Pursuant to 15 USC 1692g Sec. 809 (of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to them. This would be a situation where the original creditor had assigned the debt to the collection agency. Use this form letter requires that the agency verify that the debt is actually the alleged creditor and owed by the alleged debtor.

Dallas Texas Letter Requesting a Collection Agency to Validate That You Owe Them a Debt

Description

How to fill out Letter Requesting A Collection Agency To Validate That You Owe Them A Debt?

Legislation and policies in every domain vary throughout the nation.

If you're not a lawyer, it's simple to become confused by the different standards when it comes to composing legal documents.

To steer clear of costly legal help while preparing the Dallas Letter Asking a Collection Agency to Confirm That You Owe Them a Debt, you need a verified template that is valid for your county.

That's the easiest and most cost-effective method to acquire updated templates for any legal circumstances. Discover them all with just a few clicks and maintain your paperwork organized with US Legal Forms!

- This is when utilizing the US Legal Forms platform becomes highly beneficial.

- US Legal Forms is an online repository trusted by millions, containing over 85,000 state-specific legal templates.

- It's an excellent option for both professionals and individuals seeking do-it-yourself templates for various life and business circumstances.

- All the documents can be reused: once you acquire a sample, it stays accessible in your profile for future use.

- Thus, if you possess an account with a valid subscription, you can simply Log In and re-download the Dallas Letter Asking a Collection Agency to Confirm That You Owe Them a Debt from the My documents tab.

- For new users, additional steps are required to obtain the Dallas Letter Asking a Collection Agency to Confirm That You Owe Them a Debt.

- Examine the content of the page to confirm that you have located the appropriate sample.

- Utilize the Preview option or review the form overview if one is provided.

Form popularity

FAQ

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

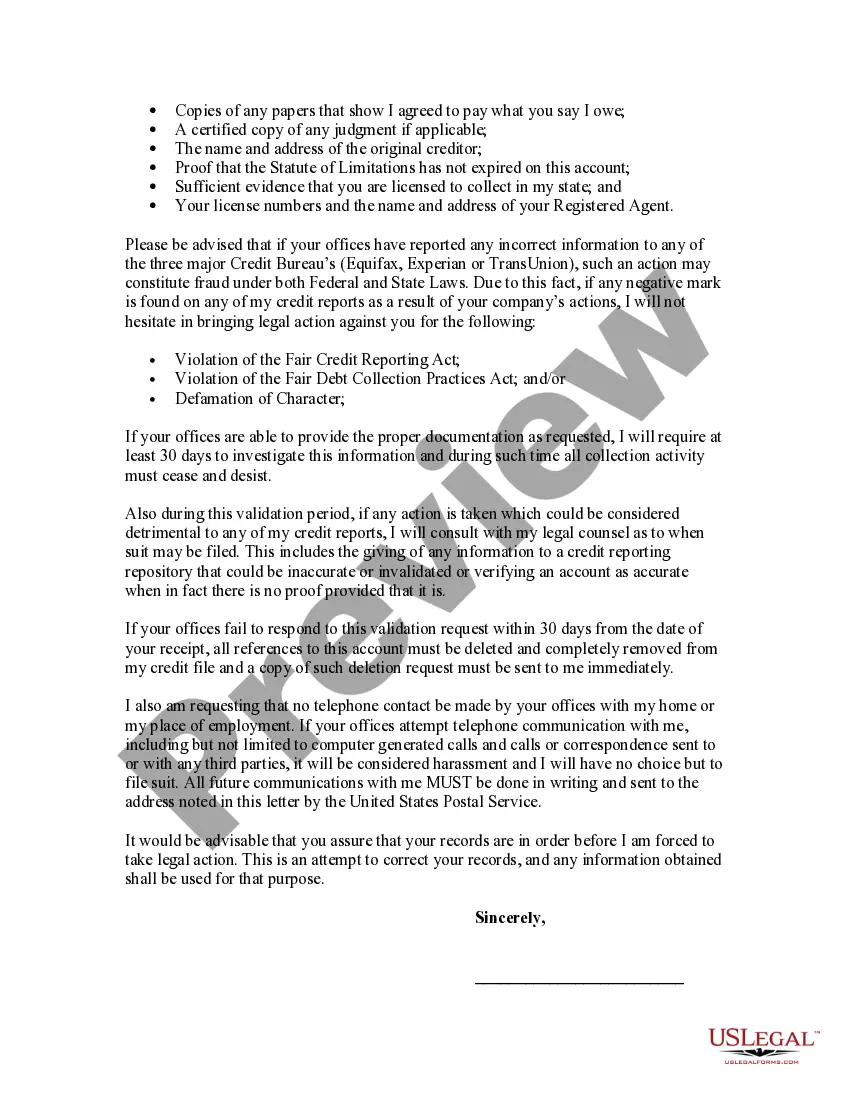

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

3. Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

How to Write a Debt Verification Letter Determine the exact amounts you owe. Gather documents that verify your debt. Get information on who you owe. Determine how old the debt is. Place a pause on the collection proceedings.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

More info

The lender will take a late fee, and it's usually in the same amount: 50. But if you don't pay it back when it comes due, the lender may sue you for the entire amount plus interest. So let's work together to avoid a nasty surprise. Your credit score takes a beating when lenders see you paying yourself too much debt. Credit scoring has its own story, and is very complicated. Many experts say that if your average credit utilization ratio is 20 to 25% you have a good score, and you can probably pay back your card with no problem. If your average utilization is under 25%, however, your score will drop, and the ability to borrow money might be limited. Keep in mind that this is your total debt, not just your principal balance. If your total debt drops from 10,000 to 8,000, your score is probably a little worse. Your debt-to-income ratio is not the same thing as a credit score. It's the percentage of income that you are paying on your credit card bills to pay off debt.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.