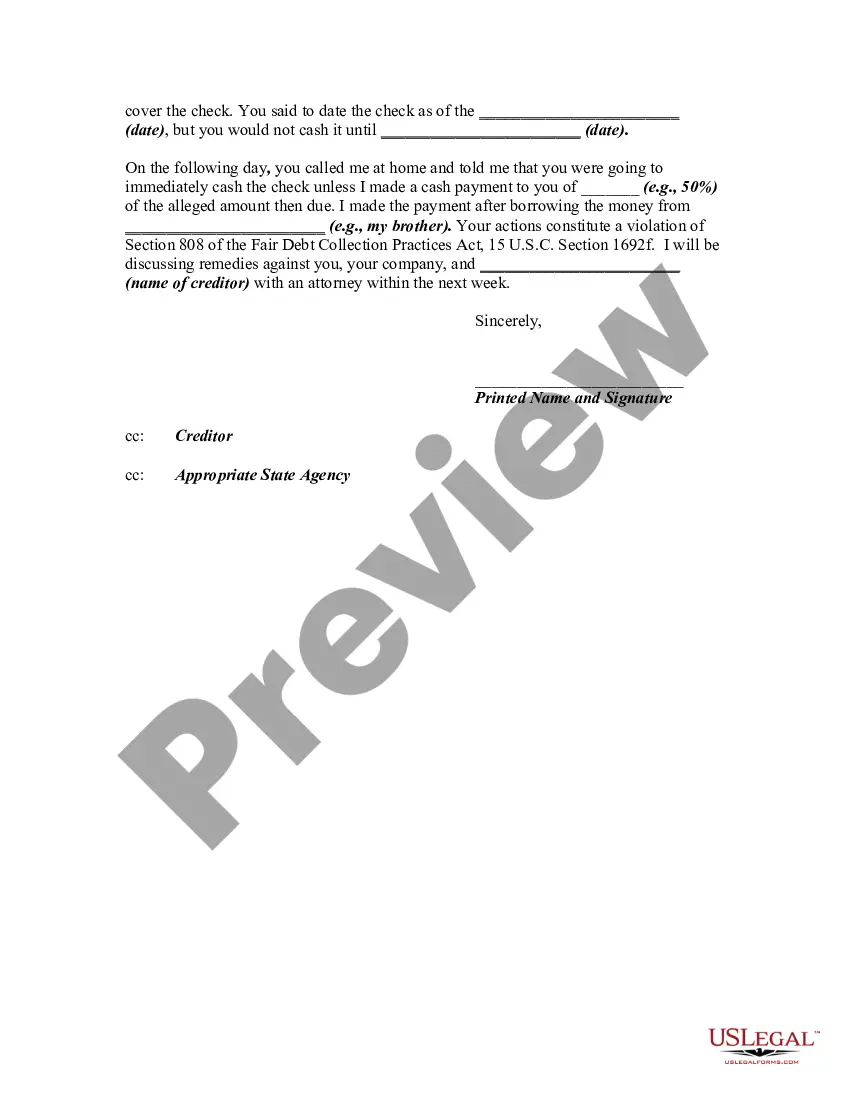

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."

Title: Addressing Unfair Debt Collection Practices in Mecklenburg, North Carolina — Unfair Solicitation of Postdated Checks Introduction: In Mecklenburg, North Carolina, individuals may encounter unfair debt collection practices, including the solicitation of postdated checks by debt collectors for depositing or threatening to deposit them before the agreed-upon date. Such practices infringe upon consumer rights and can cause undue financial stress. To counter these unethical actions, it is essential to draft a Letter Informing Debt Collector of Unfair Practices in Collection Activities — specifically, soliciting postdated checks- to protect one's rights and bring attention to the issue. Key Keywords: 1. Mecklenburg, North Carolina 2. Debt collector 3. Unfair practices 4. Collection activities 5. Soliciting postdated checks 6. Depositing postdated checks 7. Threatening to deposit postdated checks 8. Consumer rights Content: I. Introduction: Addressing Unfair Debt Collection Practices A. Importance of maintaining fair debt collection practices B. Overview of solicitation of postdated checks as an unfair practice in Mecklenburg, NC C. Purpose of the letter: Protecting consumer rights and reporting the unfair practices II. Legal Rights: Understanding Consumer Protections A. Highlighting federal and state laws that protect consumers' rights B. Identifying specific regulations in Mecklenburg, NC that prohibit unfair debt collection practices C. Emphasizing the right to dispute inaccurate debt claims III. Unfair Practice — Soliciting Postdated Checks A. Definition of a postdated check and its intended purpose B. Explaining the unfairness of soliciting postdated checks for premature deposit or threats thereof C. Clarifying that the collection activities compromise the legal validity of the check IV. Negative Consequences of Unfair Debt Collection Practices A. Financial implications of premature check deposits B. Impact on consumers' bank accounts, causing overdraft fees and additional financial burdens C. Negative implications for credit scores and financial standing V. Drafting the Letter Informing Debt Collector of Unfair Practices A. Addressing the letter to the appropriate authority, such as a senior debt collector or supervisor B. Including the date, subject, and your contact details for easy identification C. Accurate and concise description of the unfair solicitation of postdated checks D. Assertively requesting an immediate cessation of these unfair practices E. Politely demanding a written acknowledgement of receipt and action taken VI. Supporting Documentation and Evidence A. Maintaining copies of all relevant communication with the debt collector B. Including any evidence supporting the claim of solicitation of postdated checks C. Encouraging the debt collector to review the attached evidence before responding VII. Conclusion A. Restating the importance of fair debt collection practices and consumer rights in Mecklenburg, NC B. Encouraging proactive measures to report unfair collection practices to relevant authorities C. Expressing hope for swift action and resolution of the matter (Note: For different types of debt collection practices letters, one can modify the content to specifically address other unfair practices such as harassment, misrepresentation, or legal violations by debt collectors.)Title: Addressing Unfair Debt Collection Practices in Mecklenburg, North Carolina — Unfair Solicitation of Postdated Checks Introduction: In Mecklenburg, North Carolina, individuals may encounter unfair debt collection practices, including the solicitation of postdated checks by debt collectors for depositing or threatening to deposit them before the agreed-upon date. Such practices infringe upon consumer rights and can cause undue financial stress. To counter these unethical actions, it is essential to draft a Letter Informing Debt Collector of Unfair Practices in Collection Activities — specifically, soliciting postdated checks- to protect one's rights and bring attention to the issue. Key Keywords: 1. Mecklenburg, North Carolina 2. Debt collector 3. Unfair practices 4. Collection activities 5. Soliciting postdated checks 6. Depositing postdated checks 7. Threatening to deposit postdated checks 8. Consumer rights Content: I. Introduction: Addressing Unfair Debt Collection Practices A. Importance of maintaining fair debt collection practices B. Overview of solicitation of postdated checks as an unfair practice in Mecklenburg, NC C. Purpose of the letter: Protecting consumer rights and reporting the unfair practices II. Legal Rights: Understanding Consumer Protections A. Highlighting federal and state laws that protect consumers' rights B. Identifying specific regulations in Mecklenburg, NC that prohibit unfair debt collection practices C. Emphasizing the right to dispute inaccurate debt claims III. Unfair Practice — Soliciting Postdated Checks A. Definition of a postdated check and its intended purpose B. Explaining the unfairness of soliciting postdated checks for premature deposit or threats thereof C. Clarifying that the collection activities compromise the legal validity of the check IV. Negative Consequences of Unfair Debt Collection Practices A. Financial implications of premature check deposits B. Impact on consumers' bank accounts, causing overdraft fees and additional financial burdens C. Negative implications for credit scores and financial standing V. Drafting the Letter Informing Debt Collector of Unfair Practices A. Addressing the letter to the appropriate authority, such as a senior debt collector or supervisor B. Including the date, subject, and your contact details for easy identification C. Accurate and concise description of the unfair solicitation of postdated checks D. Assertively requesting an immediate cessation of these unfair practices E. Politely demanding a written acknowledgement of receipt and action taken VI. Supporting Documentation and Evidence A. Maintaining copies of all relevant communication with the debt collector B. Including any evidence supporting the claim of solicitation of postdated checks C. Encouraging the debt collector to review the attached evidence before responding VII. Conclusion A. Restating the importance of fair debt collection practices and consumer rights in Mecklenburg, NC B. Encouraging proactive measures to report unfair collection practices to relevant authorities C. Expressing hope for swift action and resolution of the matter (Note: For different types of debt collection practices letters, one can modify the content to specifically address other unfair practices such as harassment, misrepresentation, or legal violations by debt collectors.)