A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

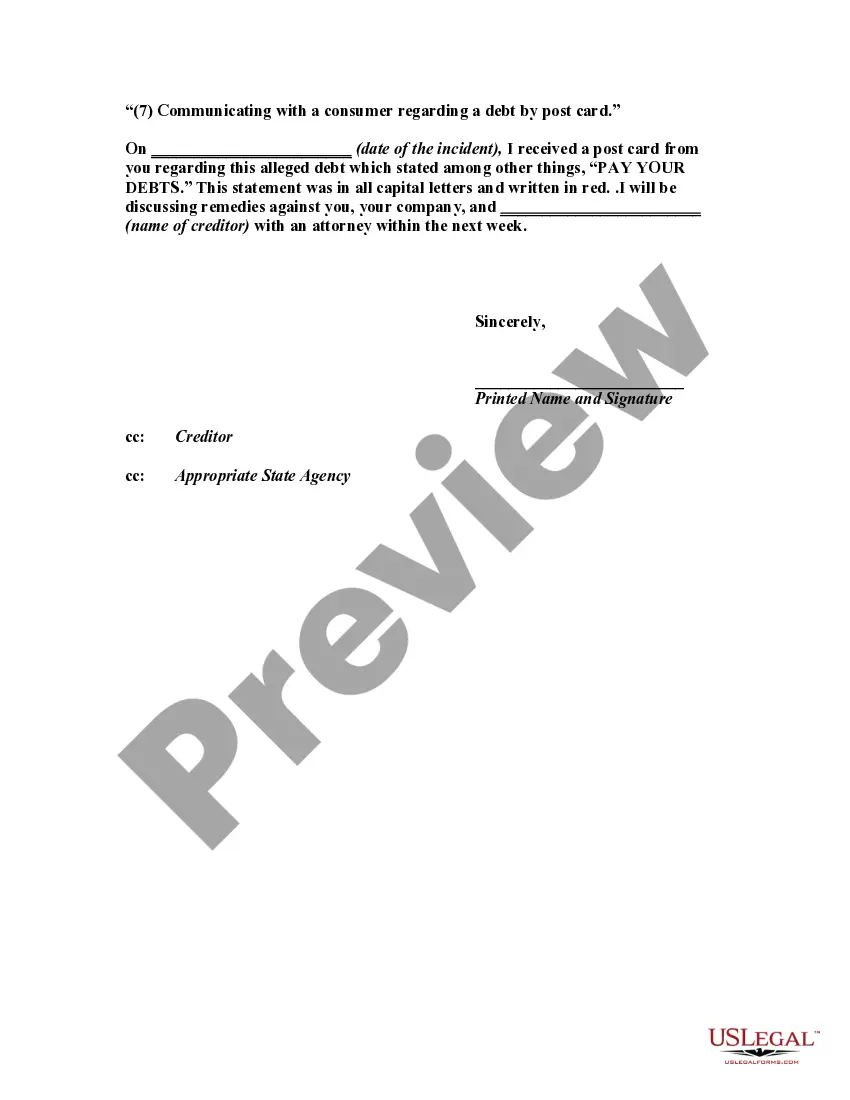

"(7) Communicating with a consumer regarding a debt by post card."

Oakland Michigan is a county located in the state of Michigan, USA. It encompasses various cities and townships, including the city of Rochester, Rochester Hills, and Auburn Hills. Oakland County is known for its vibrant communities, picturesque landscapes, and thriving business environment. When it comes to debt collection activities, it is crucial for consumers to be aware of their rights and know what actions are considered unfair or unethical. The Fair Debt Collection Practices Act (FD CPA) aims to protect consumers from abusive and deceptive practices by debt collectors. If you find yourself facing unfair collection practices in Oakland, Michigan, it is essential to address the issue promptly and protect your rights as a consumer. One method of communication that some debt collectors may employ is sending debt collection notices or reminders via postcards. However, it is important to note that communicating through postcards regarding a debt can be highly inappropriate and potentially violate the FD CPA. Debt collectors should prioritize the privacy of consumers' financial matters and ensure that communication is conducted in a confidential manner. To address this concern, a letter informing the debt collector of their unfair practices in communicating with you through postcards can be sent. This letter should outline the violation of the FD CPA, provide evidence or specific instances of the postcard communication, and request the debt collector to cease this method immediately. Some other types of letters that may be relevant in this situation include: 1. Letter Informing Debt Collector of Harassment: If you have experienced constant and persistent harassment by a debt collector, you can send this letter to inform them of their unfair practices and demand an end to the harassment. 2. Letter Requesting Verification of Debt: If you believe the debt in question is inaccurate, or you are unsure of its validity, you can send a letter requesting the debt collector to provide evidence and documentation to verify the debt's authenticity. 3. Letter Disputing Debt: In cases where you believe the debt is entirely invalid, or you dispute the amount owed, you can send a letter disputing the debt and requesting the debt collector to provide evidence supporting their claim. 4. Letter Requesting Cease and Desist: If you wish to stop all communication from the debt collector, you can send a letter requesting them to cease all contact with you, as allowed by the FD CPA. Remember, when dealing with debt collectors and addressing unfair practices, it is crucial to remain calm, assertive, and knowledgeable about your rights. Consulting with a legal professional experienced in debt collection matters can provide valuable guidance in navigating these situations effectively.Oakland Michigan is a county located in the state of Michigan, USA. It encompasses various cities and townships, including the city of Rochester, Rochester Hills, and Auburn Hills. Oakland County is known for its vibrant communities, picturesque landscapes, and thriving business environment. When it comes to debt collection activities, it is crucial for consumers to be aware of their rights and know what actions are considered unfair or unethical. The Fair Debt Collection Practices Act (FD CPA) aims to protect consumers from abusive and deceptive practices by debt collectors. If you find yourself facing unfair collection practices in Oakland, Michigan, it is essential to address the issue promptly and protect your rights as a consumer. One method of communication that some debt collectors may employ is sending debt collection notices or reminders via postcards. However, it is important to note that communicating through postcards regarding a debt can be highly inappropriate and potentially violate the FD CPA. Debt collectors should prioritize the privacy of consumers' financial matters and ensure that communication is conducted in a confidential manner. To address this concern, a letter informing the debt collector of their unfair practices in communicating with you through postcards can be sent. This letter should outline the violation of the FD CPA, provide evidence or specific instances of the postcard communication, and request the debt collector to cease this method immediately. Some other types of letters that may be relevant in this situation include: 1. Letter Informing Debt Collector of Harassment: If you have experienced constant and persistent harassment by a debt collector, you can send this letter to inform them of their unfair practices and demand an end to the harassment. 2. Letter Requesting Verification of Debt: If you believe the debt in question is inaccurate, or you are unsure of its validity, you can send a letter requesting the debt collector to provide evidence and documentation to verify the debt's authenticity. 3. Letter Disputing Debt: In cases where you believe the debt is entirely invalid, or you dispute the amount owed, you can send a letter disputing the debt and requesting the debt collector to provide evidence supporting their claim. 4. Letter Requesting Cease and Desist: If you wish to stop all communication from the debt collector, you can send a letter requesting them to cease all contact with you, as allowed by the FD CPA. Remember, when dealing with debt collectors and addressing unfair practices, it is crucial to remain calm, assertive, and knowledgeable about your rights. Consulting with a legal professional experienced in debt collection matters can provide valuable guidance in navigating these situations effectively.