A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."

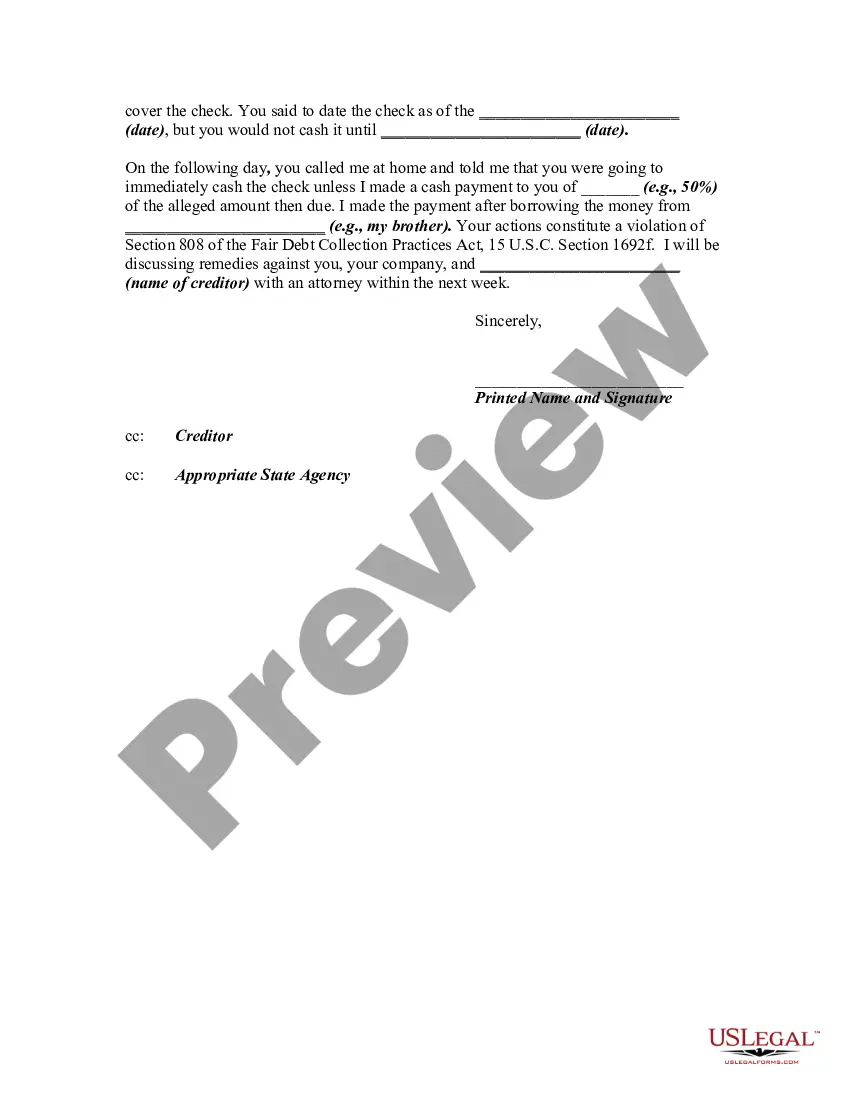

Title: Addressing Unfair Practices: Cuyahoga Ohio Letter Informing Debt Collector of Unfair Solicitation of Postdated Checks Introduction: In Cuyahoga, Ohio, individuals have the right to protect themselves from unfair practices by debt collectors. One concerning practice is the solicitation of postdated checks for the purpose of depositing them before the agreed-upon date, or threatening to do so. This article aims to provide a detailed description of what this practice entails, its potential consequences, and how individuals can draft a comprehensive letter to inform debt collectors of their unfair collection activities. Key Points: 1. Understanding the Unfair Practice: — Debt collectors may request a debtor to provide a postdated check as part of a payment plan. — Typically, the postdated check signifies that the payment should be deposited on a specific future date. — Unfair solicitation occurs when debt collectors deposit or threaten to deposit the postdated check before the agreed-upon date. — This practice undermines the debtor's intent, potentially causing financial hardships or overdraft fees. 2. Consequences of Unfair Collection Activities: — Depositing or threatening to deposit postdated checks prematurely violates the debtor's rights and can lead to legal consequences. — Debt collectors engaging in this unfair practice may incur penalties or face legal action. — Debtors may suffer financial instability, bank penalties, and a damaged credit score due to the premature withdrawal of funds. 3. Drafting a Comprehensive Letter: — Heading: Clearly state that this is a formal letter addressing unfair practices in debt collection. — Introductory Paragraph: Introduce yourself as the debtor and provide key information such as account details and dates of interaction. — State the Concern: Clearly describe the unfair practice involving the solicitation or premature depositing of postdated checks. — Cite Legal Regulations: Reference applicable state and federal laws that prohibit this unfair practice. — Demand Remedial Actions: Politely request that the debt collector ceases such activities immediately and provide a warning about potential legal actions if necessary. — Request Response: Ask for a written response acknowledging the receipt of the letter and confirming the debt collector's commitment to rectify their actions. — Closing: Provide contact details and express gratitude for their attention to the matter. Conclusion: Protecting oneself from unfair practices in debt collection is essential, and individuals in Cuyahoga, Ohio have the right to address these issues accordingly. By drafting a comprehensive letter to inform debt collectors of their unfair practice of soliciting or prematurely depositing postdated checks, debtors can assert their rights and potentially prevent further negative consequences. Note: Different types of letters may include a variation in content, such as addressing different unfair practices or targeting specific debt collection agencies.Title: Addressing Unfair Practices: Cuyahoga Ohio Letter Informing Debt Collector of Unfair Solicitation of Postdated Checks Introduction: In Cuyahoga, Ohio, individuals have the right to protect themselves from unfair practices by debt collectors. One concerning practice is the solicitation of postdated checks for the purpose of depositing them before the agreed-upon date, or threatening to do so. This article aims to provide a detailed description of what this practice entails, its potential consequences, and how individuals can draft a comprehensive letter to inform debt collectors of their unfair collection activities. Key Points: 1. Understanding the Unfair Practice: — Debt collectors may request a debtor to provide a postdated check as part of a payment plan. — Typically, the postdated check signifies that the payment should be deposited on a specific future date. — Unfair solicitation occurs when debt collectors deposit or threaten to deposit the postdated check before the agreed-upon date. — This practice undermines the debtor's intent, potentially causing financial hardships or overdraft fees. 2. Consequences of Unfair Collection Activities: — Depositing or threatening to deposit postdated checks prematurely violates the debtor's rights and can lead to legal consequences. — Debt collectors engaging in this unfair practice may incur penalties or face legal action. — Debtors may suffer financial instability, bank penalties, and a damaged credit score due to the premature withdrawal of funds. 3. Drafting a Comprehensive Letter: — Heading: Clearly state that this is a formal letter addressing unfair practices in debt collection. — Introductory Paragraph: Introduce yourself as the debtor and provide key information such as account details and dates of interaction. — State the Concern: Clearly describe the unfair practice involving the solicitation or premature depositing of postdated checks. — Cite Legal Regulations: Reference applicable state and federal laws that prohibit this unfair practice. — Demand Remedial Actions: Politely request that the debt collector ceases such activities immediately and provide a warning about potential legal actions if necessary. — Request Response: Ask for a written response acknowledging the receipt of the letter and confirming the debt collector's commitment to rectify their actions. — Closing: Provide contact details and express gratitude for their attention to the matter. Conclusion: Protecting oneself from unfair practices in debt collection is essential, and individuals in Cuyahoga, Ohio have the right to address these issues accordingly. By drafting a comprehensive letter to inform debt collectors of their unfair practice of soliciting or prematurely depositing postdated checks, debtors can assert their rights and potentially prevent further negative consequences. Note: Different types of letters may include a variation in content, such as addressing different unfair practices or targeting specific debt collection agencies.