A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

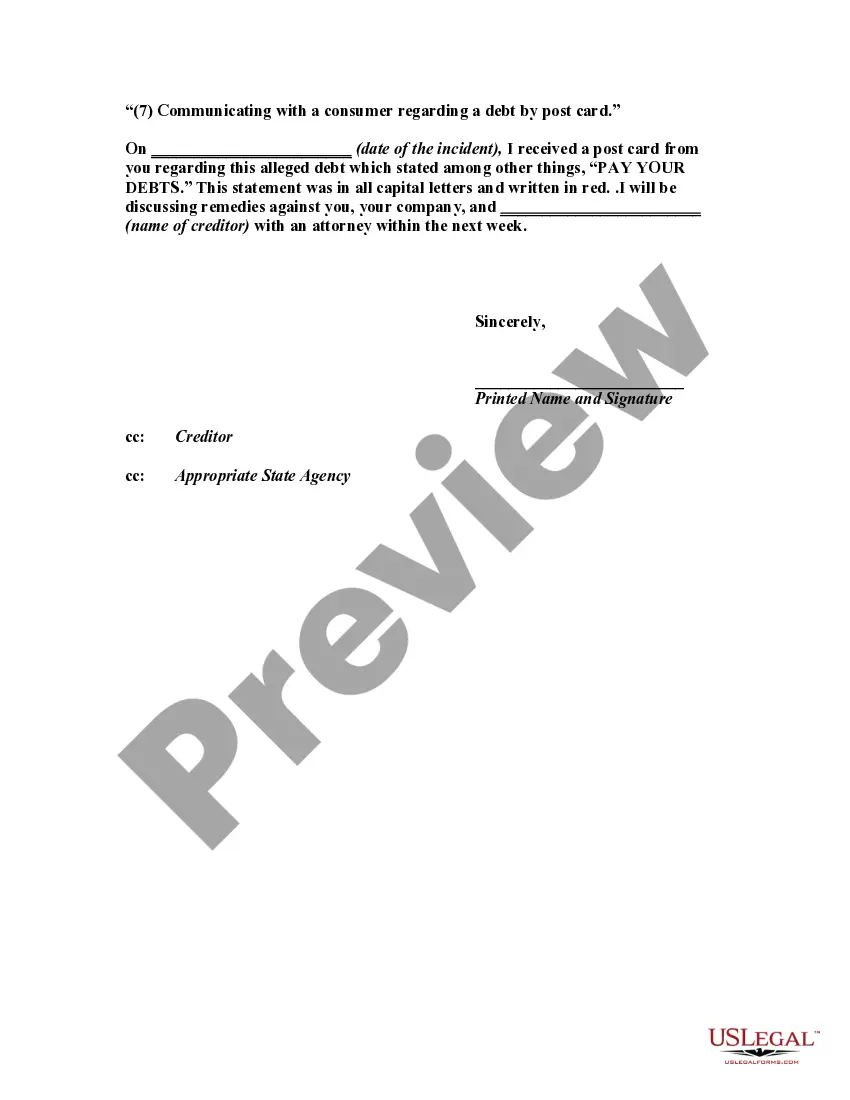

"(7) Communicating with a consumer regarding a debt by post card."

Title: San Jose, California: Unfair Debt Collection Practices — Letter Addressing Post Card Communication Introduction: In San Jose, California, consumer protection laws aim to safeguard residents against unfair debt collection practices. When a debt collector resorts to using a post card to communicate with a consumer regarding a debt, it can raise concerns about the privacy and sensitivity of personal financial information. This letter provides a comprehensive overview of the unfair practices in collection activities involving post card communication, informing the debt collector about their legal obligations, and requesting appropriate action to rectify the situation. Key Topics to Include: 1. Understanding Unfair Debt Collection Practices in San Jose, California: a. Highlight the California Rosenthal Fair Debt Collection Practices Act (RFD CPA) that protects consumers in San Jose from deceptive or harassing debt collection tactics. b. Emphasize the prohibition of unfair practices that violate a debtor's privacy or put unreasonable pressure on the debtor. 2. Communicating with a Consumer Regarding a Debt via Post Card: a. Ensure the debt collector understands the exact nature of the communication method used — a post card sent through regular mail. b. Explain the potential problems associated with this practice, such as risk of exposure to third parties, violation of privacy rights, and increased vulnerability to identity theft. 3. Legal Obligations and Violations: a. Describe the specific legal obligations placed on debt collectors when communicating with consumers regarding a debt. b. Point out how the post card communication method fails to comply with these legal obligations. c. Discuss potential violations of the RFD CPA, including lack of validation notice, failure to protect consumer confidentiality, and disregard for consumer rights. 4. Negative Consequences and Concluding Actions: a. Discuss the potential negative consequences of the debt collector's unfair practices, such as reputational damage and legal consequences. b. Emphasize the rights of the consumer and their ability to take legal action if the unfair practices persist. c. Request immediate action from the debt collector to cease communicating through post cards and to adopt legally compliant methods of communication. Types of San Jose, California Letters Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card: 1. Formal Letter to Debt Collector Demanding Cease of Post Card Communication: This letter formally notifies the debt collector of their non-compliance with the RFD CPA and requests an immediate halt to post card communication. 2. Cease and Desist Letter: This letter warns the debt collector to cease all communication regarding the debt through post cards and to limit future contact to comply with legal obligations. 3. Letter Seeking Remedies for Violations: This type of letter requests remedies for any damages suffered due to the unfair debt collection practices, such as seeking compensation or requesting validation of the debt. 4. Notice of Violations and Intent to File Complaint: In this letter, the consumer highlights the unfair practices used by the debt collector and warns of their intention to file a complaint with relevant regulatory bodies if the violations persist. These letters are designed to inform the debt collector of their unfair practices, demand compliance with applicable laws, and protect the rights and privacy of the consumer.Title: San Jose, California: Unfair Debt Collection Practices — Letter Addressing Post Card Communication Introduction: In San Jose, California, consumer protection laws aim to safeguard residents against unfair debt collection practices. When a debt collector resorts to using a post card to communicate with a consumer regarding a debt, it can raise concerns about the privacy and sensitivity of personal financial information. This letter provides a comprehensive overview of the unfair practices in collection activities involving post card communication, informing the debt collector about their legal obligations, and requesting appropriate action to rectify the situation. Key Topics to Include: 1. Understanding Unfair Debt Collection Practices in San Jose, California: a. Highlight the California Rosenthal Fair Debt Collection Practices Act (RFD CPA) that protects consumers in San Jose from deceptive or harassing debt collection tactics. b. Emphasize the prohibition of unfair practices that violate a debtor's privacy or put unreasonable pressure on the debtor. 2. Communicating with a Consumer Regarding a Debt via Post Card: a. Ensure the debt collector understands the exact nature of the communication method used — a post card sent through regular mail. b. Explain the potential problems associated with this practice, such as risk of exposure to third parties, violation of privacy rights, and increased vulnerability to identity theft. 3. Legal Obligations and Violations: a. Describe the specific legal obligations placed on debt collectors when communicating with consumers regarding a debt. b. Point out how the post card communication method fails to comply with these legal obligations. c. Discuss potential violations of the RFD CPA, including lack of validation notice, failure to protect consumer confidentiality, and disregard for consumer rights. 4. Negative Consequences and Concluding Actions: a. Discuss the potential negative consequences of the debt collector's unfair practices, such as reputational damage and legal consequences. b. Emphasize the rights of the consumer and their ability to take legal action if the unfair practices persist. c. Request immediate action from the debt collector to cease communicating through post cards and to adopt legally compliant methods of communication. Types of San Jose, California Letters Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card: 1. Formal Letter to Debt Collector Demanding Cease of Post Card Communication: This letter formally notifies the debt collector of their non-compliance with the RFD CPA and requests an immediate halt to post card communication. 2. Cease and Desist Letter: This letter warns the debt collector to cease all communication regarding the debt through post cards and to limit future contact to comply with legal obligations. 3. Letter Seeking Remedies for Violations: This type of letter requests remedies for any damages suffered due to the unfair debt collection practices, such as seeking compensation or requesting validation of the debt. 4. Notice of Violations and Intent to File Complaint: In this letter, the consumer highlights the unfair practices used by the debt collector and warns of their intention to file a complaint with relevant regulatory bodies if the violations persist. These letters are designed to inform the debt collector of their unfair practices, demand compliance with applicable laws, and protect the rights and privacy of the consumer.