Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

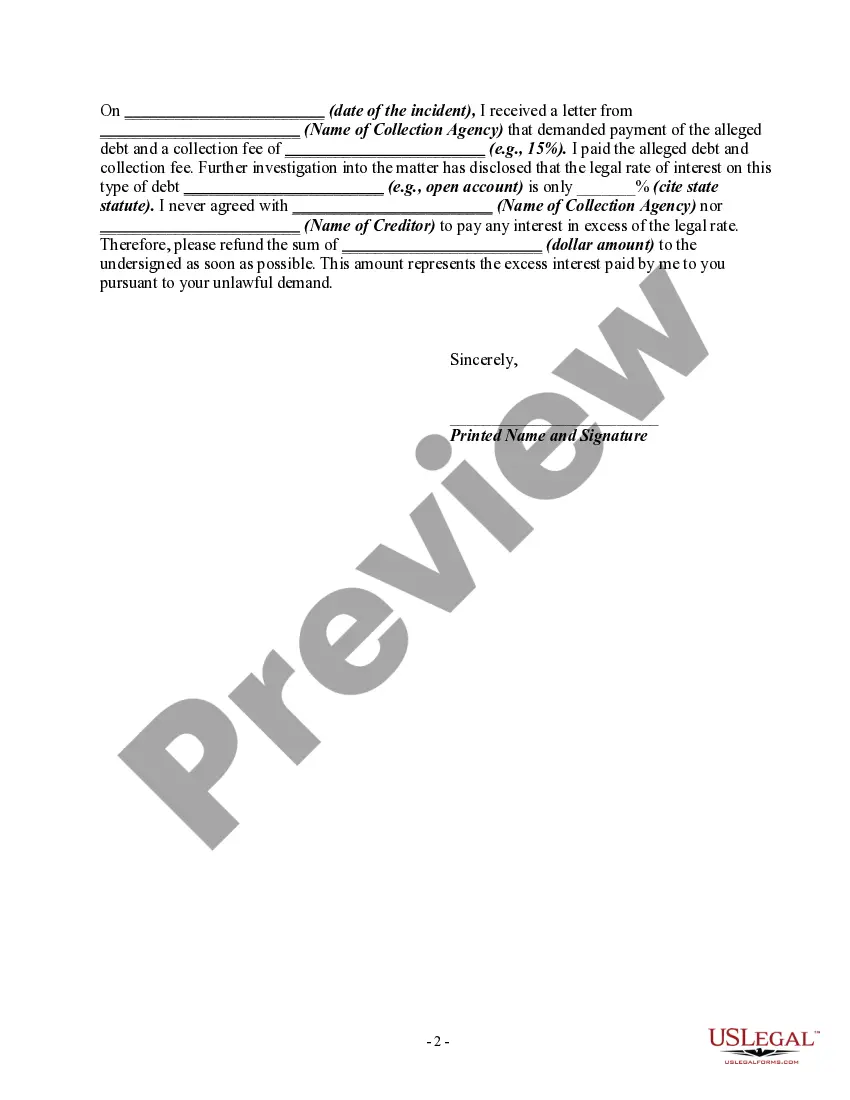

Subject: Letter Informing Debt Collector of Unfair Practices — Unauthorized Collection Amount in Houston, Texas [Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, Zip Code] Subject: Unauthorized Collection Activities — Violation of Agreement and Texas Law Dear [Debt Collector's Name], I am writing to bring to your attention a serious concern regarding the collection activities related to the debt owed by [Your Name]. As a resident of Houston, Texas, I am aware of the laws and regulations that govern debt collection practices in our state, and it has come to my attention that your company has engaged in practices that are both unfair and potentially illegal. Upon reviewing the details of the debt in question, as well as the corresponding agreement, I have discovered that the collection amount being pursued by your company is not authorized by the agreement creating the debt or by any relevant laws. This action by your agency not only breaches our initial agreement but also violates the Fair Debt Collection Practices Act (FD CPA) as well as the Texas Debt Collection Act (TCA). Please be aware that under the FD CPA and TCA, debt collectors are required to: 1. Provide accurate information: It is the duty of the debt collector to accurately represent the amount owed, including any additional fees or interest charges that may have accumulated after the account was assigned to your agency. Your collection amount exceeds the authorized debt, and as a result, it misleads and deceives me as the debtor. 2. Cease collection activities on disputed debts: Upon being notified that a debtor disputes the validity or the amount owed on a debt, the debt collector must cease all collection activities until the matter has been resolved. I dispute the collection amount being pursued by your agency, and as such, I request that all collection efforts cease immediately until this matter is resolved. 3. Avoid any deceptive or unfair practices: It is prohibited by law for a debt collector to engage in any deceptive, unfair, or abusive practices when attempting to collect a debt. Collecting an unauthorized amount that is not in adherence with the agreement or applicable laws is a clear violation of these provisions. I kindly request that your agency review the details of the debt in question and rectify the unauthorized collection amount immediately. Failure to do so will leave me no choice but to pursue legal remedies available to me under the FD CPA and TCA, including the right to file complaints with relevant regulatory authorities and seek appropriate legal counsel. I believe in acting in good faith and finding an amicable resolution to this matter. Therefore, I request that you provide a written response within 30 days from the date of receipt of this letter, addressing the concerns raised and confirming the rectification of the unauthorized collection amount. Thank you for your prompt attention to this matter. I trust that we can resolve this issue in a fair and satisfactory manner. Sincerely, [Your Name]Subject: Letter Informing Debt Collector of Unfair Practices — Unauthorized Collection Amount in Houston, Texas [Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, Zip Code] Subject: Unauthorized Collection Activities — Violation of Agreement and Texas Law Dear [Debt Collector's Name], I am writing to bring to your attention a serious concern regarding the collection activities related to the debt owed by [Your Name]. As a resident of Houston, Texas, I am aware of the laws and regulations that govern debt collection practices in our state, and it has come to my attention that your company has engaged in practices that are both unfair and potentially illegal. Upon reviewing the details of the debt in question, as well as the corresponding agreement, I have discovered that the collection amount being pursued by your company is not authorized by the agreement creating the debt or by any relevant laws. This action by your agency not only breaches our initial agreement but also violates the Fair Debt Collection Practices Act (FD CPA) as well as the Texas Debt Collection Act (TCA). Please be aware that under the FD CPA and TCA, debt collectors are required to: 1. Provide accurate information: It is the duty of the debt collector to accurately represent the amount owed, including any additional fees or interest charges that may have accumulated after the account was assigned to your agency. Your collection amount exceeds the authorized debt, and as a result, it misleads and deceives me as the debtor. 2. Cease collection activities on disputed debts: Upon being notified that a debtor disputes the validity or the amount owed on a debt, the debt collector must cease all collection activities until the matter has been resolved. I dispute the collection amount being pursued by your agency, and as such, I request that all collection efforts cease immediately until this matter is resolved. 3. Avoid any deceptive or unfair practices: It is prohibited by law for a debt collector to engage in any deceptive, unfair, or abusive practices when attempting to collect a debt. Collecting an unauthorized amount that is not in adherence with the agreement or applicable laws is a clear violation of these provisions. I kindly request that your agency review the details of the debt in question and rectify the unauthorized collection amount immediately. Failure to do so will leave me no choice but to pursue legal remedies available to me under the FD CPA and TCA, including the right to file complaints with relevant regulatory authorities and seek appropriate legal counsel. I believe in acting in good faith and finding an amicable resolution to this matter. Therefore, I request that you provide a written response within 30 days from the date of receipt of this letter, addressing the concerns raised and confirming the rectification of the unauthorized collection amount. Thank you for your prompt attention to this matter. I trust that we can resolve this issue in a fair and satisfactory manner. Sincerely, [Your Name]