A debt collector may not use unfair or unconscionable means to collect a debt.

Examples of unfair practices include:

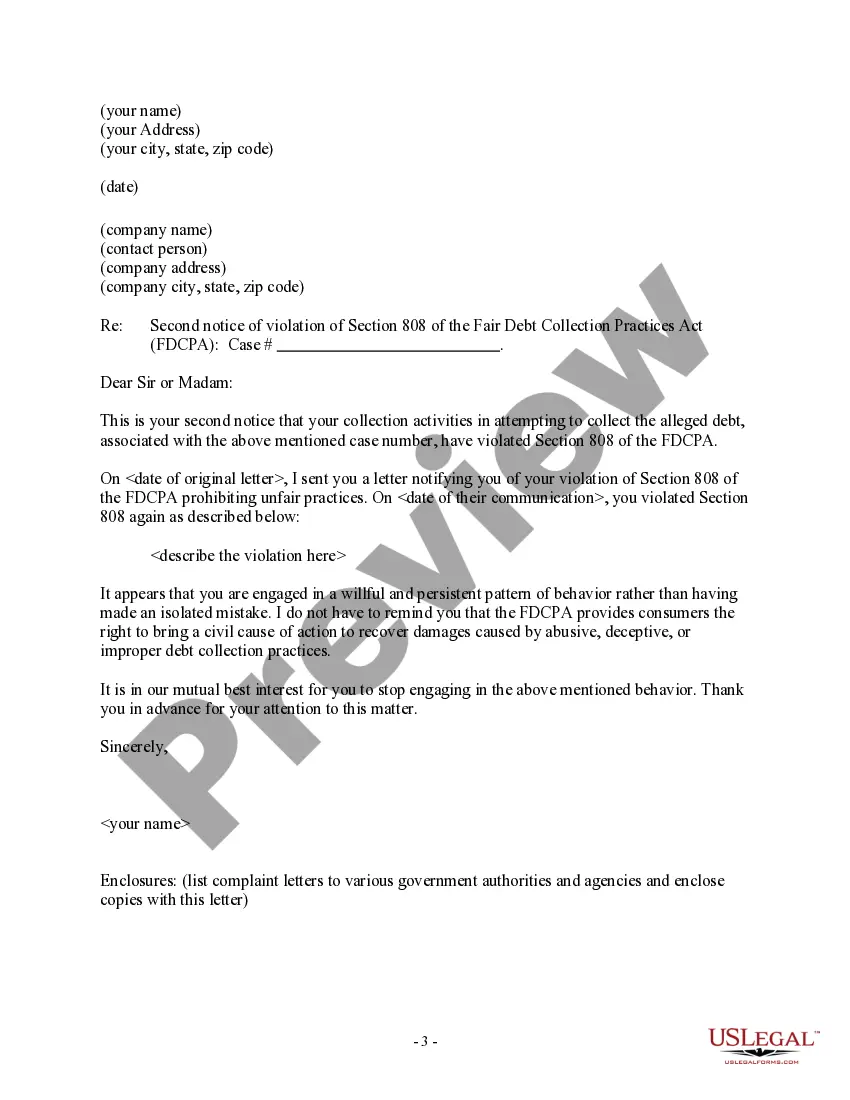

Use this form to let a debt collector know you will not tolerate unfair practices.

This form also also includes follow-up letters containing a warning that the debt collector may face going to court if they continue engaging in behavior that violates the FDCPA.

Lima Arizona Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices: ExplaineClimatema, Arizona, a Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices is an important legal document used to address instances of debt collectors engaging in unfair practices, as outlined in Section 808 of the Fair Debt Collection Practices Act (FD CPA). This letter serves as a formal notification to the debt collector, informing them of their violation and demanding corrective action. Section 808 of the FD CPA prohibits debt collectors from engaging in unfair practices, including but not limited to, using abusive or threatening language, making false statements, contacting consumers at inconvenient times, and disclosing debt information to unauthorized individuals. It aims to protect consumers from harassment and ensure fair treatment during the debt collection process. The Lima Arizona Notice Letter is a specific template provided by legal professionals to help individuals affected by such unfair practices. It includes relevant keywords and sections that should be included in your letter to effectively communicate your concerns and demand resolution. Different types or variations of this letter may exist depending on the specific circumstances and violations experienced by the individual. Here are some potential types of Lima Arizona Notice Letters to Debt Collectors of Section 808 Violation — Unfair Practices: 1. StandarLimama Arizona Notice Letter: This is a general template that can be used for various types of violations, such as abusive language, false statements, or unauthorized disclosure. 2. Lima Arizona Notice Letter for Harassment: This is a specialized template designed specifically for cases where debt collectors repeatedly contact the consumer with the intent to harass or intimidate. 3. Lima Arizona Notice Letter for False Statements: This type of letter focuses on instances where the debt collector has intentionally provided false or misleading information to coerce the consumer into paying the debt. 4. Lima Arizona Notice Letter for Unauthorized Disclosure: This letter template addresses cases where the debt collector has unlawfully shared the consumer's debt information with third parties without proper authorization. When drafting a Lima Arizona Notice Letter, it is essential to include key details such as the debt collector's name and contact information, a clear and concise description of the violation, supporting evidence if available, and a firm request for immediate resolution or corrective action. By utilizing the appropriate Lima Arizona Notice Letter to Debt Collector of Section 808 Violation — Unfair Practices, consumers can assert their rights and hold debt collectors accountable for their unfair actions. It is always advisable to seek legal guidance or consult an attorney to ensure the letter adheres to all necessary legal requirements.