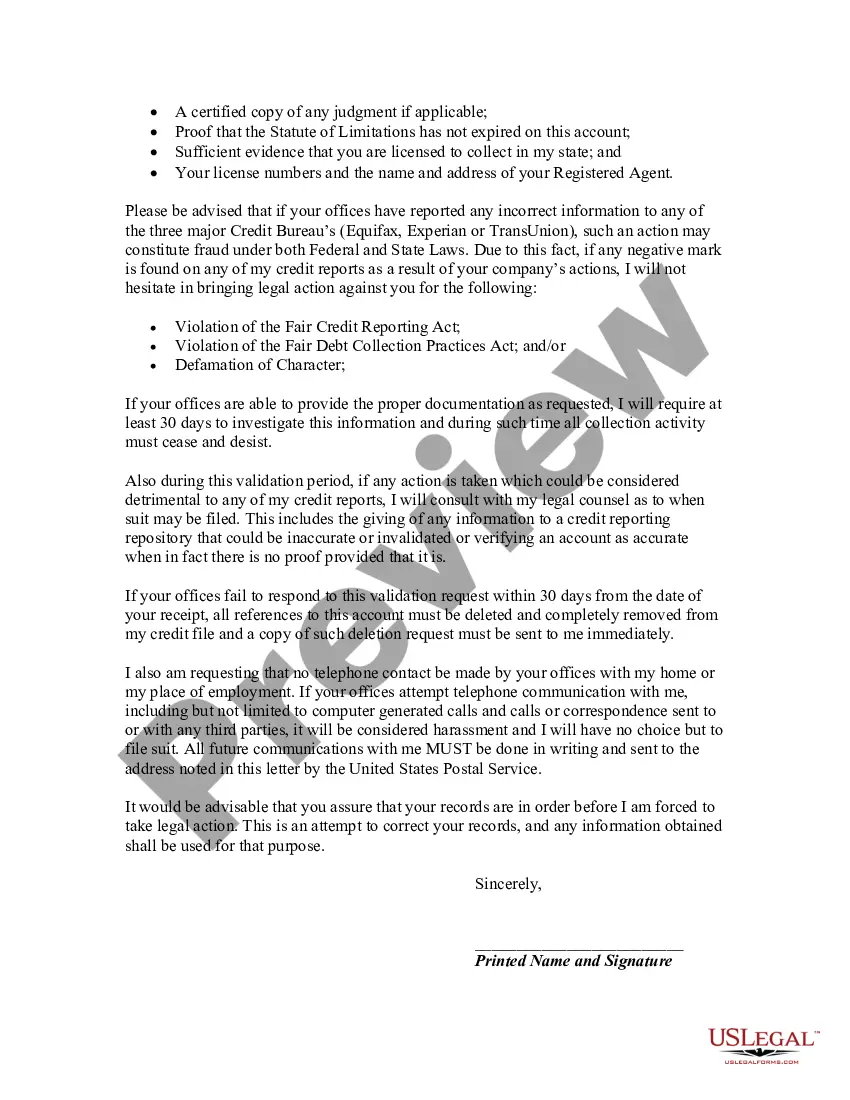

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Cook County Letter Denying Debt and Requesting Validation: A Comprehensive Guide Introduction: If you find yourself receiving a letter from a collection agency claiming that you owe a debt, it is crucial to assert your rights as a consumer. Cook County residents can benefit from using the Cook Illinois Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt. This detailed description will outline the purpose, importance, and different types of Cook Illinois letters, enabling you to take control of your debt situation. Key Points: 1. Understanding the Cook Illinois Letter Denying Debt: — It serves as a written response to collection agencies, expressing your denial and disbelief of the alleged debt. — By disputing the debt, you ensure that the collection agency is obligated to provide evidence of the debt's validity. — This letter is designed to protect you, as the alleged debtor, from unjust or fraudulent claims by collection agencies. 2. Why Request Debt Validation? — Debt validation is a crucial step that forces the collection agency to provide concrete evidence that you owe the debt. — It ensures that you are not held responsible for a debt that may be erroneous, mistaken, or invalid. — Utilizing debt validation protects your consumer rights and prevents unfair or deceptive collection practices. Types of Cook Illinois Letters Denying Debt: 1. Basic Cook Illinois Letter Denying Debt: — This is a standard template that can be used when disputing any alleged debt. — The letter asserts that you do not owe the claimed debt and requests court-admissible evidence to substantiate their claims. — It emphasizes your right to challenge the accuracy and validity of the alleged debt based on the Fair Debt Collection Practices Act (FD CPA) and other applicable laws. 2. Cook Illinois Letter Denying Debt on the Basis of Identity Theft: — Specifically addresses situations where the alleged debt results from identity theft or mistaken identity. — Highlights your innocence by stating that you are not the person responsible for the debt and urges the collection agency to investigate further. — Requests the collection agency's assistance in resolving the identity theft issue promptly. 3. Cook Illinois Letter Denying Debt Due to Statute of Limitations: — Pertains to instances where the debt is time-barred or outside the statute of limitations. — Emphasizes that the collection agency's attempts to collect the debt are illegal, explaining the expiration of the legal timeframe within which they can pursue it. — Points out that any legal action taken will be met with a vigorous defense, including filing complaints against the collection agency if necessary. Conclusion: Facing an alleged debt can be stressful and overwhelming. Fortunately, Cook Illinois Letters Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt empower you to challenge the collections and exercise your rights. By utilizing these letters, you assert your stance, seek accountability from collection agencies, and protect yourself from potential fraud or undue pressure. Keywords: Cook Illinois, Cook County, letter, denial, alleged debtor, debt, collection agency, validation, consumer rights, debt validation, Fair Debt Collection Practices Act, FD CPA, identity theft, mistaken identity, statute of limitations, time-barred, illegal collections, complaints against collection agency, rights, fraud, pressure.Cook County Letter Denying Debt and Requesting Validation: A Comprehensive Guide Introduction: If you find yourself receiving a letter from a collection agency claiming that you owe a debt, it is crucial to assert your rights as a consumer. Cook County residents can benefit from using the Cook Illinois Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt. This detailed description will outline the purpose, importance, and different types of Cook Illinois letters, enabling you to take control of your debt situation. Key Points: 1. Understanding the Cook Illinois Letter Denying Debt: — It serves as a written response to collection agencies, expressing your denial and disbelief of the alleged debt. — By disputing the debt, you ensure that the collection agency is obligated to provide evidence of the debt's validity. — This letter is designed to protect you, as the alleged debtor, from unjust or fraudulent claims by collection agencies. 2. Why Request Debt Validation? — Debt validation is a crucial step that forces the collection agency to provide concrete evidence that you owe the debt. — It ensures that you are not held responsible for a debt that may be erroneous, mistaken, or invalid. — Utilizing debt validation protects your consumer rights and prevents unfair or deceptive collection practices. Types of Cook Illinois Letters Denying Debt: 1. Basic Cook Illinois Letter Denying Debt: — This is a standard template that can be used when disputing any alleged debt. — The letter asserts that you do not owe the claimed debt and requests court-admissible evidence to substantiate their claims. — It emphasizes your right to challenge the accuracy and validity of the alleged debt based on the Fair Debt Collection Practices Act (FD CPA) and other applicable laws. 2. Cook Illinois Letter Denying Debt on the Basis of Identity Theft: — Specifically addresses situations where the alleged debt results from identity theft or mistaken identity. — Highlights your innocence by stating that you are not the person responsible for the debt and urges the collection agency to investigate further. — Requests the collection agency's assistance in resolving the identity theft issue promptly. 3. Cook Illinois Letter Denying Debt Due to Statute of Limitations: — Pertains to instances where the debt is time-barred or outside the statute of limitations. — Emphasizes that the collection agency's attempts to collect the debt are illegal, explaining the expiration of the legal timeframe within which they can pursue it. — Points out that any legal action taken will be met with a vigorous defense, including filing complaints against the collection agency if necessary. Conclusion: Facing an alleged debt can be stressful and overwhelming. Fortunately, Cook Illinois Letters Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt empower you to challenge the collections and exercise your rights. By utilizing these letters, you assert your stance, seek accountability from collection agencies, and protect yourself from potential fraud or undue pressure. Keywords: Cook Illinois, Cook County, letter, denial, alleged debtor, debt, collection agency, validation, consumer rights, debt validation, Fair Debt Collection Practices Act, FD CPA, identity theft, mistaken identity, statute of limitations, time-barred, illegal collections, complaints against collection agency, rights, fraud, pressure.