A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

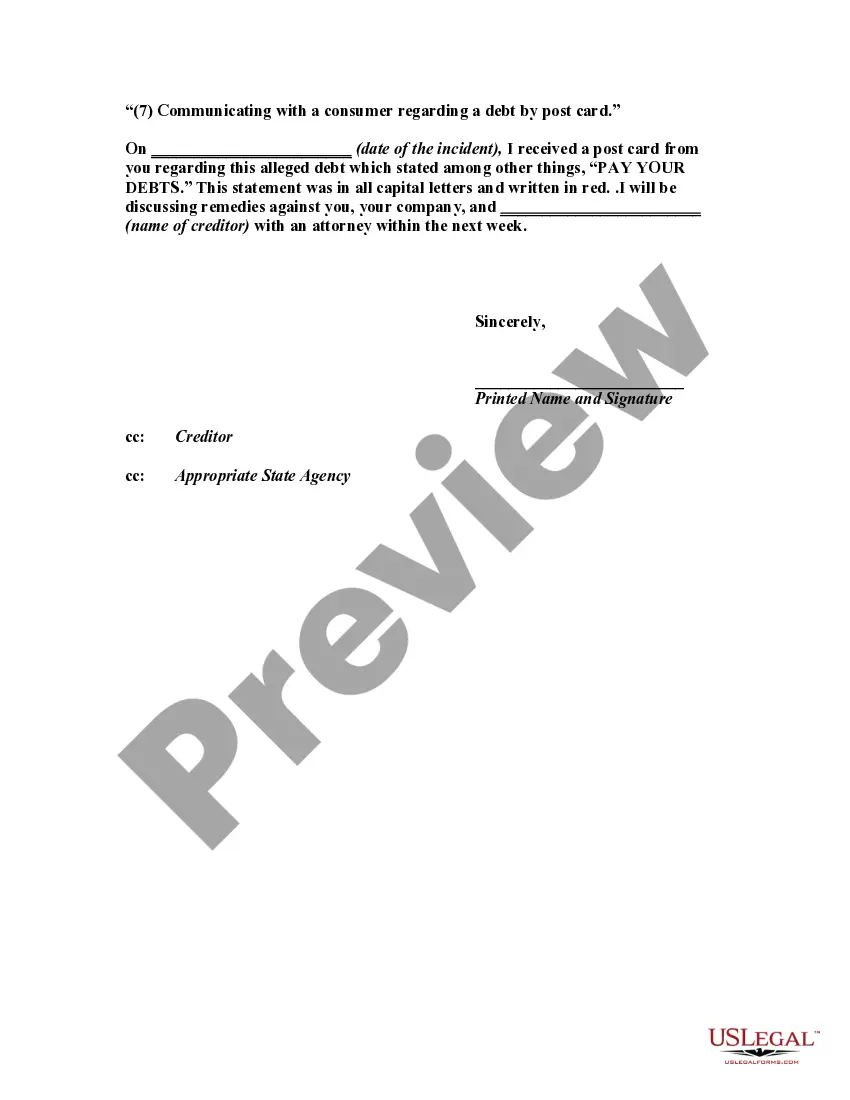

"(7) Communicating with a consumer regarding a debt by post card."

Los Angeles, California, commonly known as LA, is a vibrant and diverse city located on the West Coast of the United States. Known for its glamorous lifestyle, beautiful beaches, and thriving entertainment industry, LA is a cultural and economic hub with a population of nearly four million people. In recent years, consumer debt has become a prevalent issue in LA, as well as across the nation. This has led to the rise of debt collection agencies that aim to recover outstanding debts on behalf of creditors. However, some debt collectors engage in unfair and unethical practices, which can cause distress and harm to consumers. To address this concern, individuals in Los Angeles can write a powerful letter informing debt collectors of their unfair practices in collection activities. Communication by postcard can be an effective method to convey this message, as it ensures a documented record of the interaction. By using appropriate keywords, the letter can convey the severity of the situation and demand the debt collector to rectify their practices. Here are a few types of Los Angeles California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card: 1. Standard Complaint Letter: This type of letter outlines the unfair practices experienced by the consumer, such as harassment, false statements, or deceptive collection tactics. It emphasizes the negative impact of these practices and requests immediate cessation in a concise yet assertive tone. 2. Legal Demand Letter: A more formal approach, this type of letter cites specific laws and regulations that the debt collector is violating. It demonstrates the consumer's knowledge of their rights and demands compliance to avoid legal repercussions, such as reporting the unfair activities to relevant authorities. 3. Cease and Desist Letter: In cases of persistent and excessive harassment, a cease and desist letter can be appropriate. It demands that the debt collector immediately stop all communication attempts and provides legal consequences if they fail to comply. 4. Debt Validation Letter: To challenge the validity of a debt, a debt validation letter seeks proof of the debt's legitimacy. It states that until satisfactory documentation is provided, all collection attempts should cease, preventing further unfair practices. By using these different types of letters, individuals in Los Angeles, California, can effectively address debt collectors' unfair activities through written communication. It is crucial to incorporate relevant keywords such as "unfair practices," "deceptive collection tactics," and "cease and desist" to ensure the letter accurately conveys the consumer's concerns and expectations.Los Angeles, California, commonly known as LA, is a vibrant and diverse city located on the West Coast of the United States. Known for its glamorous lifestyle, beautiful beaches, and thriving entertainment industry, LA is a cultural and economic hub with a population of nearly four million people. In recent years, consumer debt has become a prevalent issue in LA, as well as across the nation. This has led to the rise of debt collection agencies that aim to recover outstanding debts on behalf of creditors. However, some debt collectors engage in unfair and unethical practices, which can cause distress and harm to consumers. To address this concern, individuals in Los Angeles can write a powerful letter informing debt collectors of their unfair practices in collection activities. Communication by postcard can be an effective method to convey this message, as it ensures a documented record of the interaction. By using appropriate keywords, the letter can convey the severity of the situation and demand the debt collector to rectify their practices. Here are a few types of Los Angeles California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card: 1. Standard Complaint Letter: This type of letter outlines the unfair practices experienced by the consumer, such as harassment, false statements, or deceptive collection tactics. It emphasizes the negative impact of these practices and requests immediate cessation in a concise yet assertive tone. 2. Legal Demand Letter: A more formal approach, this type of letter cites specific laws and regulations that the debt collector is violating. It demonstrates the consumer's knowledge of their rights and demands compliance to avoid legal repercussions, such as reporting the unfair activities to relevant authorities. 3. Cease and Desist Letter: In cases of persistent and excessive harassment, a cease and desist letter can be appropriate. It demands that the debt collector immediately stop all communication attempts and provides legal consequences if they fail to comply. 4. Debt Validation Letter: To challenge the validity of a debt, a debt validation letter seeks proof of the debt's legitimacy. It states that until satisfactory documentation is provided, all collection attempts should cease, preventing further unfair practices. By using these different types of letters, individuals in Los Angeles, California, can effectively address debt collectors' unfair activities through written communication. It is crucial to incorporate relevant keywords such as "unfair practices," "deceptive collection tactics," and "cease and desist" to ensure the letter accurately conveys the consumer's concerns and expectations.