San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Second Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

How long does it typically require for you to prepare a legal document.

Since each state has its own laws and regulations for every aspect of life, finding a San Antonio Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor that meets all local criteria can be exhausting, and obtaining it from a qualified attorney is frequently costly.

Many online platforms provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most beneficial.

Select the subscription plan that fits you best. Set up an account on the platform or Log In to continue to payment options. Complete the payment via PayPal or your credit card. Alter the file format if needed. Click Download to store the San Antonio Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. Print the document or utilize any preferred online editor to complete it electronically. Regardless of how many times you need to utilize the purchased document, you can find all samples you've downloaded in your profile by accessing the My documents tab. Give it a chance!

- US Legal Forms is the most comprehensive online collection of templates, organized by states and areas of application.

- In addition to the San Antonio Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, here you can discover any particular document to facilitate your business or personal affairs, adhering to your local regulations.

- Experts confirm all samples for their authenticity, so you can be confident in preparing your documents accurately.

- Using the service is fairly straightforward.

- If you already possess an account on the site and your subscription is active, you only need to Log In, select the necessary template, and download it.

- You can access the file in your profile at any time later.

- Conversely, if you are new to the platform, there will be additional steps to take before obtaining your San Antonio Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor.

- Review the content of the page you’re visiting.

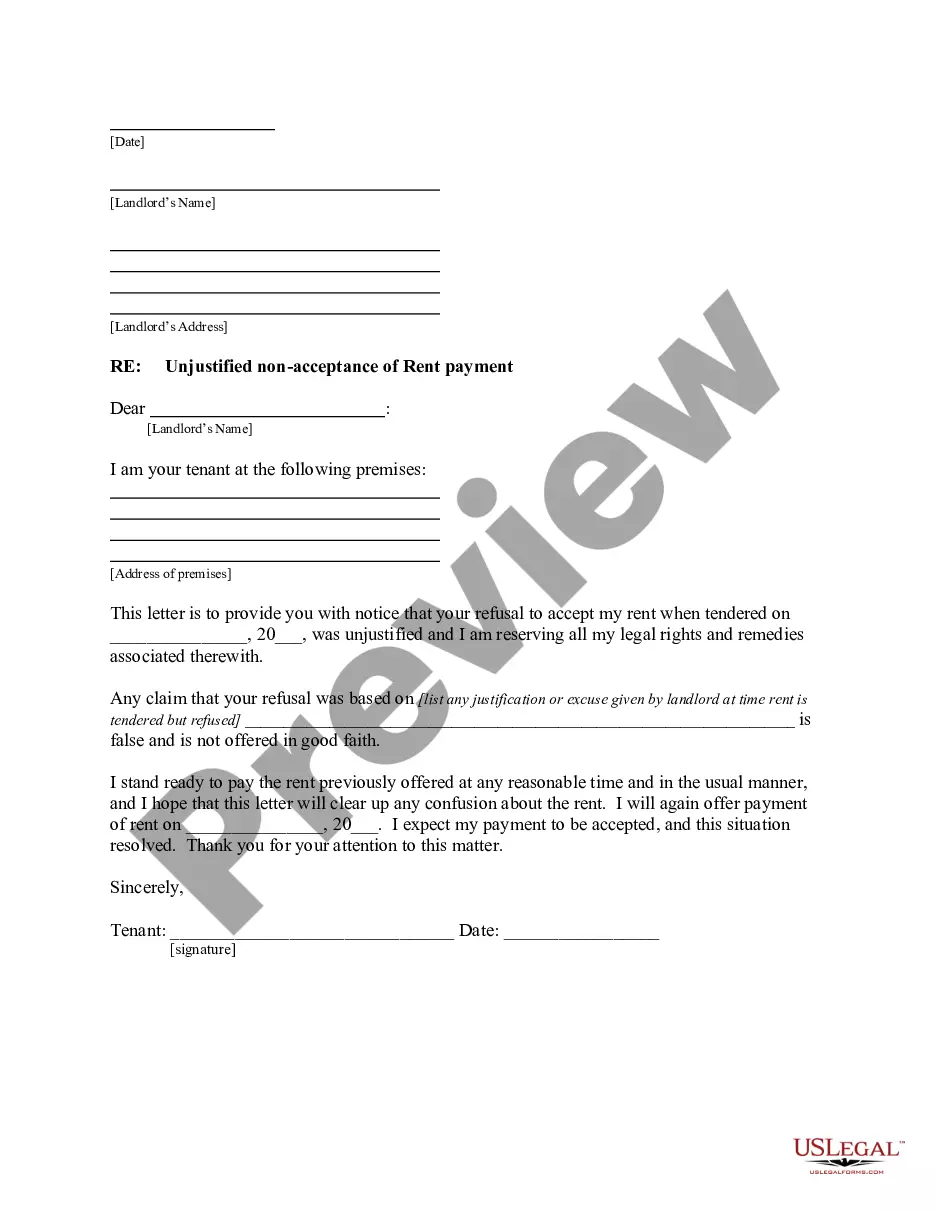

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re confident in the selected file.

Form popularity

FAQ

To write a letter requesting proof of debt, start with your contact information and the date at the top. Clearly state your intention to obtain validation of the debt, mentioning the original creditor's name and the amount you allegedly owe. This correspondence is essentially a San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. US Legal Forms provides user-friendly templates that can guide you through this letter-writing process, ensuring you include all necessary elements.

A debt validation letter is very effective in ensuring that you are not paying a debt that may not be yours. By sending a letter asserting your right to verification, you prompt the collection agency to provide proof. This communication qualifies as a San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. If they cannot validate the debt, they must cease all collection activities against you.

To ask a debt collector to verify a debt, you should send a written request that includes your personal information and the details of the debt in question. This request serves as a San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. It is important to send this letter within 30 days of the initial contact from the debt collector to ensure your rights are protected. You can use templates available on platforms like US Legal Forms to simplify this process.

Yes, debt validation letters can be effective tools for consumers. By utilizing the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, you can compel collection agencies to prove that the debt is valid. This solidifies your defense against unjust collection practices or inaccuracies. Always track your correspondence to support your case if needed.

To write a letter to a collection agency, clearly state your name, address, and the date at the beginning. Indicate that the letter serves as the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. Be succinct in outlining your request for debt validation, and include any relevant account information. Finally, express your expectation for a prompt response.

When dealing with a debt collector, avoid making statements that could be interpreted as admitting liability for the debt. Refrain from discussing your financial situation excessively, and do not provide unverified personal information. With the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, your communication should focus on validation and clarity. Always keep the conversation professional.

An effective collection letter should be clear, concise, and professional. Start by addressing the recipient politely and state the purpose of your letter directly. Use the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. Include account details and a call to action, encouraging the recipient to respond or make payments. Ending on a courteous note can also improve outcomes.

When requesting debt validation, begin your letter by stating your intention to dispute the debt and request validation. Specify that you are sending the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. Include your contact information and a request for the collection agency to provide proof of the debt. Make sure to keep a copy of the letter for your records.

The 7 7 7 rule refers to a guideline suggesting that creditors should wait at least seven days before contacting a debtor, seven times to collect debt, and pause for seven days after each attempt. This method helps to prevent harassing behavior from collection agencies. When you're considering the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, knowing this rule can empower you in your negotiations. It’s important to know your rights.

To write a letter to a debt collection agency, start with your name and address at the top. Clearly state your request by mentioning that you are sending the San Antonio Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. Make sure to include account details and any relevant dates, and request a response within a specific time frame. Use a polite but firm tone to convey your request.