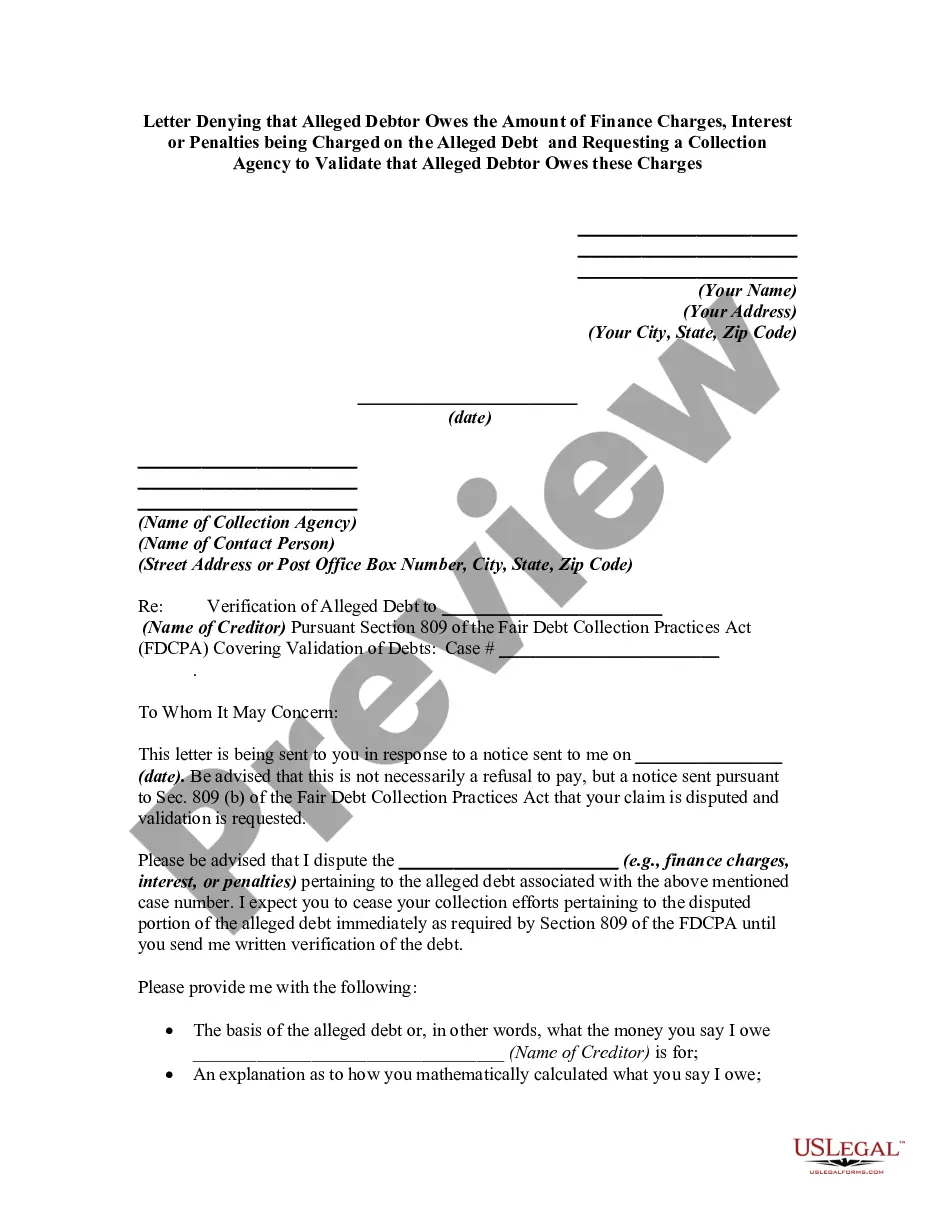

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

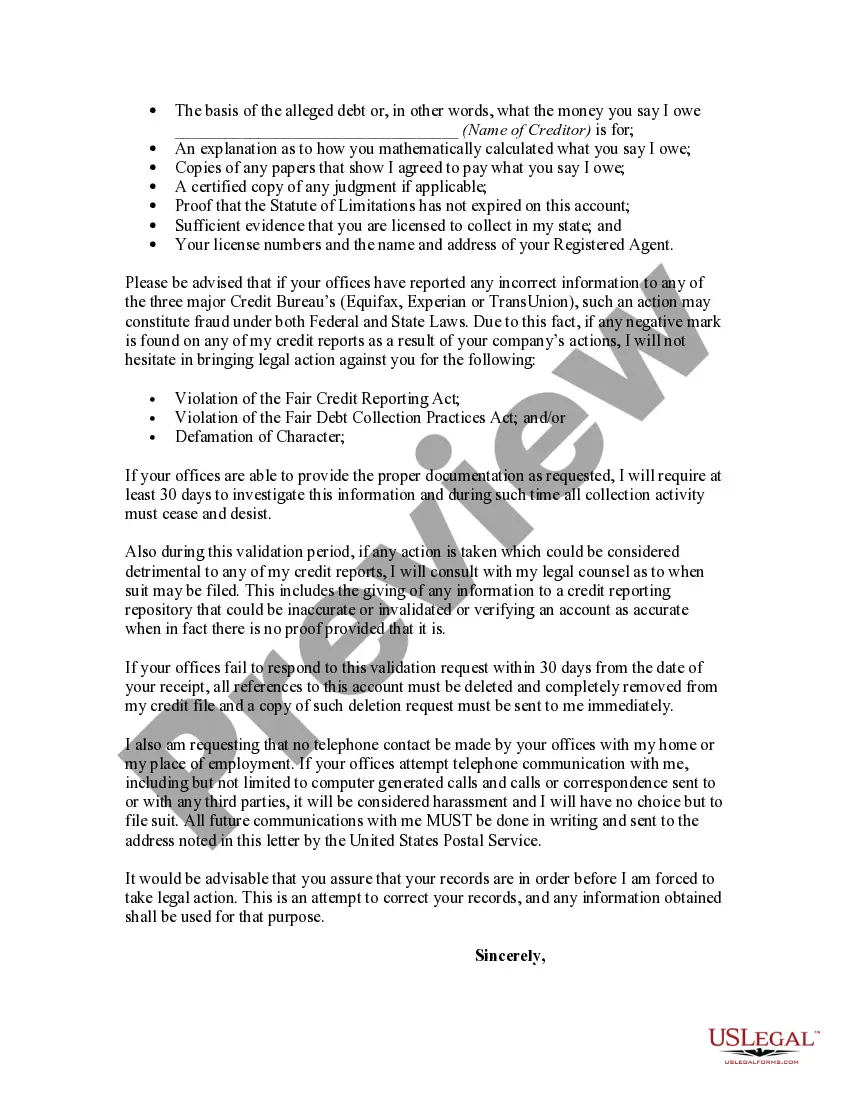

Subject: Fairfax Virginia Letter Denying Alleged Debt and Requesting Validation of Charges by Collection Agency Dear [Collection Agency's Name], I hope this letter finds you well. I am writing in response to the recent correspondence I received from your agency regarding an alleged debt attributed to my name. Upon reviewing the details provided, I respectfully deny any liability for the amount of finance charges, interest, or penalties being claimed. It is of utmost importance to ensure that the alleged debt is accurate and appropriately validated, thus warranting my request for your assistance in verifying the charges imposed upon me. I kindly ask that your agency specifically validate the following aspects: 1. Amount of the Alleged Debt: I request a detailed breakdown of the principal debt, finance charges, interest, and penalties being imposed on this alleged account. Kindly provide a comprehensive record of all transactions and accrued charges that have led to the current outstanding balance. 2. Validity of the Debt: My denial stems from the lack of clarity and supporting evidence regarding the origin and legitimacy of the alleged debt. As per the Fair Debt Collection Practices Act (FD CPA), I am entitled to receive accurate and verifiable information about the debt's validity, including the original creditor's name, address, and the nature of the obligations incurred leading to this alleged debt. 3. Proof of Ownership: I request your agency to provide proper documentation that substantiates your authority to collect on behalf of the original creditor. This includes a copy of the assigned contract or agreement outlining the terms and conditions of repayment, in addition to any subsequent agreements or assignments that may have occurred. 4. Verification Timeline: Considering the FD CPA stipulates that you must provide verification within 30 days after initial contact, I request the prompt resolution of this matter so that all parties involved can effectively address the situation. Please note that until such time that proper validation has been provided to confirm my liability for the alleged charges, I respectfully request for any and all collection activities, including contact attempts, to cease immediately. This will allow for a fair and unbiased assessment of the situation. Should your agency fail to validate the alleged debt fully or continue collection activities without providing the requested information within the stipulated timeframe, I reserve the right to take appropriate legal action to protect my rights and interests as governed by applicable consumer protection laws. I urge you to give this matter the utmost attention it requires and provide me with the requested validation and documentation at your earliest convenience. I believe in the principle of fair and transparent debt resolution, and I trust that your agency shares this commitment. Thank you for your prompt attention to this matter. I kindly request that all future communication be conducted in writing to ensure a documented record of our discussions. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]Subject: Fairfax Virginia Letter Denying Alleged Debt and Requesting Validation of Charges by Collection Agency Dear [Collection Agency's Name], I hope this letter finds you well. I am writing in response to the recent correspondence I received from your agency regarding an alleged debt attributed to my name. Upon reviewing the details provided, I respectfully deny any liability for the amount of finance charges, interest, or penalties being claimed. It is of utmost importance to ensure that the alleged debt is accurate and appropriately validated, thus warranting my request for your assistance in verifying the charges imposed upon me. I kindly ask that your agency specifically validate the following aspects: 1. Amount of the Alleged Debt: I request a detailed breakdown of the principal debt, finance charges, interest, and penalties being imposed on this alleged account. Kindly provide a comprehensive record of all transactions and accrued charges that have led to the current outstanding balance. 2. Validity of the Debt: My denial stems from the lack of clarity and supporting evidence regarding the origin and legitimacy of the alleged debt. As per the Fair Debt Collection Practices Act (FD CPA), I am entitled to receive accurate and verifiable information about the debt's validity, including the original creditor's name, address, and the nature of the obligations incurred leading to this alleged debt. 3. Proof of Ownership: I request your agency to provide proper documentation that substantiates your authority to collect on behalf of the original creditor. This includes a copy of the assigned contract or agreement outlining the terms and conditions of repayment, in addition to any subsequent agreements or assignments that may have occurred. 4. Verification Timeline: Considering the FD CPA stipulates that you must provide verification within 30 days after initial contact, I request the prompt resolution of this matter so that all parties involved can effectively address the situation. Please note that until such time that proper validation has been provided to confirm my liability for the alleged charges, I respectfully request for any and all collection activities, including contact attempts, to cease immediately. This will allow for a fair and unbiased assessment of the situation. Should your agency fail to validate the alleged debt fully or continue collection activities without providing the requested information within the stipulated timeframe, I reserve the right to take appropriate legal action to protect my rights and interests as governed by applicable consumer protection laws. I urge you to give this matter the utmost attention it requires and provide me with the requested validation and documentation at your earliest convenience. I believe in the principle of fair and transparent debt resolution, and I trust that your agency shares this commitment. Thank you for your prompt attention to this matter. I kindly request that all future communication be conducted in writing to ensure a documented record of our discussions. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]