Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

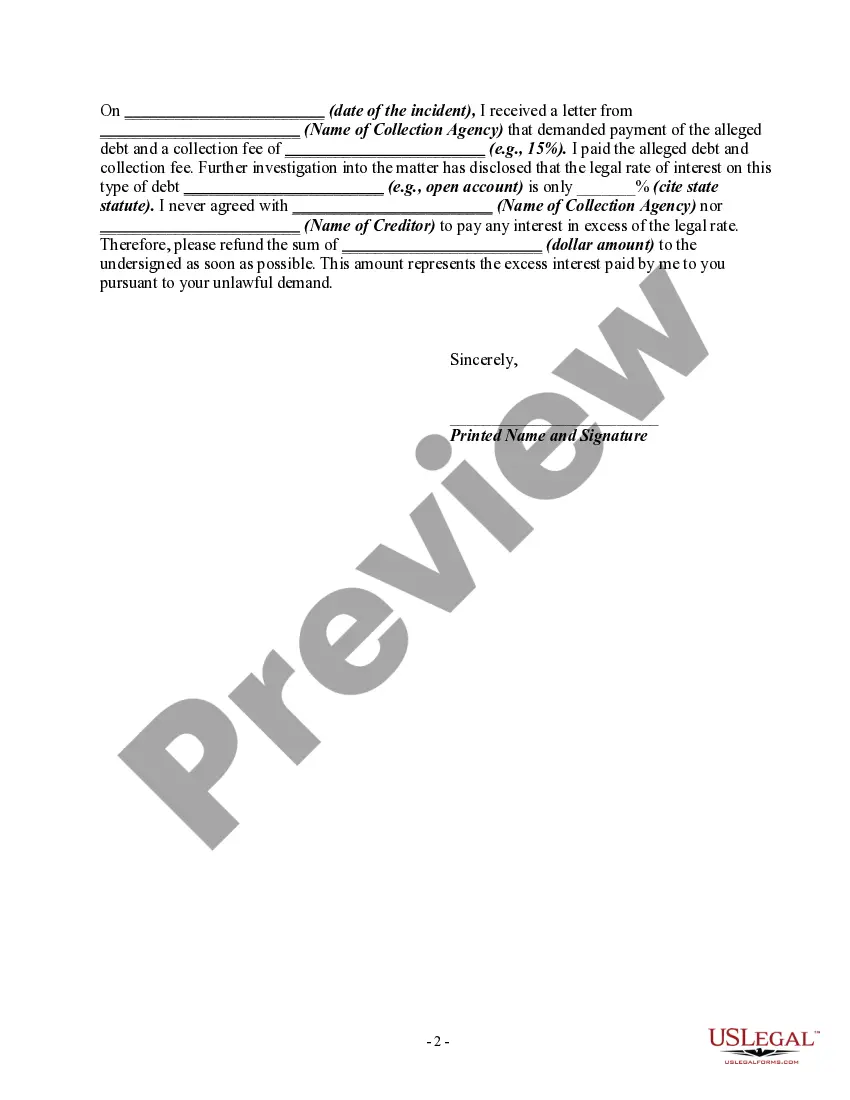

Title: San Jose California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Introduction: This letter serves as a formal complaint against [Debt Collector's Name] regarding their unfair practices in collection activities, specifically collecting an amount that was not authorized by the agreement creating the debt or by law. As a resident of San Jose, California, I am exercising my rights under the Fair Debt Collection Practices Act (FD CPA) to address this issue and demand immediate action. The use of relevant keywords in this letter will reinforce the seriousness of the matter and urge the debt collector to rectify their actions promptly. Content: 1. Sender's Information: — Full Nam— - Address - City, State, Zip Code — PhonNumberbe— - Email Address 2. Recipient's Information: — Debt Collector's Nam— - Address - City, State, Zip Code 3. Subject Line: Letter Informing Debt Collector of Unfair Practices in Collection Activities 4. Salutation: Dear [Debt Collector's Name], 5. Statement of Complaint: Clearly state the reason for this letter, emphasizing the unfair practice of collecting an amount that was not authorized by the agreement creating the debt or by law. Cite any specific instances or evidence that support your claim. 6. Relevant Keywords: — Unfair collection practice— - Violation of FD CPA - Unauthorized debt collection — Illegal debt collection activities — Violation of debtor's right— - San Jose, California debt collection regulations — Agreement terms and authorized debt collection amount — Breach of contract 7. Detailed Account of Events: Provide a chronological account of the events that transpired, highlighting the instances where the debt collector collected an amount that exceeded the authorized limits set by the agreement or violated debt collection laws. 8. Supporting Evidence: Attach copies of any relevant documents that support your claim, such as the original debt agreement, correspondence with the debt collector, or any receipts or bills indicating the amount collected. Make sure to keep the originals for your own records. 9. Demand for Immediate Action: State your expectation for immediate action from the debt collector, such as ceasing collection activities, correcting the amount owed, or providing a valid explanation for their actions. Indicate the deadline by which you expect a response for resolution. 10. Legal Consequences Reminder: Remind the debt collector of the potential legal consequences they may face if they fail to rectify the situation. Refer to relevant laws, such as the FD CPA and California state debt collection regulations, to reinforce the seriousness of the matter. 11. Request for Confirmation: Politely ask the debt collector to confirm in writing that they have received your complaint and are taking action to address your concerns. 12. Conclusion: Thank the debt collector for their attention to this matter and express your hope for a swift resolution that is fair and in compliance with the law. 13. Closing: Sincerely, 14. Signature: Handwritten signature It is important to note that while this general template provides guidance, it's advisable to consult an attorney or debt collection professional to customize the letter according to your specific circumstances and applicable laws in San Jose, California.Title: San Jose California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law Introduction: This letter serves as a formal complaint against [Debt Collector's Name] regarding their unfair practices in collection activities, specifically collecting an amount that was not authorized by the agreement creating the debt or by law. As a resident of San Jose, California, I am exercising my rights under the Fair Debt Collection Practices Act (FD CPA) to address this issue and demand immediate action. The use of relevant keywords in this letter will reinforce the seriousness of the matter and urge the debt collector to rectify their actions promptly. Content: 1. Sender's Information: — Full Nam— - Address - City, State, Zip Code — PhonNumberbe— - Email Address 2. Recipient's Information: — Debt Collector's Nam— - Address - City, State, Zip Code 3. Subject Line: Letter Informing Debt Collector of Unfair Practices in Collection Activities 4. Salutation: Dear [Debt Collector's Name], 5. Statement of Complaint: Clearly state the reason for this letter, emphasizing the unfair practice of collecting an amount that was not authorized by the agreement creating the debt or by law. Cite any specific instances or evidence that support your claim. 6. Relevant Keywords: — Unfair collection practice— - Violation of FD CPA - Unauthorized debt collection — Illegal debt collection activities — Violation of debtor's right— - San Jose, California debt collection regulations — Agreement terms and authorized debt collection amount — Breach of contract 7. Detailed Account of Events: Provide a chronological account of the events that transpired, highlighting the instances where the debt collector collected an amount that exceeded the authorized limits set by the agreement or violated debt collection laws. 8. Supporting Evidence: Attach copies of any relevant documents that support your claim, such as the original debt agreement, correspondence with the debt collector, or any receipts or bills indicating the amount collected. Make sure to keep the originals for your own records. 9. Demand for Immediate Action: State your expectation for immediate action from the debt collector, such as ceasing collection activities, correcting the amount owed, or providing a valid explanation for their actions. Indicate the deadline by which you expect a response for resolution. 10. Legal Consequences Reminder: Remind the debt collector of the potential legal consequences they may face if they fail to rectify the situation. Refer to relevant laws, such as the FD CPA and California state debt collection regulations, to reinforce the seriousness of the matter. 11. Request for Confirmation: Politely ask the debt collector to confirm in writing that they have received your complaint and are taking action to address your concerns. 12. Conclusion: Thank the debt collector for their attention to this matter and express your hope for a swift resolution that is fair and in compliance with the law. 13. Closing: Sincerely, 14. Signature: Handwritten signature It is important to note that while this general template provides guidance, it's advisable to consult an attorney or debt collection professional to customize the letter according to your specific circumstances and applicable laws in San Jose, California.