A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

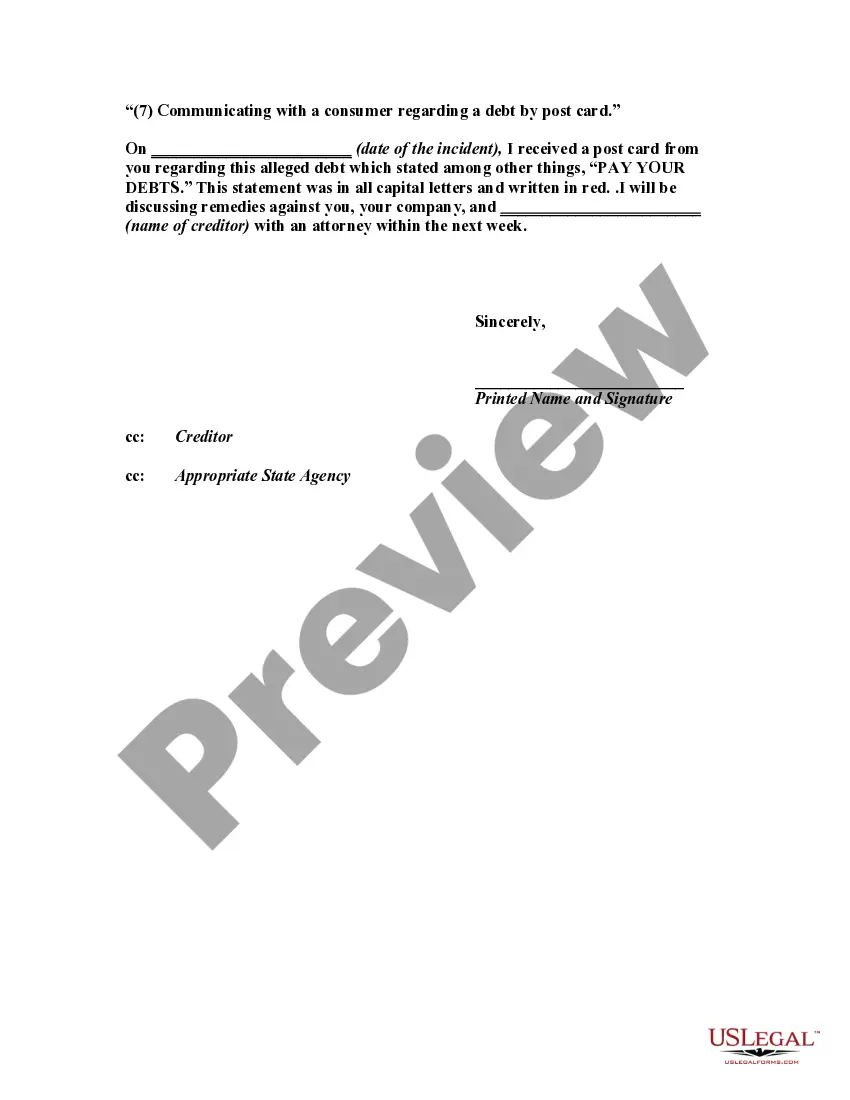

"(7) Communicating with a consumer regarding a debt by post card."

Keywords: Bexar Texas, letter, informing, debt collector, unfair practices, collection activities, communicating, consumer, debt, post card Title: Bexar Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card Introduction: In Bexar County, Texas, consumers have rights when it comes to dealing with debt collectors. This article provides a detailed description of a letter that individuals can use to inform debt collectors about unfair practices in their collection activities, specifically related to communicating with a consumer regarding a debt using a post card. Types of Bexar Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities: 1. Bexar Texas Letter Regarding Unfair Practices in Collection Activities by Post Card: This type of letter is designed to address situations where a debt collector has been using post cards to communicate with consumers regarding their outstanding debts. It focuses on informing the debt collector about the consumer's rights and the unfairness of this practice. 2. Bexar Texas Letter Informing Debt Collector of Unfair Communication Practices: This type of letter is broader and covers various unfair communication practices used by debt collectors. It highlights the specific issues faced by consumers in Bexar County, Texas, and requests the debt collector to cease these practices immediately. Components of the Letter: 1. Consumer Information: The letter should start with the consumer's full name, address, and contact details. Including this information is important to ensure that the debt collector can accurately identify and respond to the consumer's concerns. 2. Debt Collector Information: The letter should include the name, address, and contact details of the debt collector or agency in question. Providing this information helps establish clear communication between the consumer and the debt collector. 3. Reference to Unfair Practices: The letter should explicitly mention the specific unfair practices that the debt collector has been utilizing, focusing specifically on the use of post cards to communicate about the debt. It should explain why this practice is considered unfair and how it potentially violates consumer rights. 4. Consumer Rights: This section should state the rights that the consumer possesses under Texas and federal laws, including the Fair Debt Collection Practices Act (FD CPA). Mentioning these rights serves as a reminder to the debt collector of their legal obligations and the consequences of non-compliance. 5. Cease and Desist Demand: The letter should demand that the debt collector immediately cease all communication regarding the debt through post cards or any other unfair means. This section should emphasize the consumer's expectation of fair and lawful debt collection practices. 6. Documentation and Response: The letter should request written confirmation from the debt collector acknowledging receipt of the letter and a written response detailing the actions they will take to rectify the unfair practices. Encouraging debt collectors to respond in writing provides a record of communication for potential future legal actions, if necessary. Conclusion: By utilizing a Bexar Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — specifically related to communicating with a consumer regarding a debt by post card — consumers can assert their rights and demand fair treatment from debt collectors. It is crucial to keep copies of all correspondence for personal records and potential legal proceedings, should the debt collector fail to rectify the unfair practices.Keywords: Bexar Texas, letter, informing, debt collector, unfair practices, collection activities, communicating, consumer, debt, post card Title: Bexar Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card Introduction: In Bexar County, Texas, consumers have rights when it comes to dealing with debt collectors. This article provides a detailed description of a letter that individuals can use to inform debt collectors about unfair practices in their collection activities, specifically related to communicating with a consumer regarding a debt using a post card. Types of Bexar Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities: 1. Bexar Texas Letter Regarding Unfair Practices in Collection Activities by Post Card: This type of letter is designed to address situations where a debt collector has been using post cards to communicate with consumers regarding their outstanding debts. It focuses on informing the debt collector about the consumer's rights and the unfairness of this practice. 2. Bexar Texas Letter Informing Debt Collector of Unfair Communication Practices: This type of letter is broader and covers various unfair communication practices used by debt collectors. It highlights the specific issues faced by consumers in Bexar County, Texas, and requests the debt collector to cease these practices immediately. Components of the Letter: 1. Consumer Information: The letter should start with the consumer's full name, address, and contact details. Including this information is important to ensure that the debt collector can accurately identify and respond to the consumer's concerns. 2. Debt Collector Information: The letter should include the name, address, and contact details of the debt collector or agency in question. Providing this information helps establish clear communication between the consumer and the debt collector. 3. Reference to Unfair Practices: The letter should explicitly mention the specific unfair practices that the debt collector has been utilizing, focusing specifically on the use of post cards to communicate about the debt. It should explain why this practice is considered unfair and how it potentially violates consumer rights. 4. Consumer Rights: This section should state the rights that the consumer possesses under Texas and federal laws, including the Fair Debt Collection Practices Act (FD CPA). Mentioning these rights serves as a reminder to the debt collector of their legal obligations and the consequences of non-compliance. 5. Cease and Desist Demand: The letter should demand that the debt collector immediately cease all communication regarding the debt through post cards or any other unfair means. This section should emphasize the consumer's expectation of fair and lawful debt collection practices. 6. Documentation and Response: The letter should request written confirmation from the debt collector acknowledging receipt of the letter and a written response detailing the actions they will take to rectify the unfair practices. Encouraging debt collectors to respond in writing provides a record of communication for potential future legal actions, if necessary. Conclusion: By utilizing a Bexar Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — specifically related to communicating with a consumer regarding a debt by post card — consumers can assert their rights and demand fair treatment from debt collectors. It is crucial to keep copies of all correspondence for personal records and potential legal proceedings, should the debt collector fail to rectify the unfair practices.