A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."

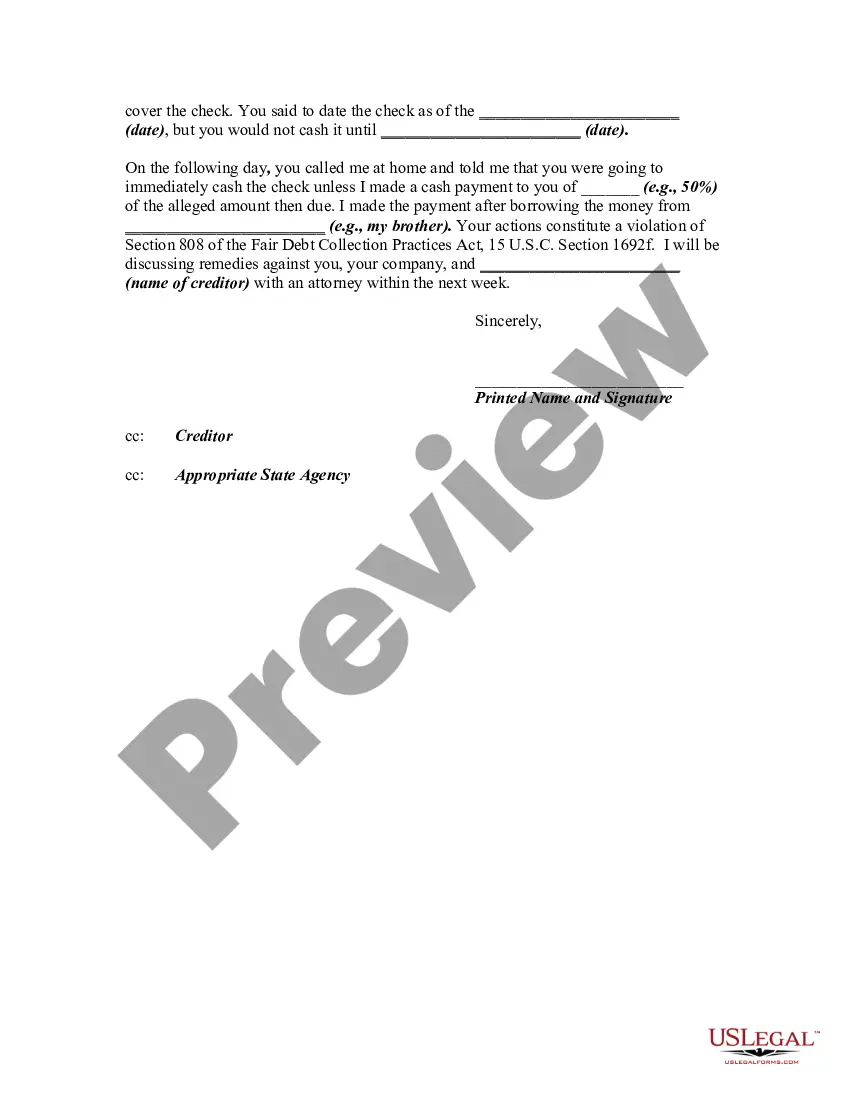

Title: Santa Clara, California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Soliciting a Postdated Check for the Purpose of Depositing or Threatening to Deposit the Check Prior to the Date on the Check Introduction: If you find yourself in a situation where a debt collector in Santa Clara, California has engaged in unfair practices by soliciting a postdated check or threatening to deposit it before the agreed upon date, it is crucial to take immediate action. This letter serves as a formal notification to bring attention to the debt collector's unethical behavior and demand that they cease such practices in accordance with the law. Key Points to Include in the Letter: 1. Identifying Information: — Your full name, address, and contact details. — Debt collector's full name, address, and contact details. — Date of the letter. 2. Clear Statement of Unfair Practice: Clearly state that the purpose of this letter is to address the debt collector's unfair collection practices. Detail the specific activity being contested, such as soliciting a postdated check with the intention of depositing or threatening to deposit it prior to the agreed date mentioned on the check. 3. Legal Grounds: Mention the relevant laws, regulations, or codes that prohibit such actions. For example, in California, it is prohibited under the Fair Debt Collections Practices Act (FD CPA) and the Rosenthal Fair Debt Collection Practices Act (RFD CPA) to engage in unfair or deceptive practices. 4. Supporting Evidence: Present any available evidence supporting your claim. This may include copies of the postdated check, any communication or correspondence exchanged with the debt collector regarding the check, and any records or logs of collection calls or meetings. 5. Consequences: Clearly state the consequences the debt collector may face if they continue the unlawful collection activity. Cite potential legal actions, complaints to relevant regulatory bodies, and negative publicity that may arise as a result of their actions. 6. Demand for Action: Formally demand that the debt collector ceases all unfair collection practices immediately. Explicitly instruct them to refrain from soliciting postdated checks or threatening premature deposits in the future. 7. Request for Confirmation: Ask the debt collector to confirm in writing, within a specific timeframe, that they have received and understood your letter, and that they will cease the mentioned unfair practices. 8. Enclosure: Include a list of all documents enclosed with the letter (e.g., copies of postdated checks, correspondence, and evidence). 9. Keeping a Copy: State that a copy of the letter is being kept for your records. Conclusion: In conclusion, it is essential to address any unfair collection practices proactively, ensuring your rights are protected as a consumer. By sending a detailed letter to the debt collector in Santa Clara, California, communicating your objections, demands, and legal grounds, you assert your rights and urge them to rectify their actions. Additional Types of Santa Clara California Letters Informing Debt Collector of Unfair Practices in Collection Activities: — Santa Clara, California Letter Informing Debt Collector of Unauthorized Communication with Third Parties — Santa Clara, California Letter Informing Debt Collector of Harassment or Abuse during Collection Activities — Santa Clara, California Letter Informing Debt Collector of Threats of Legal Action without Intent to Proceed — Santa Clara, California Letter Informing Debt Collector of Misrepresentation or False Statements during Collection Activities.Title: Santa Clara, California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Soliciting a Postdated Check for the Purpose of Depositing or Threatening to Deposit the Check Prior to the Date on the Check Introduction: If you find yourself in a situation where a debt collector in Santa Clara, California has engaged in unfair practices by soliciting a postdated check or threatening to deposit it before the agreed upon date, it is crucial to take immediate action. This letter serves as a formal notification to bring attention to the debt collector's unethical behavior and demand that they cease such practices in accordance with the law. Key Points to Include in the Letter: 1. Identifying Information: — Your full name, address, and contact details. — Debt collector's full name, address, and contact details. — Date of the letter. 2. Clear Statement of Unfair Practice: Clearly state that the purpose of this letter is to address the debt collector's unfair collection practices. Detail the specific activity being contested, such as soliciting a postdated check with the intention of depositing or threatening to deposit it prior to the agreed date mentioned on the check. 3. Legal Grounds: Mention the relevant laws, regulations, or codes that prohibit such actions. For example, in California, it is prohibited under the Fair Debt Collections Practices Act (FD CPA) and the Rosenthal Fair Debt Collection Practices Act (RFD CPA) to engage in unfair or deceptive practices. 4. Supporting Evidence: Present any available evidence supporting your claim. This may include copies of the postdated check, any communication or correspondence exchanged with the debt collector regarding the check, and any records or logs of collection calls or meetings. 5. Consequences: Clearly state the consequences the debt collector may face if they continue the unlawful collection activity. Cite potential legal actions, complaints to relevant regulatory bodies, and negative publicity that may arise as a result of their actions. 6. Demand for Action: Formally demand that the debt collector ceases all unfair collection practices immediately. Explicitly instruct them to refrain from soliciting postdated checks or threatening premature deposits in the future. 7. Request for Confirmation: Ask the debt collector to confirm in writing, within a specific timeframe, that they have received and understood your letter, and that they will cease the mentioned unfair practices. 8. Enclosure: Include a list of all documents enclosed with the letter (e.g., copies of postdated checks, correspondence, and evidence). 9. Keeping a Copy: State that a copy of the letter is being kept for your records. Conclusion: In conclusion, it is essential to address any unfair collection practices proactively, ensuring your rights are protected as a consumer. By sending a detailed letter to the debt collector in Santa Clara, California, communicating your objections, demands, and legal grounds, you assert your rights and urge them to rectify their actions. Additional Types of Santa Clara California Letters Informing Debt Collector of Unfair Practices in Collection Activities: — Santa Clara, California Letter Informing Debt Collector of Unauthorized Communication with Third Parties — Santa Clara, California Letter Informing Debt Collector of Harassment or Abuse during Collection Activities — Santa Clara, California Letter Informing Debt Collector of Threats of Legal Action without Intent to Proceed — Santa Clara, California Letter Informing Debt Collector of Misrepresentation or False Statements during Collection Activities.