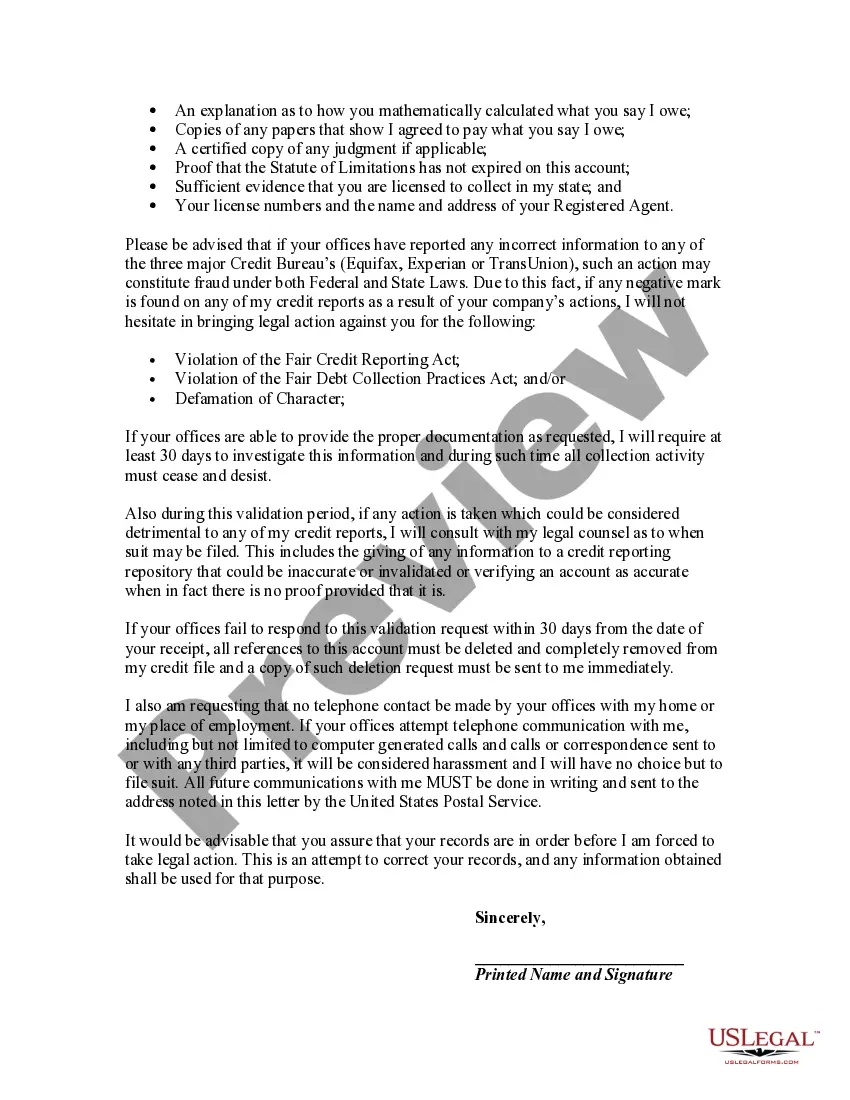

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

San Diego, California is a vibrant coastal city located in the southwestern part of the United States. Known for its beautiful beaches, pleasant climate, and diverse culture, San Diego offers residents and visitors a wide range of attractions and activities to enjoy. A San Diego California letter requesting a collection agency to validate a debt that you allegedly owe a creditor is a formal written communication aimed at seeking validation of an alleged debt. The purpose of this letter is to request the collection agency to provide proof that the debt is valid and that you are the rightful debtor. Keywords: San Diego California, collection agency, debt validation, alleged debt, creditor. Different types of San Diego California letters requesting a collection agency to validate a debt that you allegedly owe a creditor may include: 1. General Debt Validation Letter: This type of letter is a standard request for the collection agency to validate the debt by providing details such as the original creditor, account number, and the amount owed. 2. Request for Documentation: This type of letter seeks specific documentation to validate the debt, such as a copy of the original signed contract or agreement, itemized billing statements, or any other supporting documentation related to the alleged debt. 3. Dispute of Debt Letter: If you believe the debt is not valid or if you have already disputed the debt, this type of letter can be used to request the collection agency to provide evidence supporting their claim. 4. Cease and Desist Letter: In cases where you believe the debt is invalid or if you want to stop further communication from the collection agency, a cease and desist letter can be sent to request them to halt all contact regarding the debt. 5. Verification of Creditor's Authority Letter: Sometimes, it may be necessary to request proof that the collection agency has the legal authority to collect the debt on behalf of the creditor. This type of letter aims to verify the agency's authorization to pursue the debt. In conclusion, a San Diego California letter requesting a collection agency to validate a debt that you allegedly owe a creditor is a formal request seeking validation and proof of an alleged debt. The letter can take different forms depending on the specific circumstances, such as a general debt validation letter, request for documentation, dispute of debt letter, cease and desist letter, or verification of creditor's authority letter.San Diego, California is a vibrant coastal city located in the southwestern part of the United States. Known for its beautiful beaches, pleasant climate, and diverse culture, San Diego offers residents and visitors a wide range of attractions and activities to enjoy. A San Diego California letter requesting a collection agency to validate a debt that you allegedly owe a creditor is a formal written communication aimed at seeking validation of an alleged debt. The purpose of this letter is to request the collection agency to provide proof that the debt is valid and that you are the rightful debtor. Keywords: San Diego California, collection agency, debt validation, alleged debt, creditor. Different types of San Diego California letters requesting a collection agency to validate a debt that you allegedly owe a creditor may include: 1. General Debt Validation Letter: This type of letter is a standard request for the collection agency to validate the debt by providing details such as the original creditor, account number, and the amount owed. 2. Request for Documentation: This type of letter seeks specific documentation to validate the debt, such as a copy of the original signed contract or agreement, itemized billing statements, or any other supporting documentation related to the alleged debt. 3. Dispute of Debt Letter: If you believe the debt is not valid or if you have already disputed the debt, this type of letter can be used to request the collection agency to provide evidence supporting their claim. 4. Cease and Desist Letter: In cases where you believe the debt is invalid or if you want to stop further communication from the collection agency, a cease and desist letter can be sent to request them to halt all contact regarding the debt. 5. Verification of Creditor's Authority Letter: Sometimes, it may be necessary to request proof that the collection agency has the legal authority to collect the debt on behalf of the creditor. This type of letter aims to verify the agency's authorization to pursue the debt. In conclusion, a San Diego California letter requesting a collection agency to validate a debt that you allegedly owe a creditor is a formal request seeking validation and proof of an alleged debt. The letter can take different forms depending on the specific circumstances, such as a general debt validation letter, request for documentation, dispute of debt letter, cease and desist letter, or verification of creditor's authority letter.