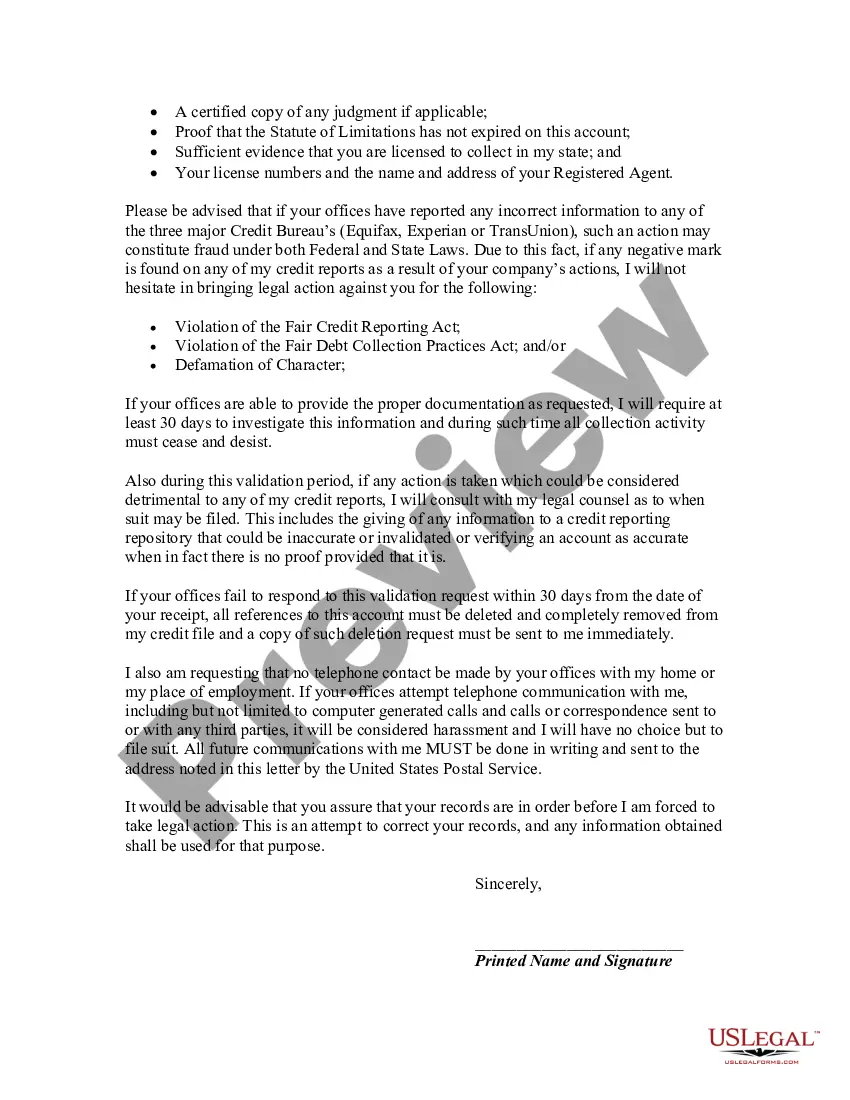

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Queens, New York: Letter Rejecting Alleged Debt and Seeking Debt Validation from Collection Agency Keywords: Queens, New York; debt denial letter; alleged debtor; debt validation; collection agency Introduction: In the bustling borough of Queens, New York, a letter is a powerful tool for disputing an alleged debt and seeking validation from a collection agency. This detailed description explores the nature and purpose of a "Queens, New York Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt" — a crucial step for individuals wrongly accused of financial liabilities. Types of Queens New York Letter Denying Alleged Debt: 1. Formal Debt Denial and Validation Request: This type of letter is typically used to challenge the validity of the alleged debt. It emphasizes that the debtor denies any liability and requests the collection agency to validate the existence of such a debt by providing relevant records and evidence. 2. Statute of Limitations Defense: If the alleged debt is beyond the legal time limit (statute of limitations) for enforcing collection, this letter highlights this defense. It asserts that the debtor is no longer liable due to the expiration of the specified time frame. 3. Lack of Documentation and Supporting Evidence: In this type of letter, the debtor challenges the collection agency to provide supporting documents, such as the original debt agreement, accurate accounting, and verified ownership, to substantiate the claim. 4. Identity Theft and Fraudulent Activity Claim: When a debtor suspects identity theft or fraudulent activity is behind the alleged debt, this letter raises such concerns and urges the collection agency to investigate the matter thoroughly. It may include a request for an identity theft affidavit to be completed. Content of the Letter Denying Alleged Debt and Requesting Validation: The primary goal of this letter is to assert the debtor's denial of any debt liability and the necessity for the collection agency to validate the claim. Here is a breakdown of essential content: 1. Sender's Information: Include your full name, address, phone number, and email address at the beginning of the letter. 2. Date and Collection Agency's Information: Include the current date and provide accurate information about the debt collection agency, including their name, address, phone number, and any reference numbers associated with the alleged debt. 3. Subject Statement: Clearly state the subject of the letter, such as "Letter Refuting Alleged Debt and Demanding Debt Validation." 4. Debtor's Claim: In a concise and assertive manner, state that you deny any obligation or liability for the alleged debt in question. 5. Request for Validation: Clearly demand that the collection agency provides the necessary evidence, such as the original debt agreement, accurate accounting, and proof of ownership, to validate the existence and legitimacy of the alleged debt. 6. Supporting Information: If applicable, provide any supporting evidence or circumstances that strengthen your claim, such as documents demonstrating mistaken identity, fraudulent activity, or the expiration of the statute of limitations. 7. Action Deadline: Set a reasonable deadline for the collection agency to respond and validate the alleged debt. The timeline should be sufficient to allow for thorough investigation without undue delay. 8. Closing Remarks: Politely express your expectation for the collection agency to halt any further debt collection activities until the validation process is complete. Thank them for their cooperation. 9. Signature: End the letter with your full name and signature to verify its authenticity. Conclusion: A "Queens, New York Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt" is a vital resource for disputing questionable debts. Tailoring the letter to specific circumstances, such as statute of limitations defense or identity theft claims, enables individuals to assert their rights and protect their financial well-being effectively.Title: Queens, New York: Letter Rejecting Alleged Debt and Seeking Debt Validation from Collection Agency Keywords: Queens, New York; debt denial letter; alleged debtor; debt validation; collection agency Introduction: In the bustling borough of Queens, New York, a letter is a powerful tool for disputing an alleged debt and seeking validation from a collection agency. This detailed description explores the nature and purpose of a "Queens, New York Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt" — a crucial step for individuals wrongly accused of financial liabilities. Types of Queens New York Letter Denying Alleged Debt: 1. Formal Debt Denial and Validation Request: This type of letter is typically used to challenge the validity of the alleged debt. It emphasizes that the debtor denies any liability and requests the collection agency to validate the existence of such a debt by providing relevant records and evidence. 2. Statute of Limitations Defense: If the alleged debt is beyond the legal time limit (statute of limitations) for enforcing collection, this letter highlights this defense. It asserts that the debtor is no longer liable due to the expiration of the specified time frame. 3. Lack of Documentation and Supporting Evidence: In this type of letter, the debtor challenges the collection agency to provide supporting documents, such as the original debt agreement, accurate accounting, and verified ownership, to substantiate the claim. 4. Identity Theft and Fraudulent Activity Claim: When a debtor suspects identity theft or fraudulent activity is behind the alleged debt, this letter raises such concerns and urges the collection agency to investigate the matter thoroughly. It may include a request for an identity theft affidavit to be completed. Content of the Letter Denying Alleged Debt and Requesting Validation: The primary goal of this letter is to assert the debtor's denial of any debt liability and the necessity for the collection agency to validate the claim. Here is a breakdown of essential content: 1. Sender's Information: Include your full name, address, phone number, and email address at the beginning of the letter. 2. Date and Collection Agency's Information: Include the current date and provide accurate information about the debt collection agency, including their name, address, phone number, and any reference numbers associated with the alleged debt. 3. Subject Statement: Clearly state the subject of the letter, such as "Letter Refuting Alleged Debt and Demanding Debt Validation." 4. Debtor's Claim: In a concise and assertive manner, state that you deny any obligation or liability for the alleged debt in question. 5. Request for Validation: Clearly demand that the collection agency provides the necessary evidence, such as the original debt agreement, accurate accounting, and proof of ownership, to validate the existence and legitimacy of the alleged debt. 6. Supporting Information: If applicable, provide any supporting evidence or circumstances that strengthen your claim, such as documents demonstrating mistaken identity, fraudulent activity, or the expiration of the statute of limitations. 7. Action Deadline: Set a reasonable deadline for the collection agency to respond and validate the alleged debt. The timeline should be sufficient to allow for thorough investigation without undue delay. 8. Closing Remarks: Politely express your expectation for the collection agency to halt any further debt collection activities until the validation process is complete. Thank them for their cooperation. 9. Signature: End the letter with your full name and signature to verify its authenticity. Conclusion: A "Queens, New York Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt" is a vital resource for disputing questionable debts. Tailoring the letter to specific circumstances, such as statute of limitations defense or identity theft claims, enables individuals to assert their rights and protect their financial well-being effectively.