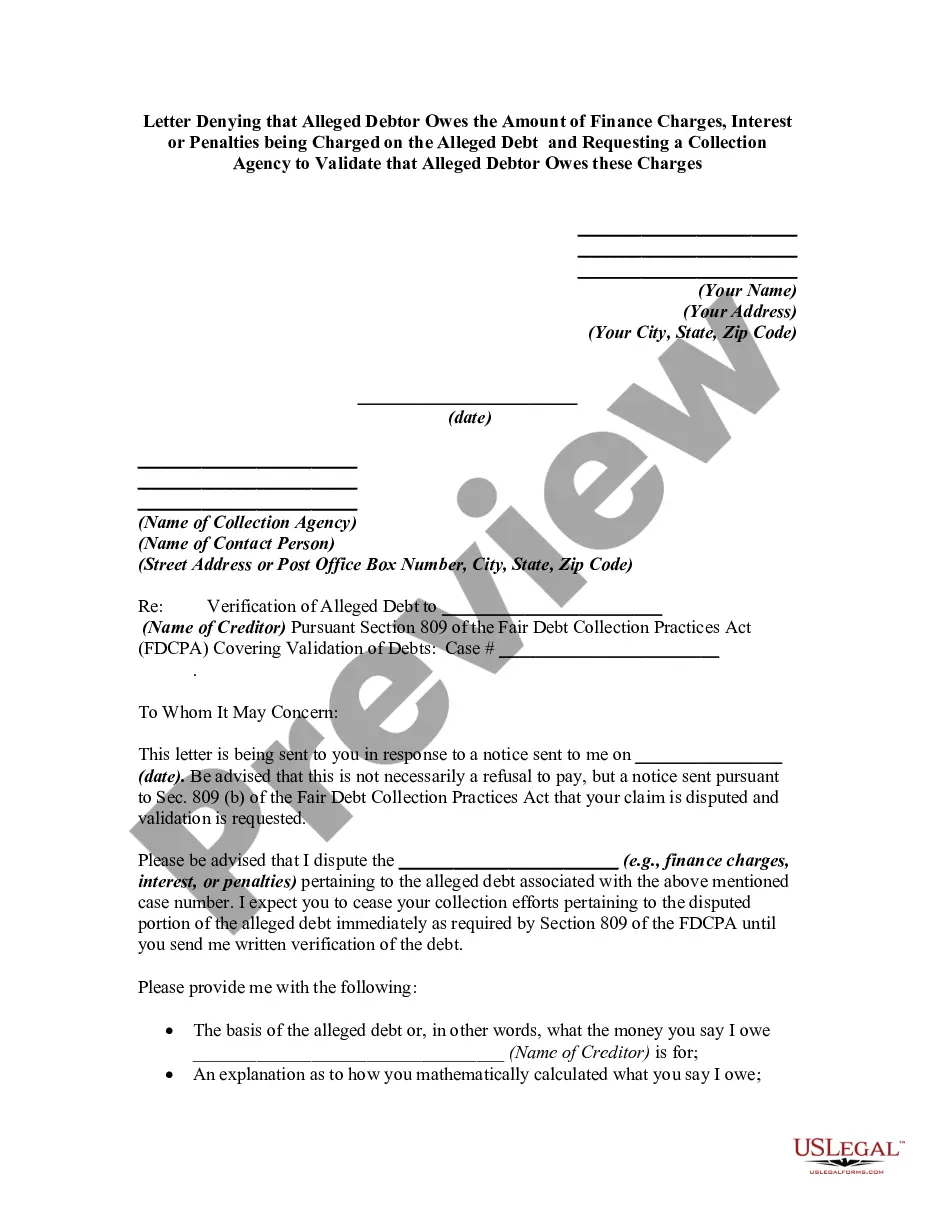

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

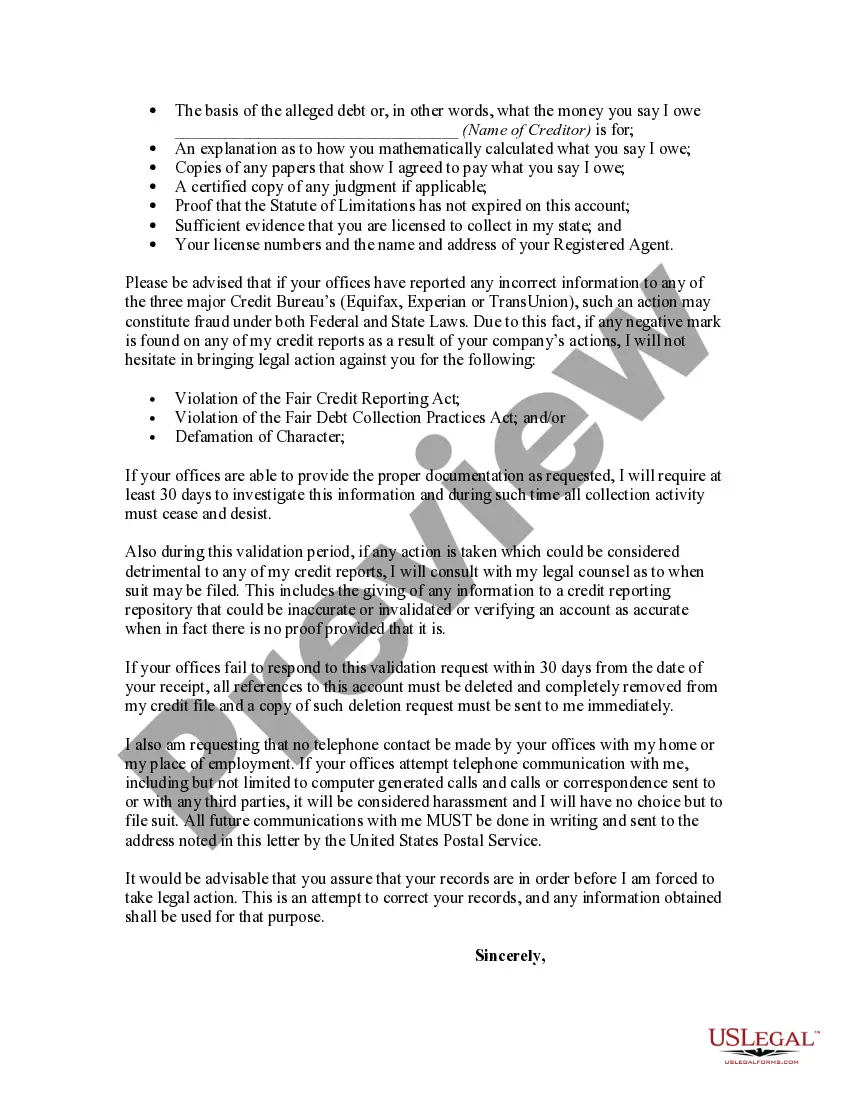

Title: Understanding Cuyahoga Ohio Letter Denying Alleged Debt and Requesting Validation Keywords: Cuyahoga Ohio, letter denying alleged debt, collection agency, finance charges, interest, penalties, validation Introduction: The following article aims to provide a detailed description of Cuyahoga Ohio's letter denying an alleged debt and requesting a collection agency to validate the charges associated with finance charges, interest, or penalties. We will explore the purpose of these letters, their importance, and different types that may exist. I. Understanding the Letter: Cuyahoga Ohio's letter denying an alleged debt serves as a formal response to a creditor, informing them that the alleged debtor does not acknowledge the validity of the claimed finance charges, interest, or penalties. This letter states the debtor's belief that these charges may be incorrect and requests that the collection agency provides valid proof to substantiate their claims. II. Importance of the Letter: 1. Protecting consumer rights: The letter ensures debtors' rights are safeguarded by allowing them to contest inaccurate or potentially inflated charges. 2. Transparency: It encourages creditors and collection agencies to demonstrate the legitimacy of the alleged debt and associated charges. 3. Debt verification process: The letter initiates the debt validation process, wherein collection agencies must provide relevant documentation as proof of the alleged debtor's liability. III. Content of the Letter: 1. Debt denial: Clearly state that the alleged debtor denies owing the stated amount of finance charges, interest, or penalties. 2. Request for validation: Ask the collection agency to provide accurate and detailed documentation validating the alleged charges, including loan agreements, billing statements, or other relevant records within a specific timeframe (usually 30 days). 3. Information accuracy: Encourage the collection agency to verify the alleged debtor's personal and account information to prevent potential identity theft or confusion. 4. Contact details: Provide the alleged debtor's contact information for further communication regarding the validation process. IV. Types of Cuyahoga Ohio Letter Denying Alleged Debt: 1. Letter disputing finance charges: Specifies the alleged debtor's denial of the finance charges claimed by the collection agency. 2. Letter disputing interest charges: Challenges the claimed interest charged on the alleged debt, asserting the debtor's disagreement. 3. Letter disputing penalties: Asserts the debtor's denial of any requested fines, penalties, or late fees associated with the alleged debt. 4. Combined letter: A comprehensive letter that disputes all aspects of the alleged debt, including finance charges, interest, and penalties. Conclusion: Cuyahoga Ohio's letter denying an alleged debt plays a vital role in protecting consumers from potentially unfair or inflated charges. By requesting validation from the collection agency, debtors can ensure transparency and accuracy in the debt collection process. Whether disputing finance charges, interest, penalties, or a combination thereof, these letters offer an avenue for debtors to assert their rights and seek clarity in their financial obligations.Title: Understanding Cuyahoga Ohio Letter Denying Alleged Debt and Requesting Validation Keywords: Cuyahoga Ohio, letter denying alleged debt, collection agency, finance charges, interest, penalties, validation Introduction: The following article aims to provide a detailed description of Cuyahoga Ohio's letter denying an alleged debt and requesting a collection agency to validate the charges associated with finance charges, interest, or penalties. We will explore the purpose of these letters, their importance, and different types that may exist. I. Understanding the Letter: Cuyahoga Ohio's letter denying an alleged debt serves as a formal response to a creditor, informing them that the alleged debtor does not acknowledge the validity of the claimed finance charges, interest, or penalties. This letter states the debtor's belief that these charges may be incorrect and requests that the collection agency provides valid proof to substantiate their claims. II. Importance of the Letter: 1. Protecting consumer rights: The letter ensures debtors' rights are safeguarded by allowing them to contest inaccurate or potentially inflated charges. 2. Transparency: It encourages creditors and collection agencies to demonstrate the legitimacy of the alleged debt and associated charges. 3. Debt verification process: The letter initiates the debt validation process, wherein collection agencies must provide relevant documentation as proof of the alleged debtor's liability. III. Content of the Letter: 1. Debt denial: Clearly state that the alleged debtor denies owing the stated amount of finance charges, interest, or penalties. 2. Request for validation: Ask the collection agency to provide accurate and detailed documentation validating the alleged charges, including loan agreements, billing statements, or other relevant records within a specific timeframe (usually 30 days). 3. Information accuracy: Encourage the collection agency to verify the alleged debtor's personal and account information to prevent potential identity theft or confusion. 4. Contact details: Provide the alleged debtor's contact information for further communication regarding the validation process. IV. Types of Cuyahoga Ohio Letter Denying Alleged Debt: 1. Letter disputing finance charges: Specifies the alleged debtor's denial of the finance charges claimed by the collection agency. 2. Letter disputing interest charges: Challenges the claimed interest charged on the alleged debt, asserting the debtor's disagreement. 3. Letter disputing penalties: Asserts the debtor's denial of any requested fines, penalties, or late fees associated with the alleged debt. 4. Combined letter: A comprehensive letter that disputes all aspects of the alleged debt, including finance charges, interest, and penalties. Conclusion: Cuyahoga Ohio's letter denying an alleged debt plays a vital role in protecting consumers from potentially unfair or inflated charges. By requesting validation from the collection agency, debtors can ensure transparency and accuracy in the debt collection process. Whether disputing finance charges, interest, penalties, or a combination thereof, these letters offer an avenue for debtors to assert their rights and seek clarity in their financial obligations.