A debt collector may not use unfair or unconscionable means to collect a debt.

Examples of unfair practices include:

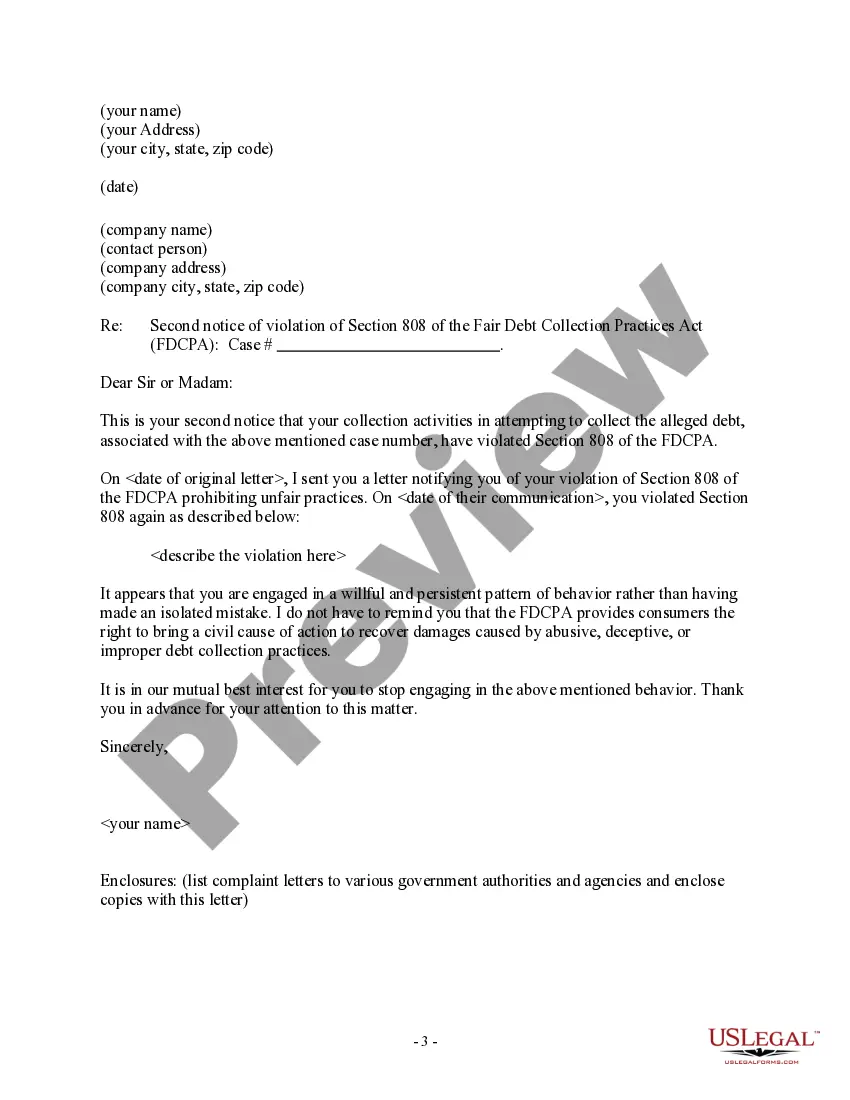

Use this form to let a debt collector know you will not tolerate unfair practices.

This form also also includes follow-up letters containing a warning that the debt collector may face going to court if they continue engaging in behavior that violates the FDCPA. Houston Texas Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices: In Houston, Texas, notice letters to debt collectors regarding Section 808 violations and unfair practices play a crucial role in protecting consumers' rights and ensuring fair debt collection practices. Such letters are essential in addressing situations where debt collectors have violated Section 808 of the Fair Debt Collection Practices Act (FD CPA) through unfair dealings or deceptive actions. When writing a notice letter in Houston, Texas, it is important to include relevant keywords that pertain to the issue at hand. The following keywords can be incorporated to establish a comprehensive and specific letter: 1. Houston, Texas: Mentioning Houston, Texas emphasizes the jurisdiction where the letter is being sent and indicates that the matter is regulated by the laws of the state. 2. Notice Letter: This term makes it clear that the letter is an official communication and serves as a formal notice to the debt collector regarding their violation. 3. Debt Collector: Highlighting the term "debt collector" ensures the recipient understands that they are the subject of the notice letter and that their actions are being addressed. 4. Section 808 Violation: Referring to the specific section of the FD CPA that has been violated aids in clarifying the law the debt collector has disregarded. 5. Unfair Practices: Including the keywords "unfair practices" underlines the nature of the violation and strengthens the claim against the debt collector's actions. Different types of Houston Texas Notice Letters to Debt Collectors of Section 808 Violation — Unfair Practices may include: 1. Initial Notice Letter: This type of letter acts as the first communication to the debt collector, informing them of their violation under Section 808 and providing details of the unfair practices they have engaged in. It may include a request for immediate action, resolution, or an explanation for the wrongdoing. 2. Cease-and-Desist Notice Letter: A cease-and-desist letter is used when the debtor wants the debt collector to immediately stop all communication and collection activities due to the Section 808 violation. This letter typically includes a warning that continued actions might result in legal consequences. 3. Demand for Damages Notice Letter: In certain instances, debtors may choose to recover damages resulting from the debt collector's violation of Section 808. This type of letter states the debtor's intention to pursue financial restitution to compensate for any harm caused by the unfair practices. Regardless of the specific type of Houston Texas Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices, it is crucial to include the relevant keywords and provide detailed information about the violation to ensure clear communication and assert the debtor's rights under the FD CPA.

Houston Texas Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices: In Houston, Texas, notice letters to debt collectors regarding Section 808 violations and unfair practices play a crucial role in protecting consumers' rights and ensuring fair debt collection practices. Such letters are essential in addressing situations where debt collectors have violated Section 808 of the Fair Debt Collection Practices Act (FD CPA) through unfair dealings or deceptive actions. When writing a notice letter in Houston, Texas, it is important to include relevant keywords that pertain to the issue at hand. The following keywords can be incorporated to establish a comprehensive and specific letter: 1. Houston, Texas: Mentioning Houston, Texas emphasizes the jurisdiction where the letter is being sent and indicates that the matter is regulated by the laws of the state. 2. Notice Letter: This term makes it clear that the letter is an official communication and serves as a formal notice to the debt collector regarding their violation. 3. Debt Collector: Highlighting the term "debt collector" ensures the recipient understands that they are the subject of the notice letter and that their actions are being addressed. 4. Section 808 Violation: Referring to the specific section of the FD CPA that has been violated aids in clarifying the law the debt collector has disregarded. 5. Unfair Practices: Including the keywords "unfair practices" underlines the nature of the violation and strengthens the claim against the debt collector's actions. Different types of Houston Texas Notice Letters to Debt Collectors of Section 808 Violation — Unfair Practices may include: 1. Initial Notice Letter: This type of letter acts as the first communication to the debt collector, informing them of their violation under Section 808 and providing details of the unfair practices they have engaged in. It may include a request for immediate action, resolution, or an explanation for the wrongdoing. 2. Cease-and-Desist Notice Letter: A cease-and-desist letter is used when the debtor wants the debt collector to immediately stop all communication and collection activities due to the Section 808 violation. This letter typically includes a warning that continued actions might result in legal consequences. 3. Demand for Damages Notice Letter: In certain instances, debtors may choose to recover damages resulting from the debt collector's violation of Section 808. This type of letter states the debtor's intention to pursue financial restitution to compensate for any harm caused by the unfair practices. Regardless of the specific type of Houston Texas Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices, it is crucial to include the relevant keywords and provide detailed information about the violation to ensure clear communication and assert the debtor's rights under the FD CPA.