A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."

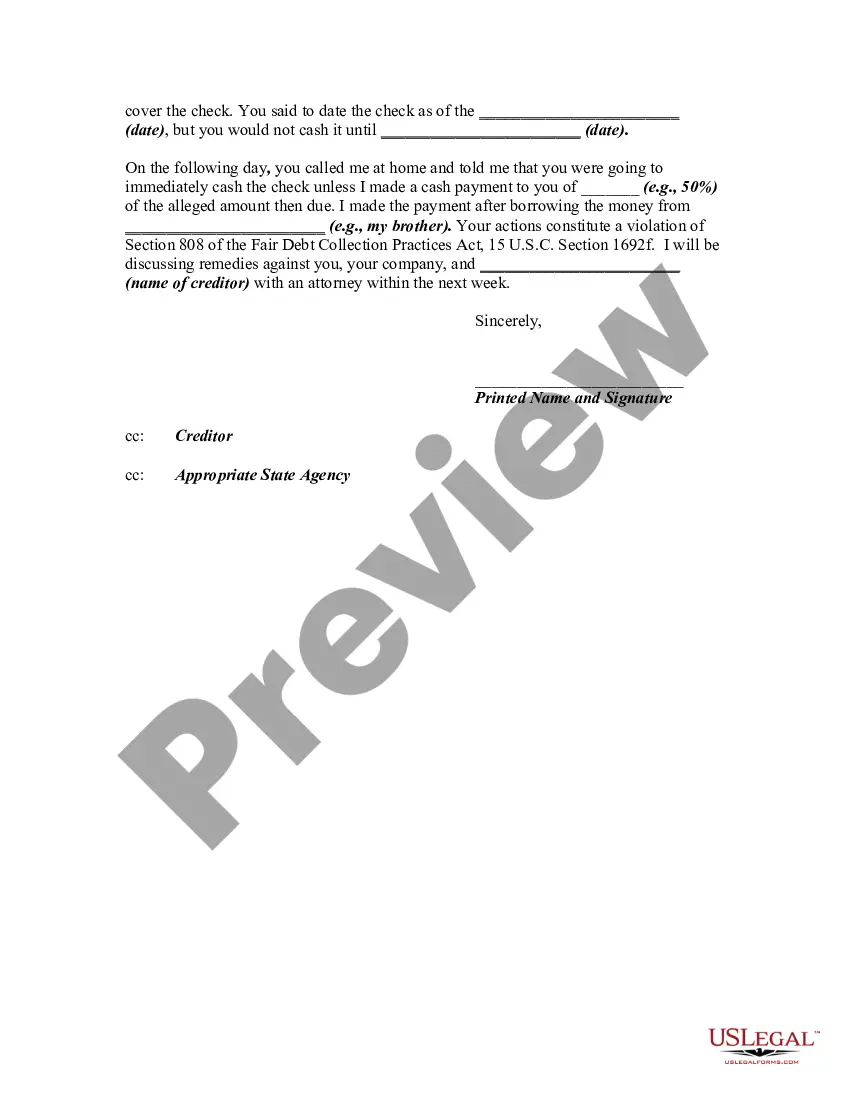

Title: Travis Texas Letter Informing Debt Collector of Unfair Practices — Postdated Check Solicitation Introduction: Dealing with debt collectors is never easy, but it is important to know your rights and what constitutes unfair practices. One such practice is when debt collectors request or threaten to deposit a postdated check before its intended date. This article will provide a detailed description of the Travis Texas Letter that can be used to inform debt collectors of their unfair practices. Key Elements of the Travis Texas Letter: 1. Addressing the recipient: The letter should be addressed to the debt collector or collection agency responsible for the unfair practice. Include their name, company name, and contact information if available. 2. Statement of purpose: Begin the letter by clearly stating its purpose, which is to inform the debt collector of the unfair practice related to soliciting a postdated check. 3. Brief explanation of postdated checks: Provide a concise definition and explanation of what a postdated check is, emphasizing that it has a future date and should not be deposited or threatened to be deposited beforehand. 4. Description of the unfair practice: Describe the exact behavior exhibited by the debt collector that violates fair debt collection laws. Focus on their request for a postdated check or the threat to deposit the check before its agreed-upon date. 5. Reference to relevant laws and regulations: Mention specific laws or regulations that protect consumers from unfair debt collection practices. In Travis Texas, this can include references to the Fair Debt Collection Practices Act (FD CPA), as well as state-level laws and guidelines. 6. Demand to cease and desist: Clearly state that the debt collector must immediately cease soliciting or threatening to deposit postdated checks before their intended date. Request confirmation in writing that they will comply with this demand. 7. Consequences of non-compliance: Address the potential consequences the debt collector may face if they fail to cease the unfair practice, such as legal action and reporting their behavior to relevant regulatory agencies. 8. Request for documentation: Encourage the debt collector to provide a written response within a specified time frame, confirming their acknowledgment and compliance with the letter's content. 9. Contact information: Include your name, address, phone number, and email address within the letter for the debt collector to communicate with you regarding the matter. Types of Travis Texas Letters Informing Debt Collectors of Unfair Practices: While the specific issue addressed here is the solicitation or threatening deposit of postdated checks, it's essential to note that there can be various other types of unfair practices in debt collection. Some examples include harassment, misrepresentation, false threats, and unauthorized sharing of personal information. Each of these practices would require a separate letter addressing the specific issue at hand. Conclusion: By utilizing the comprehensive Travis Texas Letter outlined above, individuals can assert their rights and inform debt collectors of their unfair practices relating to postdated check solicitation. Remember to tailor the letter to your specific situation and seek legal advice if needed.Title: Travis Texas Letter Informing Debt Collector of Unfair Practices — Postdated Check Solicitation Introduction: Dealing with debt collectors is never easy, but it is important to know your rights and what constitutes unfair practices. One such practice is when debt collectors request or threaten to deposit a postdated check before its intended date. This article will provide a detailed description of the Travis Texas Letter that can be used to inform debt collectors of their unfair practices. Key Elements of the Travis Texas Letter: 1. Addressing the recipient: The letter should be addressed to the debt collector or collection agency responsible for the unfair practice. Include their name, company name, and contact information if available. 2. Statement of purpose: Begin the letter by clearly stating its purpose, which is to inform the debt collector of the unfair practice related to soliciting a postdated check. 3. Brief explanation of postdated checks: Provide a concise definition and explanation of what a postdated check is, emphasizing that it has a future date and should not be deposited or threatened to be deposited beforehand. 4. Description of the unfair practice: Describe the exact behavior exhibited by the debt collector that violates fair debt collection laws. Focus on their request for a postdated check or the threat to deposit the check before its agreed-upon date. 5. Reference to relevant laws and regulations: Mention specific laws or regulations that protect consumers from unfair debt collection practices. In Travis Texas, this can include references to the Fair Debt Collection Practices Act (FD CPA), as well as state-level laws and guidelines. 6. Demand to cease and desist: Clearly state that the debt collector must immediately cease soliciting or threatening to deposit postdated checks before their intended date. Request confirmation in writing that they will comply with this demand. 7. Consequences of non-compliance: Address the potential consequences the debt collector may face if they fail to cease the unfair practice, such as legal action and reporting their behavior to relevant regulatory agencies. 8. Request for documentation: Encourage the debt collector to provide a written response within a specified time frame, confirming their acknowledgment and compliance with the letter's content. 9. Contact information: Include your name, address, phone number, and email address within the letter for the debt collector to communicate with you regarding the matter. Types of Travis Texas Letters Informing Debt Collectors of Unfair Practices: While the specific issue addressed here is the solicitation or threatening deposit of postdated checks, it's essential to note that there can be various other types of unfair practices in debt collection. Some examples include harassment, misrepresentation, false threats, and unauthorized sharing of personal information. Each of these practices would require a separate letter addressing the specific issue at hand. Conclusion: By utilizing the comprehensive Travis Texas Letter outlined above, individuals can assert their rights and inform debt collectors of their unfair practices relating to postdated check solicitation. Remember to tailor the letter to your specific situation and seek legal advice if needed.