Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

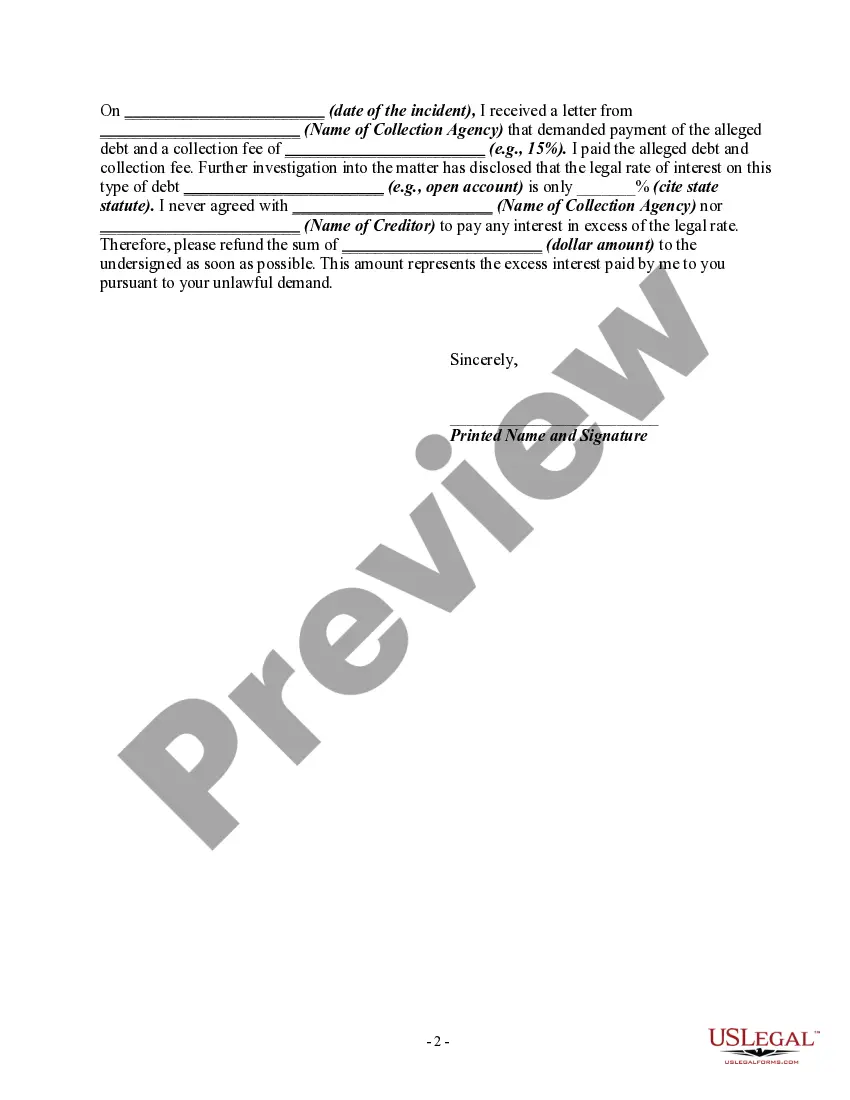

Title: Mecklenburg North Carolina Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Introduction: Welcome to our comprehensive guide on writing a detailed description of Mecklenburg, North Carolina's letter informing debt collectors of their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law. This guide will provide you with the necessary information and relevant keywords to effectively address such situations. Let's get started! 1. Understanding Debt Collection Practices: Debt collection practices are regulated by federal and state laws to protect consumers from abusive and unfair practices. In Mecklenburg County, North Carolina, individuals facing debt collection must be aware of their rights and be prepared to confront unlawful attempts to collect an unauthorized amount. 2. Elements of a Mecklenburg North Carolina Letter Informing Debt Collector of Unfair Practices: When writing a letter informing debt collectors of their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law, consider including the following elements: a) Personal Information: Begin by providing your full name, address, and contact details. It is crucial to maintain a formal tone throughout the letter. b) Debt Collection Agency Details: Include the name, address, and contact information of the debt collection agency involved, such as their name, mailing address, and phone number. c) Debt Information: Clearly and concisely state the debt involved, its original amount, the date it was incurred, and any supporting documentation available, such as copies of agreements or account statements. d) Unfair Collection Practices: Describe in detail the unfair practices employed by the debt collector, emphasizing their attempt to collect an amount not authorized by the original agreement or by law. Highlight any violations of consumer protection laws, such as unfair interest charges, unauthorized fees, or improper calculation of the debt. e) Legal Rights: Assert your legal rights as a consumer, indicating you are familiar with the Fair Debt Collection Practices Act (FD CPA), which prohibits unjust practices by debt collectors. Additionally, mention specific North Carolina laws, if applicable, that protect consumers from such practices. f) Request for Action: Clearly state that you expect the debt collector to cease the unfair practices immediately. Request a written response within a reasonable time frame, acknowledging their receipt of your letter and detailing the corrective actions they will take. g) Notification of Authorities: If necessary, inform the debt collector that you will report their unfair practices to relevant regulatory authorities, such as the Consumer Financial Protection Bureau (CFPB) or the North Carolina Attorney General's Office. Conclusion: Writing a comprehensive letter informing debt collectors of their unfair practices in collecting an unauthorized amount is crucial to protecting your rights as a consumer in Mecklenburg, North Carolina. Remember to use the relevant keywords, such as debt collection laws, FD CPA, Mecklenburg laws, unfair practices, and authorized debt, to ensure your letter is effective in addressing the issue at hand.