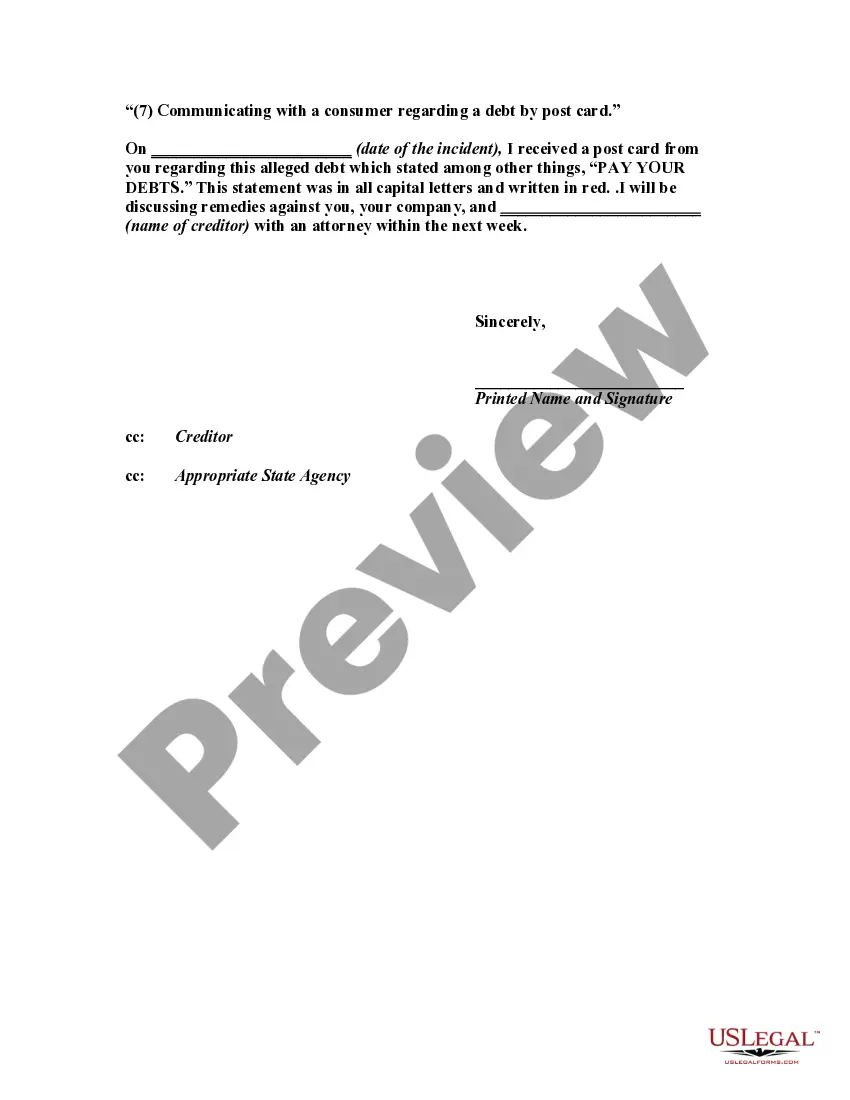

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(7) Communicating with a consumer regarding a debt by post card."

Title: Suffolk New York Letter Addressing Unfair Debt Collection Activities — Communication via Post Card Introduction: In Suffolk County, New York, it is crucial for consumers to be aware of their rights when dealing with debt collectors. One specific issue arising among debt collectors is their unfair practices in communicating with consumers regarding their debts through postcards. This is a violation of the Fair Debt Collection Practices Act (FD CPA) regulations, which protect consumers from harassment, deceptive practices, and privacy breaches. This article aims to provide a detailed description of how individuals can draft a letter to inform debt collectors of their unfair practices when using postcards to communicate about debts. Key points to include in the letter: 1. Clearly identifying the debt collector: Begin the letter by accurately identifying the debt collector involved, providing their name, contact details, and reference numbers associated with the debt in question. 2. Briefly explain the unethical collection activity: Address the specific unfair practice of communicating about the debt using postcards, without respecting the debtor's privacy. Emphasize that this violates the FD CPA, which protects consumers from unwanted exposure of their personal financial affairs. 3. Reference relevant laws and regulations: Clearly reference the FD CPA, highlighting sections that specifically prohibit unfair communication practices and outline the consequences that debt collectors may face for non-compliance. This demonstrates your knowledge and understanding of your rights as a consumer. 4. Demand immediate cessation of postcard communications: Request the debt collector to cease all communication via postcards immediately and outline alternative methods that should be used instead, such as written letters or telephone calls. 5. Request written confirmation: Ask the debt collector to provide written confirmation of their compliance with your request and their commitment to cease using postcards for debt-related communications. 6. Exhibit the potential consequences: Inform the debt collector of the potential legal consequences they may face if they continue engaging in unfair collection practices, including filing a complaint with regulatory agencies and pursuing legal action. Variations of the letter addressing unfair debt collection practices: 1. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Use of Unauthorized Third-Party Disclosures. 2. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Verbal Abuse or Harassment. 3. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Threats of Legal Action without Intent to Proceed. 4. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Improper Validation of Debts. By utilizing the above content and keywords, individuals in Suffolk County, New York can effectively address debt collectors who engage in unfair practices and protect their rights under the FD CPA.Title: Suffolk New York Letter Addressing Unfair Debt Collection Activities — Communication via Post Card Introduction: In Suffolk County, New York, it is crucial for consumers to be aware of their rights when dealing with debt collectors. One specific issue arising among debt collectors is their unfair practices in communicating with consumers regarding their debts through postcards. This is a violation of the Fair Debt Collection Practices Act (FD CPA) regulations, which protect consumers from harassment, deceptive practices, and privacy breaches. This article aims to provide a detailed description of how individuals can draft a letter to inform debt collectors of their unfair practices when using postcards to communicate about debts. Key points to include in the letter: 1. Clearly identifying the debt collector: Begin the letter by accurately identifying the debt collector involved, providing their name, contact details, and reference numbers associated with the debt in question. 2. Briefly explain the unethical collection activity: Address the specific unfair practice of communicating about the debt using postcards, without respecting the debtor's privacy. Emphasize that this violates the FD CPA, which protects consumers from unwanted exposure of their personal financial affairs. 3. Reference relevant laws and regulations: Clearly reference the FD CPA, highlighting sections that specifically prohibit unfair communication practices and outline the consequences that debt collectors may face for non-compliance. This demonstrates your knowledge and understanding of your rights as a consumer. 4. Demand immediate cessation of postcard communications: Request the debt collector to cease all communication via postcards immediately and outline alternative methods that should be used instead, such as written letters or telephone calls. 5. Request written confirmation: Ask the debt collector to provide written confirmation of their compliance with your request and their commitment to cease using postcards for debt-related communications. 6. Exhibit the potential consequences: Inform the debt collector of the potential legal consequences they may face if they continue engaging in unfair collection practices, including filing a complaint with regulatory agencies and pursuing legal action. Variations of the letter addressing unfair debt collection practices: 1. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Use of Unauthorized Third-Party Disclosures. 2. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Verbal Abuse or Harassment. 3. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Threats of Legal Action without Intent to Proceed. 4. Suffolk New York Letter Informing Debt Collector of Unfair Practices in Collection Activities — Improper Validation of Debts. By utilizing the above content and keywords, individuals in Suffolk County, New York can effectively address debt collectors who engage in unfair practices and protect their rights under the FD CPA.