Contra Costa California Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Second Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

Whether you intend to establish your business, enter into a contract, apply for your identification renewal, or resolve family-related legal matters, you need to prepare specific documentation that complies with your local laws and regulations.

Locating the appropriate documents can consume a significant amount of time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 meticulously crafted and verified legal documents for any personal or business scenario. All files are categorized by state and area of use, making it simple and fast to select a copy such as Contra Costa Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor.

Documents offered by our library are reusable. With an active subscription, you can access all of your previously obtained paperwork at any time in the My documents section of your profile. Stop wasting time on an endless search for current official documentation. Join the US Legal Forms platform and organize your paperwork with the most comprehensive online form library!

- Ensure the sample meets your personal needs and state law criteria.

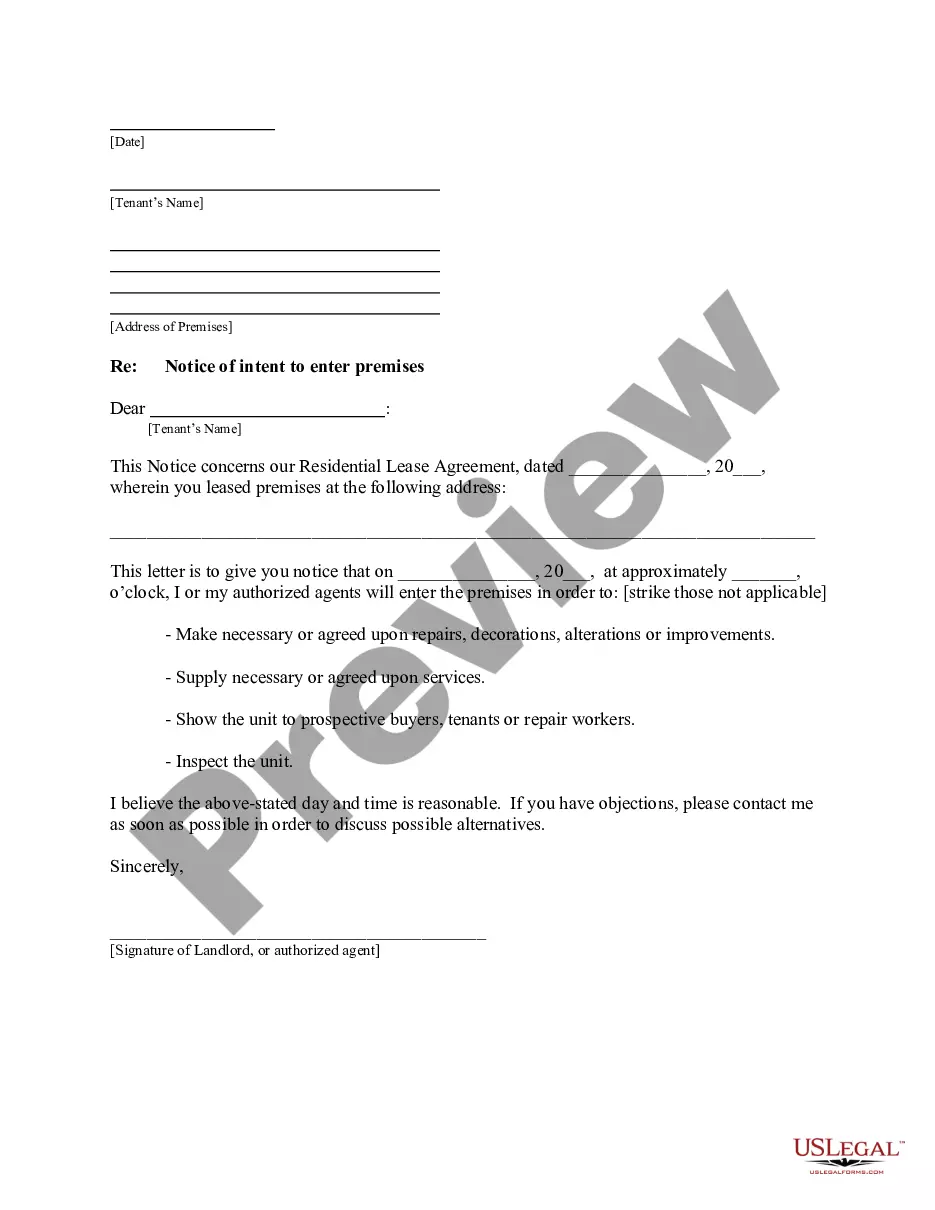

- Review the form description and examine the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to purchase the sample once you identify the right one.

- Select the subscription plan that best fits you to proceed.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the Contra Costa Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor in your preferred file format.

- Print the document or fill it out and sign it electronically via an online editor to save time.

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

(5) Validation period means the period starting on the date that a debt collector provides the validation information required by paragraph (c) of this section and ending 30 days after the consumer receives or is assumed to receive the validation information.

The debt verification letter is a letter you write and send to the debt collector, disputing the debt (if you truly don't owe it or owe as much as the collector says you do). You'll also send this letter via certified mail with a return receipt request so you have a record of your communication back to the collector.

Debt validation can be extremely effective. If the debt collector is unable to validate your debt, you can request for the debt to be removed. Without validation, your credit report could be filled with multiple debts that don't belong to you.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.