Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

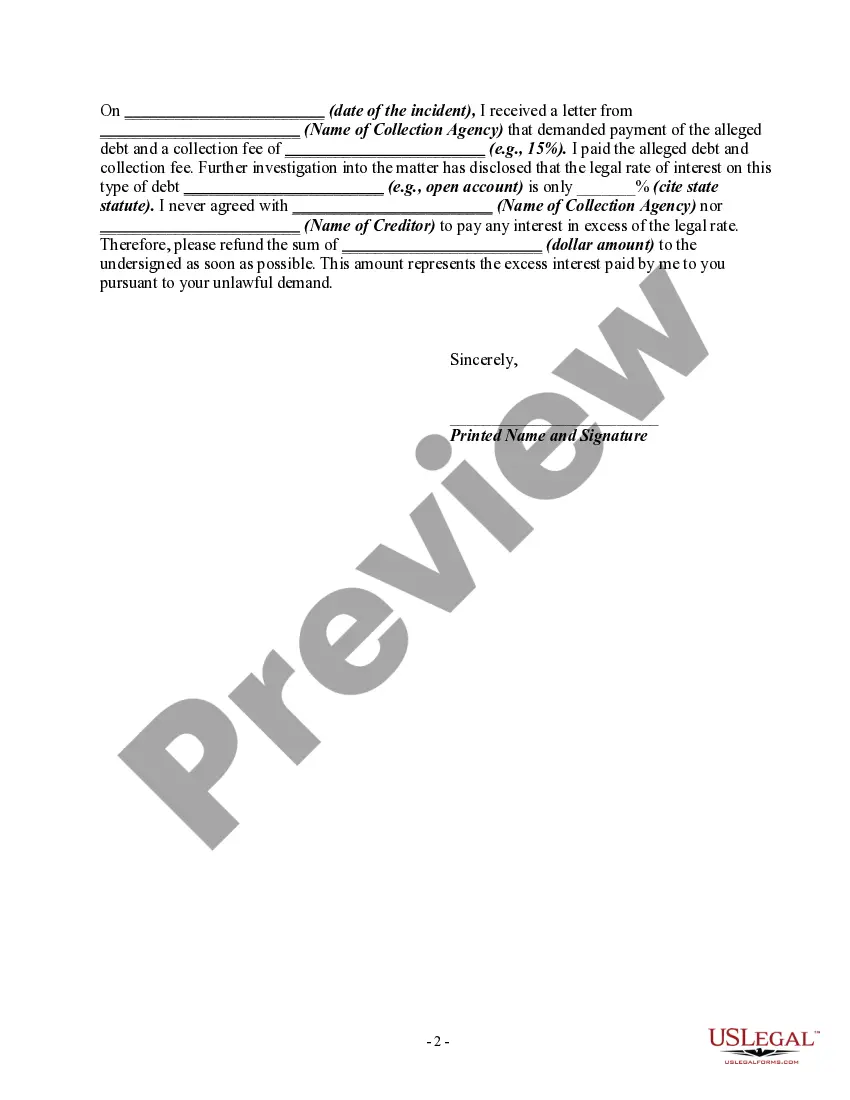

[Your Name] [Your Address] [City, State, ZIP] [Date] [Debt Collection Agency Name] [Agency Address] [City, State, ZIP] Re: [Your Account Number/Reference Number] Subject: Notice of Unfair Debt Collection Practices Dear Sir/Madam, I am writing to bring to your attention the unfair debt collection practices being utilized by your agency in relation to the collection activities regarding my debt. I want to inform you that your current actions in collecting an amount not authorized by the agreement creating the debt or by law are in violation of both federal and state laws. I have thoroughly reviewed the terms and conditions of the original agreement that led to the creation of this debt. Nowhere in the agreement does it authorize you to collect the amount you are currently asking for. Additionally, your attempt to collect an amount not permitted by law further violates the Fair Debt Collection Practices Act (FD CPA) and the regulations set by the Consumer Financial Protection Bureau (CFPB). The FD CPA clearly states that debt collectors are prohibited from collecting any amount that is not expressly authorized by the agreement creating the debt or permitted by law. It is worth noting that Oakland, Michigan also has its local regulations regarding debt collection practices, which I expect you to abide by. As a diligent consumer, I have kept detailed records of all communication between us, including copies of letters, emails, and phone call logs. I would advise you to do the same to ensure transparency and to comply with legal requirements. To rectify this situation, I demand that your agency immediately cease all collection activities related to this debt until the violation of the FD CPA and other relevant laws has been addressed and resolved. Failure to do so within [state a timeframe, typically 30 days] from the receipt of this letter will result in my filing a complaint with the appropriate authorities, including but not limited to, the CFPB, the Federal Trade Commission, and the Attorney General's office of Oakland, Michigan. Please acknowledge receipt of this letter and provide written confirmation of your intentions to rectify this matter. Also, I request that you provide detailed documentation on the amount you claim is owed, including a breakdown of charges, interest, and any other fees associated with the debt. I will require this information to accurately assess the validity of your claims and forward them to my legal counsel if necessary. I strongly advise your agency to consider this matter seriously and ensure compliance with applicable laws and regulations. Every effort will be made on my part to protect my rights as a consumer and hold you accountable for any violation thereof. Yours sincerely, [Your Name][Your Name] [Your Address] [City, State, ZIP] [Date] [Debt Collection Agency Name] [Agency Address] [City, State, ZIP] Re: [Your Account Number/Reference Number] Subject: Notice of Unfair Debt Collection Practices Dear Sir/Madam, I am writing to bring to your attention the unfair debt collection practices being utilized by your agency in relation to the collection activities regarding my debt. I want to inform you that your current actions in collecting an amount not authorized by the agreement creating the debt or by law are in violation of both federal and state laws. I have thoroughly reviewed the terms and conditions of the original agreement that led to the creation of this debt. Nowhere in the agreement does it authorize you to collect the amount you are currently asking for. Additionally, your attempt to collect an amount not permitted by law further violates the Fair Debt Collection Practices Act (FD CPA) and the regulations set by the Consumer Financial Protection Bureau (CFPB). The FD CPA clearly states that debt collectors are prohibited from collecting any amount that is not expressly authorized by the agreement creating the debt or permitted by law. It is worth noting that Oakland, Michigan also has its local regulations regarding debt collection practices, which I expect you to abide by. As a diligent consumer, I have kept detailed records of all communication between us, including copies of letters, emails, and phone call logs. I would advise you to do the same to ensure transparency and to comply with legal requirements. To rectify this situation, I demand that your agency immediately cease all collection activities related to this debt until the violation of the FD CPA and other relevant laws has been addressed and resolved. Failure to do so within [state a timeframe, typically 30 days] from the receipt of this letter will result in my filing a complaint with the appropriate authorities, including but not limited to, the CFPB, the Federal Trade Commission, and the Attorney General's office of Oakland, Michigan. Please acknowledge receipt of this letter and provide written confirmation of your intentions to rectify this matter. Also, I request that you provide detailed documentation on the amount you claim is owed, including a breakdown of charges, interest, and any other fees associated with the debt. I will require this information to accurately assess the validity of your claims and forward them to my legal counsel if necessary. I strongly advise your agency to consider this matter seriously and ensure compliance with applicable laws and regulations. Every effort will be made on my part to protect my rights as a consumer and hold you accountable for any violation thereof. Yours sincerely, [Your Name]