A second letter requesting a collection agency to validate a debt you allegedly owe a creditor in Collin, Texas is an important step to ensure the accuracy and legitimacy of the debt. The content should include relevant keywords related to debt validation, Collin, Texas, collection agency, and creditor. Title: Collin, Texas: Second Letter Requesting Debt Validation from Collection Agency Introduction: [Your Name] [Your Address] [City, State, Zip Code] [Date] [Collection Agency's Name] [Collection Agency's Address] [City, State, Zip Code] Re: [Account Number/Reference Number] Dear [Collection Agency's Name], Paragraph 1: Reference to Previous Letter I am writing in reference to my previous letter dated [Date], which was sent requesting debt validation for the alleged debt you claim I owe. I have not received any response or validation of the debt from your agency thus far. Paragraph 2: Importance of Validation As a consumer protected under the Fair Debt Collection Practices Act (FD CPA), it is my right to receive proper validation of any debt claimed against me. Considering the seriousness of this matter, I insist on receiving valid proof of the debt's existence and the authority of your agency to collect it. Paragraph 3: Specifics of Required Validation In accordance with the FD CPA, I demand that you provide the following details within thirty (30) days from the receipt of this letter: 1. A complete accounting of the alleged debt, including the initial amount, any interest or fees applied, and the total current balance. 2. The name and contact information of the original creditor, their address, and the account number associated with the debt. 3. Evidence of my contractual obligation or agreement to pay the alleged debt, such as the signed loan agreement or credit card contract. 4. Verification of your agency's license to collect debts in Collin, Texas. 5. Any documentation supporting your agency's assignment or ownership of the debt, proving that you have the legal authority to collect. Paragraph 4: Cease and Desist Collection Activities Until the required debt validation is provided, I request that you cease all collection efforts, including contacting me by phone or mail. Any reported negative information on my credit report should also be removed until the debt is properly validated. Paragraph 5: Legal Action Reminder Please be advised that failure to comply with my request within the specified time period may result in legal action and relevant complaints filed with the appropriate regulatory authorities. Conclusion: I expect your immediate attention to this matter as it directly affects my rights as a consumer. Failure to produce the requested information within the given timeframe will leave me with no choice but to pursue legal action. Sincerely, [Your Name] Alternative title: Collin, Texas: Follow-up Letter Requesting Collection Agency to Validate Alleged Debt Note: It is crucial to customize the letter according to your specific situation and consult legal professionals for advice regarding debt-related matters.

Collin Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

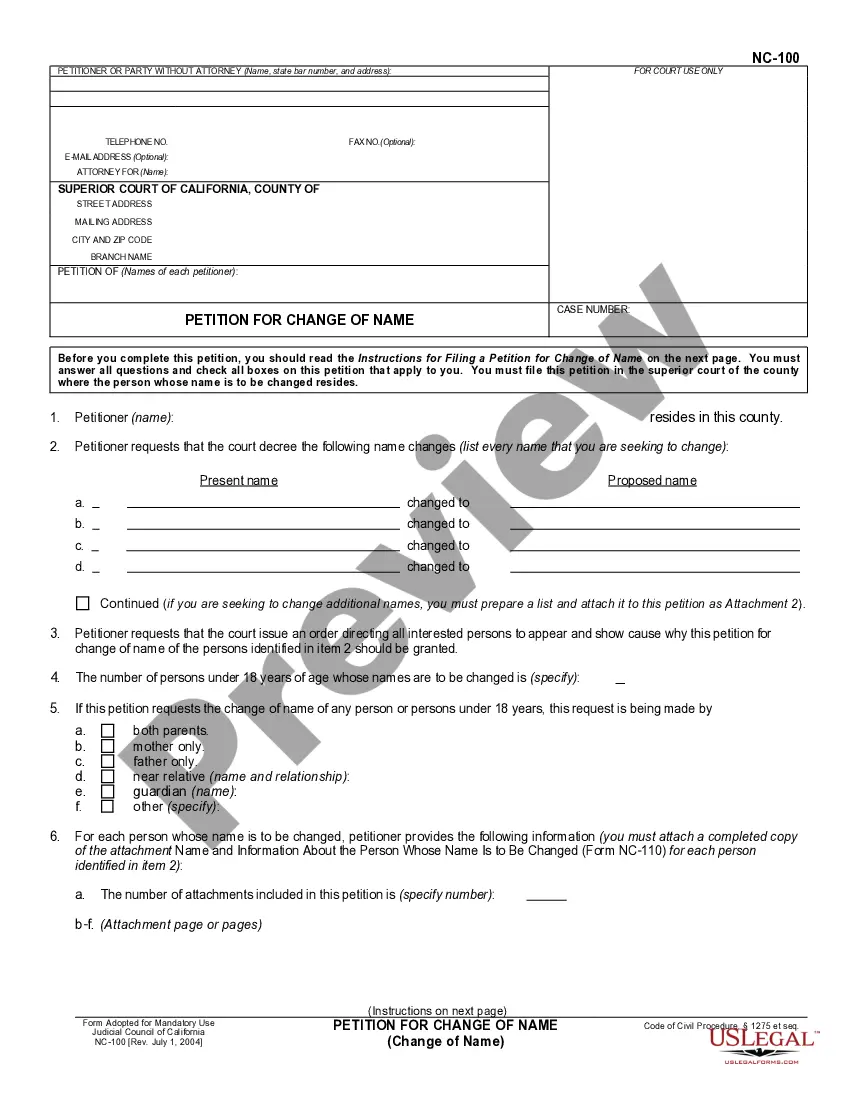

How to fill out Collin Texas Second Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, locating a Collin Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Aside from the Collin Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Collin Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Collin Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!