt collector or collection agency by name and providing the contact information (address, phone number, and email if available). Clearly state that the purpose of the letter is to dispute and formally inform them of their unfair debt collection practices. 2. Personal Information: Include your full name, address, phone number, and any other relevant identification details. This information will help the debt collector to identify your account and begin the necessary investigations. 3. Debt Information: State the specific debt in question, such as the original creditor's name, the account number, and the alleged outstanding amount. Emphasize that you are aware of your rights and that the collector's actions are in violation of the agreement or applicable laws. 4. Violation Explanation: Describe in detail how the debt collector is engaging in unfair practices. Focus primarily on the fact that they are collecting amounts not authorized by the agreement creating the debt or sanctioned by law. These unfair practices may include charging excessive fees, interest, or other penalties not outlined in the original agreement. 5. Supporting Evidence: Attach any relevant documents as evidence that prove the debt collector's unfair practices. These can include copies of the original debt agreement, payment receipts, billing statements, or any correspondence exchanged between you and the collector. Clearly mark and reference each document to ensure ease of comprehension. 6. Legal Consequences: Highlight the potential legal consequences the debt collector may face if they continue their unfair practices. Mention that their actions may violate federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA), and that you are prepared to take legal action if necessary. 7. Request for Action: Politely but firmly demand that the debt collector immediately cease their unfair practices and rectify the situation by adjusting the amount owed in accordance with the agreement or relevant laws. Specify that you expect a response within a reasonable timeframe, typically 30 days, indicating their intention to resolve the matter. 8. Closing Statement: Conclude the letter by thanking the recipient for their attention and urging them to take immediate action to resolve the issue. State that you will be monitoring the situation closely and leave your contact information for further correspondence. Types of Harris Texas Letters Informing Debt Collector of Unfair Practices: — Harris Texas Letter Informing Debt Collector of Unjust Collection Fees — Harris Texas Letter Informing Debt Collector of Excessive Interest Charges — Harris Texas Letter Informing Debt Collector of Unauthorized Penalties — Harris Texas Letter Informing Debt Collector of Violation of Fair Debt Collection Practices Act (FD CPA) — Harris Texas Letter Informing Debt Collector of Unlawful Debt Collection Techniques.