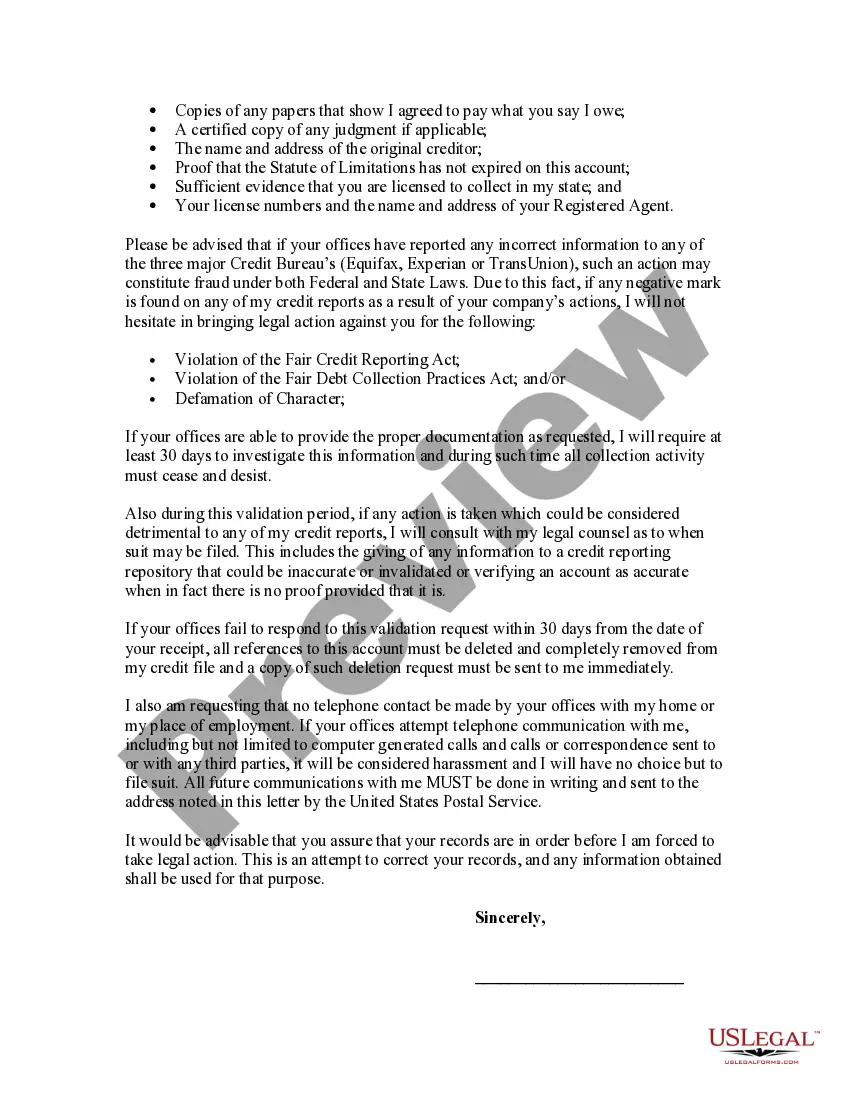

Pursuant to 15 USC 1692g Sec. 809 (of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to them. This would be a situation where the original creditor had assigned the debt to the collection agency. Use this form letter requires that the agency verify that the debt is actually the alleged creditor and owed by the alleged debtor.

Title: Maricopa, Arizona: Letter Requesting a Collection Agency to Validate a Debt You Owe Introduction: If you find yourself in a situation where a collection agency claims you owe them a debt in Maricopa, Arizona, it is essential to understand your rights under the Fair Debt Collection Practices Act (FD CPA). One way to protect yourself is by sending a letter requesting the collection agency to validate the debt and provide necessary documentation. This article will guide you through crafting a detailed Maricopa Arizona Letter Requesting a Collection Agency to Validate That You Owe Them a Debt while incorporating related keywords. Keywords: Maricopa, Arizona; letter requesting validation of debt; collection agency; Fair Debt Collection Practices Act; FD CPA 1. Types of Maricopa Arizona Letters Requesting Debt Validation: a. Basic Debt Validation Letter: A standard template used to initiate the debt validation process. b. Dispute of Debt Validity: A letter highlighting specific reasons why you dispute the validity of the alleged debt. c. Debt Verification Request: A detailed letter requesting information to verify the legitimacy of the debt. d. Cease and Desist Letter: A more assertive letter demanding that the collection agency immediately stop contacting you until they have properly validated the debt. 2. Elements to Include in the Letter: a. Your Personal Information: Provide your full name, address, phone number, and email. b. Collection Agency's Information: Include the agency's name, address, and contact details. c. Debt Details: Clearly state the amount of the alleged debt, the original creditor, and any relevant reference numbers associated with the debt. d. Request for Validation: Clearly state that you are requesting the collection agency to validate the debt as per your rights under the FD CPA. e. Provide a Deadline: Specify a reasonable timeframe (usually 30 days) for the collection agency to respond and validate the debt. f. Request for Documentation: Ask the collection agency to provide all documents and evidence supporting the validity of the debt, including the original contract with the creditor. g. Prohibition of Further Collection Activity: If you dispute the debt's validity or wish for the collection agency to cease communication, express this request explicitly. h. Certified Mail: Always send the letter via certified mail with a return receipt requested to ensure proof of delivery. 3. Legal Protection and Rights: a. Reference the Fair Debt Collection Practices Act (FD CPA): Mention specific sections of the FD CPA that protect your rights as a consumer. b. Harassment and Misleading Tactics: Emphasize that the FD CPA prohibits harassment, false representations, and unfair practices from the collection agency. Conclusion: Crafting a detailed Maricopa Arizona Letter Requesting a Collection Agency to Validate That You Owe Them a Debt can help protect your rights as a consumer while encouraging the collection agency to provide necessary documentation supporting the debt. Ensure you tailor the letter to your specific situation and send it via certified mail for proper documentation. Always consult legal advice to understand your rights fully.Title: Maricopa, Arizona: Letter Requesting a Collection Agency to Validate a Debt You Owe Introduction: If you find yourself in a situation where a collection agency claims you owe them a debt in Maricopa, Arizona, it is essential to understand your rights under the Fair Debt Collection Practices Act (FD CPA). One way to protect yourself is by sending a letter requesting the collection agency to validate the debt and provide necessary documentation. This article will guide you through crafting a detailed Maricopa Arizona Letter Requesting a Collection Agency to Validate That You Owe Them a Debt while incorporating related keywords. Keywords: Maricopa, Arizona; letter requesting validation of debt; collection agency; Fair Debt Collection Practices Act; FD CPA 1. Types of Maricopa Arizona Letters Requesting Debt Validation: a. Basic Debt Validation Letter: A standard template used to initiate the debt validation process. b. Dispute of Debt Validity: A letter highlighting specific reasons why you dispute the validity of the alleged debt. c. Debt Verification Request: A detailed letter requesting information to verify the legitimacy of the debt. d. Cease and Desist Letter: A more assertive letter demanding that the collection agency immediately stop contacting you until they have properly validated the debt. 2. Elements to Include in the Letter: a. Your Personal Information: Provide your full name, address, phone number, and email. b. Collection Agency's Information: Include the agency's name, address, and contact details. c. Debt Details: Clearly state the amount of the alleged debt, the original creditor, and any relevant reference numbers associated with the debt. d. Request for Validation: Clearly state that you are requesting the collection agency to validate the debt as per your rights under the FD CPA. e. Provide a Deadline: Specify a reasonable timeframe (usually 30 days) for the collection agency to respond and validate the debt. f. Request for Documentation: Ask the collection agency to provide all documents and evidence supporting the validity of the debt, including the original contract with the creditor. g. Prohibition of Further Collection Activity: If you dispute the debt's validity or wish for the collection agency to cease communication, express this request explicitly. h. Certified Mail: Always send the letter via certified mail with a return receipt requested to ensure proof of delivery. 3. Legal Protection and Rights: a. Reference the Fair Debt Collection Practices Act (FD CPA): Mention specific sections of the FD CPA that protect your rights as a consumer. b. Harassment and Misleading Tactics: Emphasize that the FD CPA prohibits harassment, false representations, and unfair practices from the collection agency. Conclusion: Crafting a detailed Maricopa Arizona Letter Requesting a Collection Agency to Validate That You Owe Them a Debt can help protect your rights as a consumer while encouraging the collection agency to provide necessary documentation supporting the debt. Ensure you tailor the letter to your specific situation and send it via certified mail for proper documentation. Always consult legal advice to understand your rights fully.