A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."

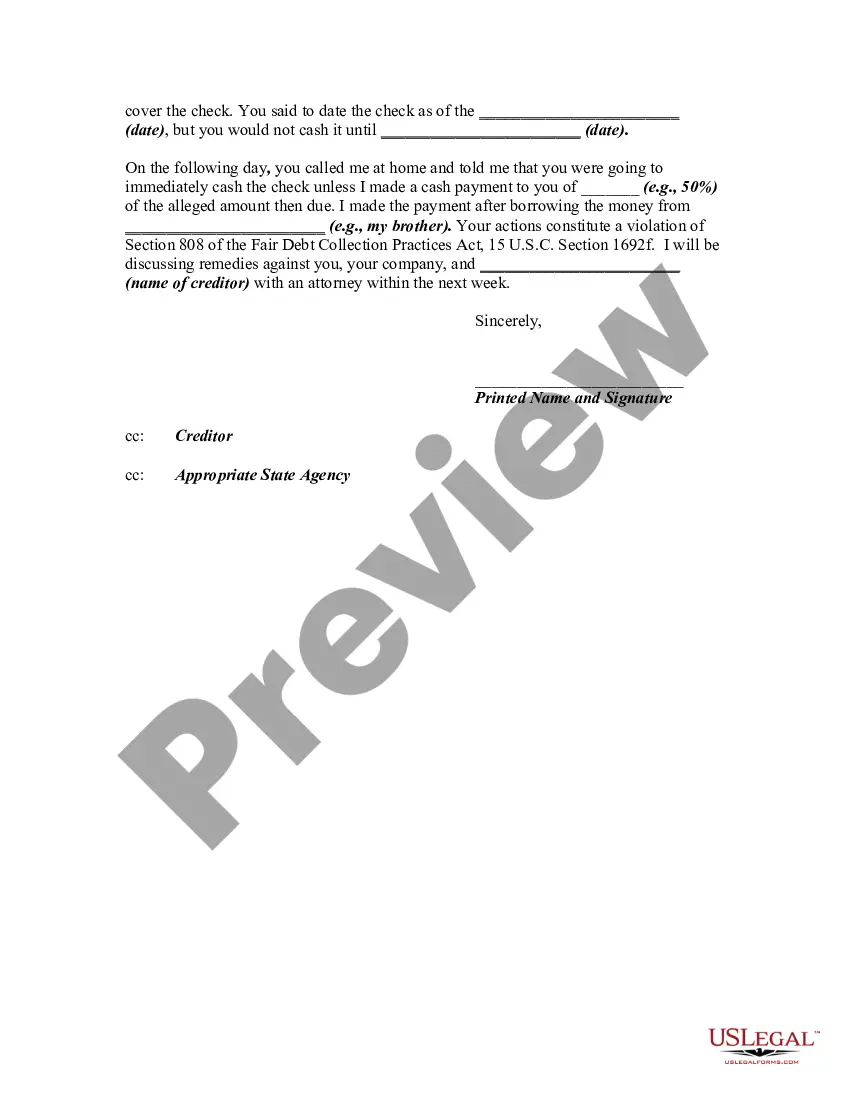

Alameda, California is a vibrant city, located in Alameda County, on the eastern shore of San Francisco Bay. It is known for its beautiful beaches, diverse culture, and charming historic neighborhoods. With its mild climate and picturesque landscapes, Alameda offers residents and visitors numerous recreational activities such as sailing, kayaking, and hiking. Now, let's delve into the important topic of debt collection practices and how to address unfair activities by debt collectors when they solicit postdated checks for the purpose of depositing or threatening to deposit them prior to the date specified on the check. If you find yourself in such a situation, it is crucial to know your rights and take appropriate action. One type of letter you might want to consider is a "Cease and Desist Letter." This letter notifies the debt collector that their actions are in violation of the Fair Debt Collection Practices Act (FD CPA) and demands an immediate end to the unfair practice of soliciting postdated checks for early deposit. It is important to clearly state the details, including the dates of communication, the debt amount, and any supporting evidence. Another type of letter could be an "Intent to File Complaint" letter. This formal letter would inform the debt collector that if their unfair practice continues, you are prepared to escalate the matter by filing a complaint with appropriate regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC). Include relevant information, such as the debt collector's contact details, any reference numbers associated with your account, and a comprehensive description of the unfair activity. When drafting your Alameda, California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Soliciting a Postdated Check for the Purpose of Depositing or Threatening to Deposit the Check Prior to the Date on the Check, be sure to incorporate relevant keywords to ensure maximum accuracy and search engine optimization (SEO). Keywords such as "Alameda debt collection practices," "unfair debt collection," "postdated check solicitation," "debt collector FD CPA violations," and "debt collection complaint process" can help your letter reach a wider audience and improve its visibility online. Remember, it is vital to consult legal advice or use templates from reputable sources when drafting these letters to ensure accuracy and effectiveness. Your letter should clearly express your concerns, provide evidence if available, and assert your rights as a consumer to end any unfair debt collection practices.Alameda, California is a vibrant city, located in Alameda County, on the eastern shore of San Francisco Bay. It is known for its beautiful beaches, diverse culture, and charming historic neighborhoods. With its mild climate and picturesque landscapes, Alameda offers residents and visitors numerous recreational activities such as sailing, kayaking, and hiking. Now, let's delve into the important topic of debt collection practices and how to address unfair activities by debt collectors when they solicit postdated checks for the purpose of depositing or threatening to deposit them prior to the date specified on the check. If you find yourself in such a situation, it is crucial to know your rights and take appropriate action. One type of letter you might want to consider is a "Cease and Desist Letter." This letter notifies the debt collector that their actions are in violation of the Fair Debt Collection Practices Act (FD CPA) and demands an immediate end to the unfair practice of soliciting postdated checks for early deposit. It is important to clearly state the details, including the dates of communication, the debt amount, and any supporting evidence. Another type of letter could be an "Intent to File Complaint" letter. This formal letter would inform the debt collector that if their unfair practice continues, you are prepared to escalate the matter by filing a complaint with appropriate regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC). Include relevant information, such as the debt collector's contact details, any reference numbers associated with your account, and a comprehensive description of the unfair activity. When drafting your Alameda, California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Soliciting a Postdated Check for the Purpose of Depositing or Threatening to Deposit the Check Prior to the Date on the Check, be sure to incorporate relevant keywords to ensure maximum accuracy and search engine optimization (SEO). Keywords such as "Alameda debt collection practices," "unfair debt collection," "postdated check solicitation," "debt collector FD CPA violations," and "debt collection complaint process" can help your letter reach a wider audience and improve its visibility online. Remember, it is vital to consult legal advice or use templates from reputable sources when drafting these letters to ensure accuracy and effectiveness. Your letter should clearly express your concerns, provide evidence if available, and assert your rights as a consumer to end any unfair debt collection practices.