A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

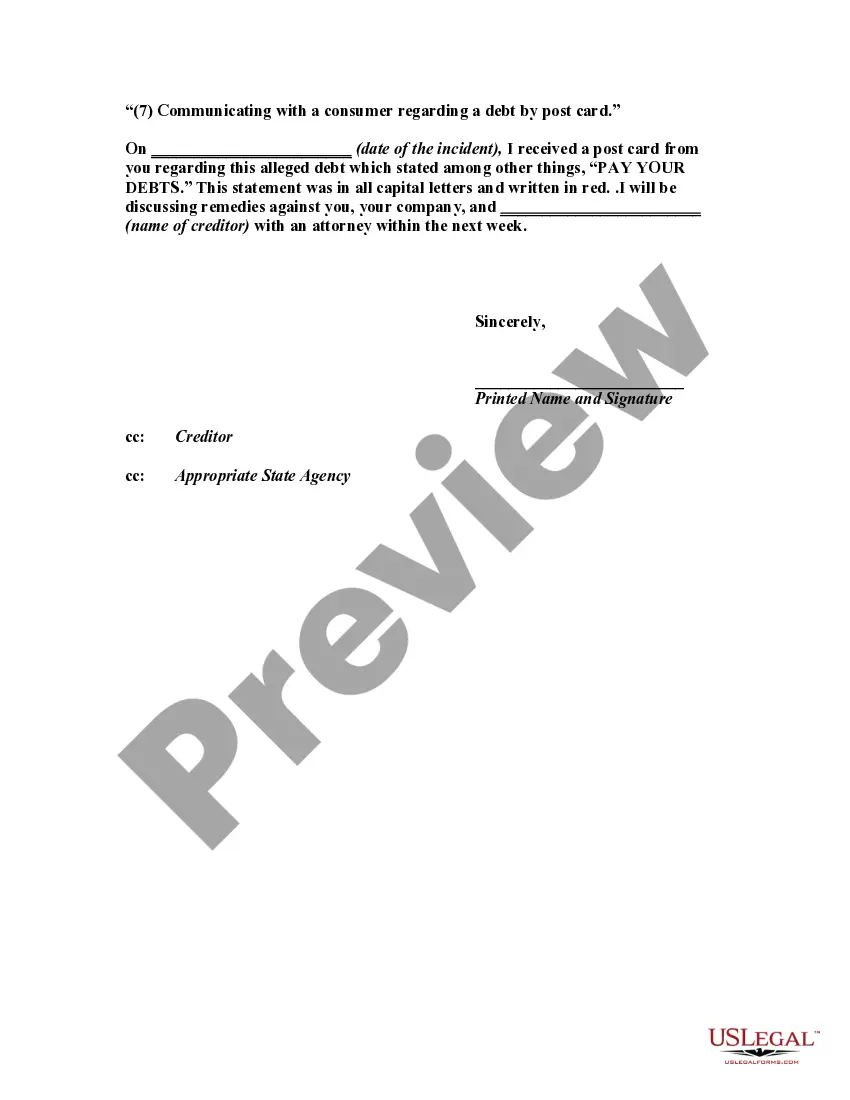

"(7) Communicating with a consumer regarding a debt by post card."

Title: San Antonio Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card Description: In San Antonio, Texas, consumers are protected by laws and regulations against unfair debt collection practices. It is essential to address any concerns regarding the communication methods used by debt collectors, especially when they involve post card correspondence, which may potentially compromise your privacy and security. This detailed description highlights the steps involved in drafting a letter to inform a debt collector about such unfair practices, utilizing appropriate keywords to ensure relevance. Keywords: San Antonio Texas, debt collector, unfair practices, collection activities, consumer, debt, post card, communication, informing, letter, privacy, security. Types of San Antonio Texas Letter Informing Debt Collector of Unfair Practices: 1. Basic Letter Informing Debt Collector of Unfair Practices: This type of letter outlines the specific unfair practices observed during debt collection activities. It requests the debt collector to cease using post cards for communicating debt-related information and advises them of the legal consequences of such actions. 2. Cease and Desist Letter: This letter not only informs the debt collector of their unfair practices but also explicitly requests them to cease all further communication regarding the debt, including any use of post cards. It serves as a formal warning that any continued violation of the law may result in legal action. 3. Warning Notification Letter: This letter highlights the debt collector's unfair practices and emphasizes the consumer's awareness and understanding of their rights under the Fair Debt Collection Practices Act (FD CPA) and other applicable state laws. The purpose is to educate the debt collector about their legal obligations and the potential consequences of failing to comply with the law. 4. Demand for Verification Letter: In cases where you dispute the validity of the debt, this letter informs the debt collector of their unfair practices while simultaneously demanding proper verification of the debt's legitimacy. It asserts your right to receive detailed documentation supporting their claim and warns against the use of post cards during this process. 5. Consumer Protection Complaint Letter: In situations where the debt collector continues to employ unfair practices despite prior warnings, this letter informs the debt collector of an official complaint being filed with relevant consumer protection agencies. It serves as a final warning, urging the debt collector to rectify their practices and avoid further legal repercussions. In conclusion, San Antonio Texas residents have legal rights when it comes to fair debt collection practices, specifically regarding communication methods used by debt collectors. It is crucial to draft a detailed letter addressing the specific unfair practices observed, especially if they involve the use of post cards.Title: San Antonio Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card Description: In San Antonio, Texas, consumers are protected by laws and regulations against unfair debt collection practices. It is essential to address any concerns regarding the communication methods used by debt collectors, especially when they involve post card correspondence, which may potentially compromise your privacy and security. This detailed description highlights the steps involved in drafting a letter to inform a debt collector about such unfair practices, utilizing appropriate keywords to ensure relevance. Keywords: San Antonio Texas, debt collector, unfair practices, collection activities, consumer, debt, post card, communication, informing, letter, privacy, security. Types of San Antonio Texas Letter Informing Debt Collector of Unfair Practices: 1. Basic Letter Informing Debt Collector of Unfair Practices: This type of letter outlines the specific unfair practices observed during debt collection activities. It requests the debt collector to cease using post cards for communicating debt-related information and advises them of the legal consequences of such actions. 2. Cease and Desist Letter: This letter not only informs the debt collector of their unfair practices but also explicitly requests them to cease all further communication regarding the debt, including any use of post cards. It serves as a formal warning that any continued violation of the law may result in legal action. 3. Warning Notification Letter: This letter highlights the debt collector's unfair practices and emphasizes the consumer's awareness and understanding of their rights under the Fair Debt Collection Practices Act (FD CPA) and other applicable state laws. The purpose is to educate the debt collector about their legal obligations and the potential consequences of failing to comply with the law. 4. Demand for Verification Letter: In cases where you dispute the validity of the debt, this letter informs the debt collector of their unfair practices while simultaneously demanding proper verification of the debt's legitimacy. It asserts your right to receive detailed documentation supporting their claim and warns against the use of post cards during this process. 5. Consumer Protection Complaint Letter: In situations where the debt collector continues to employ unfair practices despite prior warnings, this letter informs the debt collector of an official complaint being filed with relevant consumer protection agencies. It serves as a final warning, urging the debt collector to rectify their practices and avoid further legal repercussions. In conclusion, San Antonio Texas residents have legal rights when it comes to fair debt collection practices, specifically regarding communication methods used by debt collectors. It is crucial to draft a detailed letter addressing the specific unfair practices observed, especially if they involve the use of post cards.