Wake North Carolina Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Second Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

Do you require to swiftly produce a legally-binding Wake Second Letter Requesting a Collection Agency to Confirm a Debt that You Are Allegedly Obligated to a Creditor, or possibly any other document to manage your personal or business affairs.

You can choose one of the two alternatives: consult a legal expert to draft a legitimate document for you or compose it entirely by yourself. Fortunately, there’s another option - US Legal Forms. It will assist you in obtaining professionally crafted legal documents without incurring exorbitant fees for legal services.

If the template doesn’t match what you were seeking, initiate the search again using the search bar in the header.

Select the package that most suits your requirements and proceed to payment. Choose the file format you prefer for your document and download it. Print it, fill it out, and sign where indicated. If you have already created an account, you can easily Log In to it, find the Wake Second Letter Requesting a Collection Agency to Confirm a Debt that You Are Allegedly Obligated to a Creditor template, and download it. To retrieve the form again, simply navigate to the My documents tab.

- US Legal Forms provides an extensive repository of over 85,000 state-specific document templates, including Wake Second Letter Requesting a Collection Agency to Confirm a Debt that You Are Allegedly Obligated to a Creditor and form packages.

- We supply documents for a variety of use cases: from divorce forms to property documents.

- Having been in the industry for over 25 years, we have established a solid reputation among our clients.

- Here’s how you can join them and acquire the required template without unnecessary complications.

- Initially, carefully ensure that the Wake Second Letter Requesting a Collection Agency to Confirm a Debt that You Are Allegedly Obligated to a Creditor complies with your state's or county's legal requirements.

- If the form includes a description, make certain to check what it is designed for.

Form popularity

FAQ

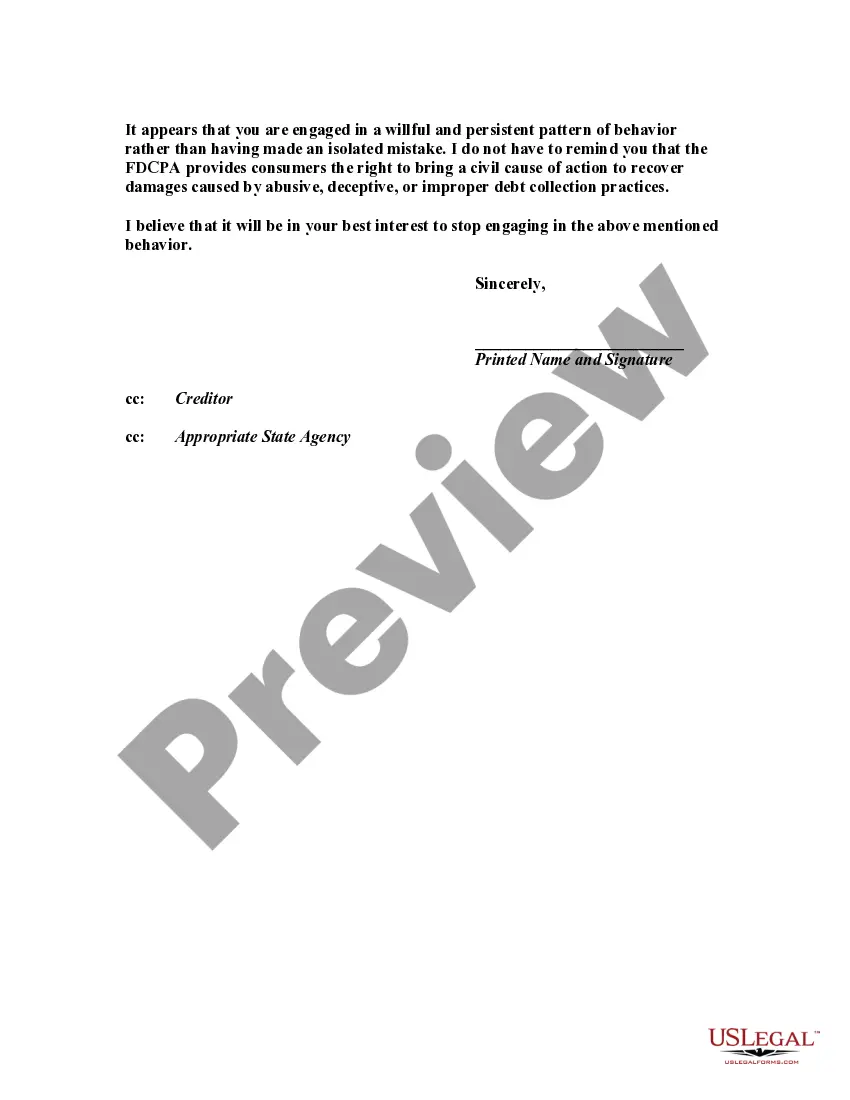

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Unfortunately, a debt collection agency can take as long as they want to respond to your request to validate an existing debt. I would say, generally, the usual range is between 130 days or they never respond. Here's a video with more info on Debt Validation Letters.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.