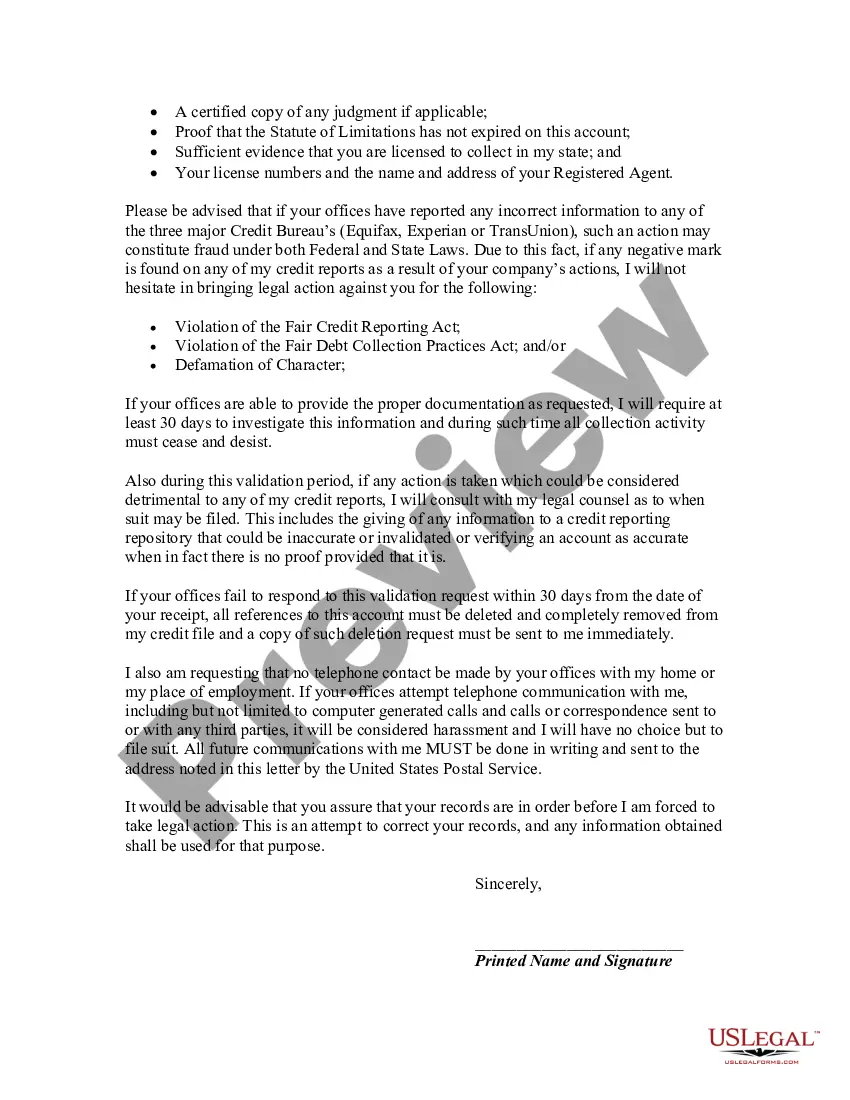

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Wake North Carolina: Legal Letter Asserting the Non-Existence of Debt and Demanding Collection Agency Validation Keywords: Wake North Carolina, letter denying debt, alleged debtor, debt validation, collection agency, debt dispute, debt verification, consumer rights, legal document, debt resolution process, consumer protection, debt collection laws, dispute resolution Description: A Wake North Carolina Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt is an essential legal document used by individuals in Wake, North Carolina, who find themselves facing an alleged debt that they believe to be unjustly imposed upon them. This letter serves the purpose of asserting the debtor's position that they do not owe any part of the alleged debt and demands that the collection agency entrusted with collecting the debt provide proper validation of the debt within the boundaries mandated by state and federal debt collection laws. In this letter, the debtor exercises their consumer rights and implements the debt resolution process by formally denying their liability. It is crucial to mention specific details about the alleged debt in question, including dates, amounts, and any relevant supporting documents. Furthermore, the debtor should include any grievances they have regarding the debt collection practices employed by the agency, such as harassment or violation of debt collection laws. Wake, North Carolina, being subject to the Fair Debt Collection Practices Act (FD CPA), ensures that consumers have the right to challenge the validity of the alleged debt and obtain proof that they actually owe the debt. A validating collection agency must validate the debt promptly upon receiving the debtor's written request and provide supporting evidence for the existence of the debt, such as original creditor agreements, statements, or contracts. Types of Wake North Carolina Letters Denying Alleged Debt and Requesting Collection Agency Validation: 1. Standard Wake North Carolina Letter Denying Alleged Debt: Used in cases where a debtor simply denies any knowledge or responsibility for the alleged debt and demands proper validation. 2. Wake North Carolina Letter Denying Alleged Debtor's Identity/Ownership of the Debt: Implementing this letter when the debtor firmly believes that they are not the rightful owner of the alleged debt and request the collection agency to prove their claim. 3. Wake North Carolina Letter Denying Alleged Debtor's Responsibility for Debt Due to Identity Theft: In instances where debt is associated with identity theft, the debtor must assert their innocence and demand the collection agency to conduct a thorough investigation to confirm their assertion. Please note that these are general descriptions, and it is recommended to consult a legal professional for personalized advice and assistance when dealing with debt disputes in Wake, North Carolina.Title: Wake North Carolina: Legal Letter Asserting the Non-Existence of Debt and Demanding Collection Agency Validation Keywords: Wake North Carolina, letter denying debt, alleged debtor, debt validation, collection agency, debt dispute, debt verification, consumer rights, legal document, debt resolution process, consumer protection, debt collection laws, dispute resolution Description: A Wake North Carolina Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt is an essential legal document used by individuals in Wake, North Carolina, who find themselves facing an alleged debt that they believe to be unjustly imposed upon them. This letter serves the purpose of asserting the debtor's position that they do not owe any part of the alleged debt and demands that the collection agency entrusted with collecting the debt provide proper validation of the debt within the boundaries mandated by state and federal debt collection laws. In this letter, the debtor exercises their consumer rights and implements the debt resolution process by formally denying their liability. It is crucial to mention specific details about the alleged debt in question, including dates, amounts, and any relevant supporting documents. Furthermore, the debtor should include any grievances they have regarding the debt collection practices employed by the agency, such as harassment or violation of debt collection laws. Wake, North Carolina, being subject to the Fair Debt Collection Practices Act (FD CPA), ensures that consumers have the right to challenge the validity of the alleged debt and obtain proof that they actually owe the debt. A validating collection agency must validate the debt promptly upon receiving the debtor's written request and provide supporting evidence for the existence of the debt, such as original creditor agreements, statements, or contracts. Types of Wake North Carolina Letters Denying Alleged Debt and Requesting Collection Agency Validation: 1. Standard Wake North Carolina Letter Denying Alleged Debt: Used in cases where a debtor simply denies any knowledge or responsibility for the alleged debt and demands proper validation. 2. Wake North Carolina Letter Denying Alleged Debtor's Identity/Ownership of the Debt: Implementing this letter when the debtor firmly believes that they are not the rightful owner of the alleged debt and request the collection agency to prove their claim. 3. Wake North Carolina Letter Denying Alleged Debtor's Responsibility for Debt Due to Identity Theft: In instances where debt is associated with identity theft, the debtor must assert their innocence and demand the collection agency to conduct a thorough investigation to confirm their assertion. Please note that these are general descriptions, and it is recommended to consult a legal professional for personalized advice and assistance when dealing with debt disputes in Wake, North Carolina.