Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

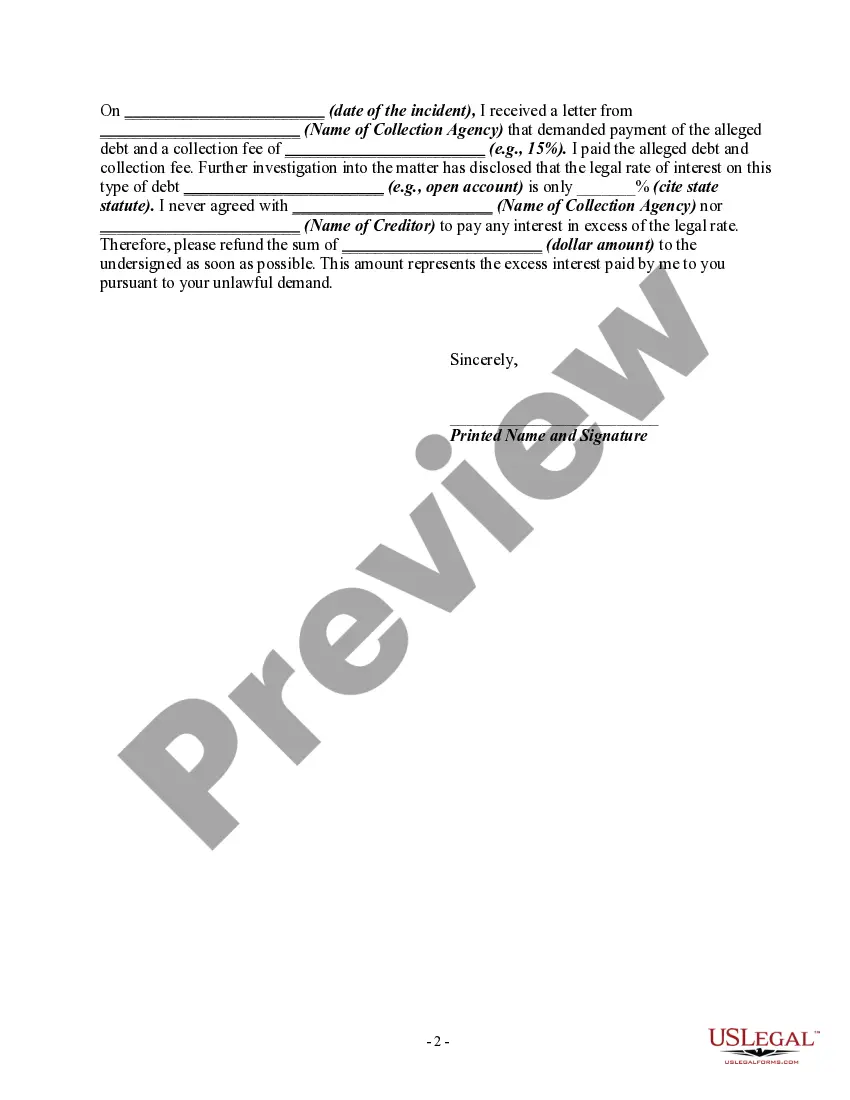

Title: Phoenix Arizona Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Keywords: Phoenix Arizona, debt collector, unfair practices, collection activities, unauthorized amount, agreement, debt, law Introduction: In Phoenix, Arizona, debtors have the right to address unfair practices conducted by debt collectors who attempt to collect amounts not authorized by the agreement creating the debt or by law. This letter serves as a means to inform debt collectors about their unfair practices in collection activities and seek resolution. Several types of letters can be written to address these unjust practices effectively. 1. Cease and Desist Letter: A Cease and Desist letter is utilized when a debt collector continues to engage in unfair practices despite previous notifications. This letter demands that the debt collector immediately stop all collection activities and refrain from collecting any unauthorized amount, giving them a final opportunity to rectify their misbehavior. 2. Notifying Unauthorized Amount Letter: This type of letter focuses on informing debt collectors that the amount they are attempting to collect is not authorized by the agreement creating the debt or by law. It may include documentation proving the correct amount owed and highlighting the discrepancy between the debt collector's claim and the actual sum owed. 3. Request for Validation of Debt Letter: A Request for Validation of Debt letter is sent when the debtor questions the validity of the debt. It requests that the debt collector provide evidence validating the debt as well as an explanation of how the disputed amount was determined. 4. Dispute Incorrect Amount Letter: This letter is used to challenge the incorrect amount mentioned by the debt collector. It includes a detailed explanation of the discrepancy, along with supporting evidence, such as statements, receipts, or agreements, which contradicts the collector's claim. It emphasizes the need for accurate and fair collection practices. 5. Notice of Intent to File Complaint Letter: When debt collectors persistently engage in unfair practices, a Notice of Intent to File Complaint letter can be sent, informing them that if they fail to address the issue promptly, a formal complaint will be filed with relevant regulatory authorities. This letter serves as a strong warning, urging the debt collector to correct their behavior to avoid potential legal consequences. Conclusion: It is crucial for debtors in Phoenix, Arizona, to assert their rights and address unfair practices by debt collectors. Depending on the particular circumstances, different types of letters can be employed to inform debt collectors about their unfair practices in collection activities, specifically collecting amounts not authorized by the debt agreement or by law. These letters aim to rectify the situation, ensure accurate collection practices, and protect the rights of the debtor.