Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

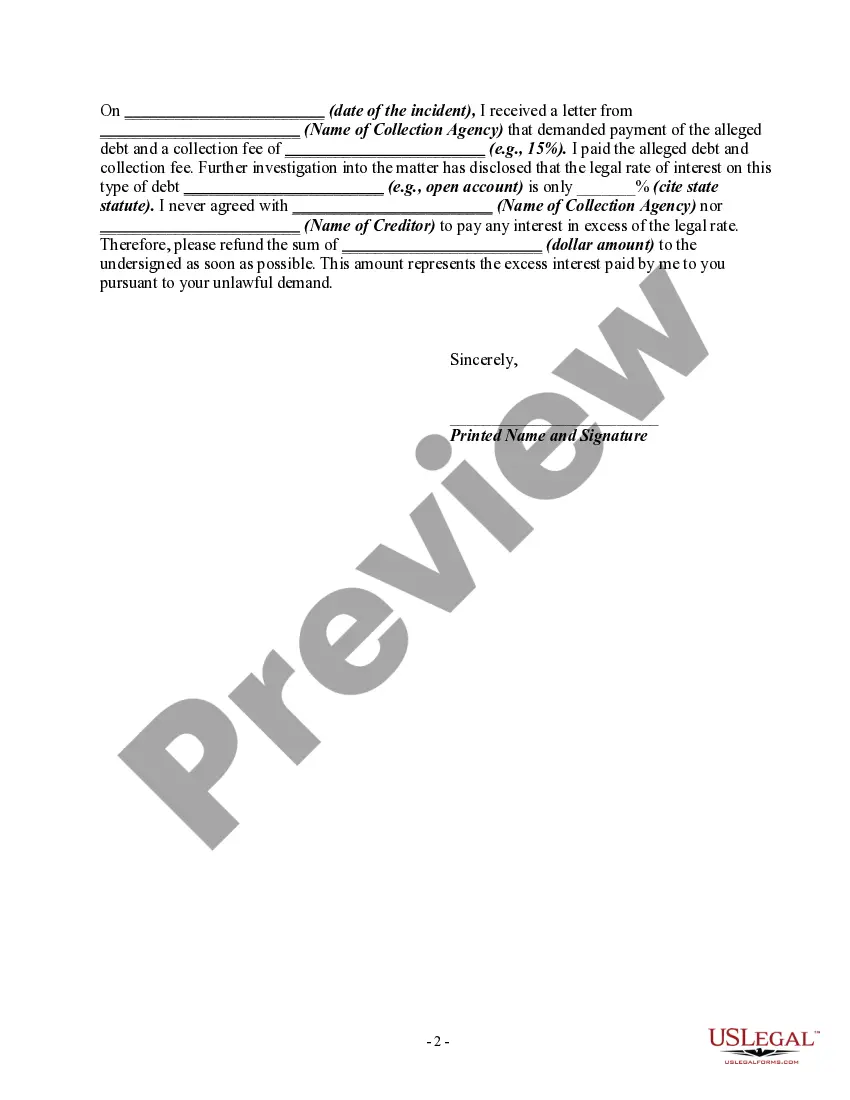

Title: Unfair Debt Collection Practices in Riverside, California: Letter Informing Debt Collector of Unauthorized Collection Activities Keywords: Riverside California, debt collector, unfair practices, collection activities, unauthorized amount, agreement, law --- [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, ZIP Code] Subject: Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Dear [Debt Collector's Name], I am writing to address serious concerns regarding the unfair debt collection practices I have experienced in relation to the debt owed to [Original Creditor] and currently serviced by your agency. This letter serves as my formal complaint and notice of your unauthorized collection activities that violate both the agreement creating the debt and relevant laws. First and foremost, I want to assert that I am fully aware of my rights as a debtor under the Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). These laws aim to protect consumers like me from being subjected to improper debt collection practices. Upon reviewing the details of my debt, as outlined by the original agreement with [Original Creditor], it has become apparent that your agency is unlawfully collecting an amount that is not authorized by the agreement nor supported by any applicable law. The specific discrepancy I have identified is [provide details here, such as incorrect balance calculations, added fees not specified in the agreement, or interest charges not agreed upon]. Therefore, I demand that your agency ceases all collection activities immediately related to this unauthorized amount. I expect you to rectify this situation promptly by providing a detailed breakdown of the debt, including any additional charges or fees that have been applied unlawfully. Furthermore, I request that you halt any further attempts to collect this unauthorized amount until we can resolve this matter in accordance with the law. Please be aware that intentional collection of an amount not authorized by the agreement creating the debt or by law is in explicit violation of consumer protection statutes, such as the FD CPA and RFD CPA. Failure to address this matter conscientiously may result in legal action, and I will not hesitate to protect my rights as a debtor under these laws. I kindly request that you acknowledge receipt of this letter within 15 days from the date you receive it, as well as provide me with a detailed response addressing the concerns raised herein. I expect this matter to be resolved within 30 days of your receipt of this letter. Failure to respond or resolve this dispute to my satisfaction will leave me with no choice but to pursue further legal actions available to me. Please note that I will keep a record of all correspondence and communications related to this matter. Your prompt attention to this issue is greatly appreciated. I look forward to a satisfactory resolution. Yours sincerely, [Your Name]Title: Unfair Debt Collection Practices in Riverside, California: Letter Informing Debt Collector of Unauthorized Collection Activities Keywords: Riverside California, debt collector, unfair practices, collection activities, unauthorized amount, agreement, law --- [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, ZIP Code] Subject: Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Dear [Debt Collector's Name], I am writing to address serious concerns regarding the unfair debt collection practices I have experienced in relation to the debt owed to [Original Creditor] and currently serviced by your agency. This letter serves as my formal complaint and notice of your unauthorized collection activities that violate both the agreement creating the debt and relevant laws. First and foremost, I want to assert that I am fully aware of my rights as a debtor under the Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). These laws aim to protect consumers like me from being subjected to improper debt collection practices. Upon reviewing the details of my debt, as outlined by the original agreement with [Original Creditor], it has become apparent that your agency is unlawfully collecting an amount that is not authorized by the agreement nor supported by any applicable law. The specific discrepancy I have identified is [provide details here, such as incorrect balance calculations, added fees not specified in the agreement, or interest charges not agreed upon]. Therefore, I demand that your agency ceases all collection activities immediately related to this unauthorized amount. I expect you to rectify this situation promptly by providing a detailed breakdown of the debt, including any additional charges or fees that have been applied unlawfully. Furthermore, I request that you halt any further attempts to collect this unauthorized amount until we can resolve this matter in accordance with the law. Please be aware that intentional collection of an amount not authorized by the agreement creating the debt or by law is in explicit violation of consumer protection statutes, such as the FD CPA and RFD CPA. Failure to address this matter conscientiously may result in legal action, and I will not hesitate to protect my rights as a debtor under these laws. I kindly request that you acknowledge receipt of this letter within 15 days from the date you receive it, as well as provide me with a detailed response addressing the concerns raised herein. I expect this matter to be resolved within 30 days of your receipt of this letter. Failure to respond or resolve this dispute to my satisfaction will leave me with no choice but to pursue further legal actions available to me. Please note that I will keep a record of all correspondence and communications related to this matter. Your prompt attention to this issue is greatly appreciated. I look forward to a satisfactory resolution. Yours sincerely, [Your Name]