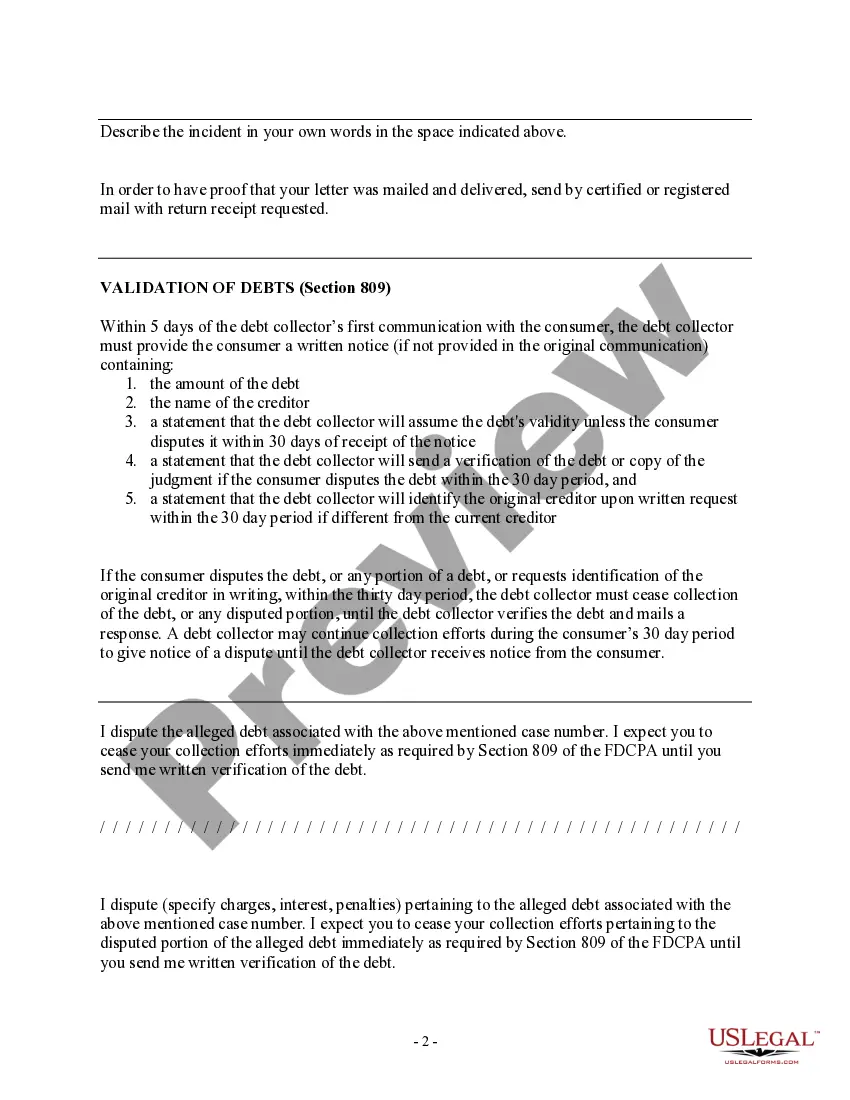

Use this form to help you respond to a debt collector's validation letter. You can respond by disputing the debt or any portion of it, asking fthe debt collector to verify the amount or validity of the debt, or request the name and contact information of the original creditor.

If you respond in writing within the 30 day period, the debt collector must stop attempting to collect the debt, or any disputed portion, until they verify the debt and mail you a response.

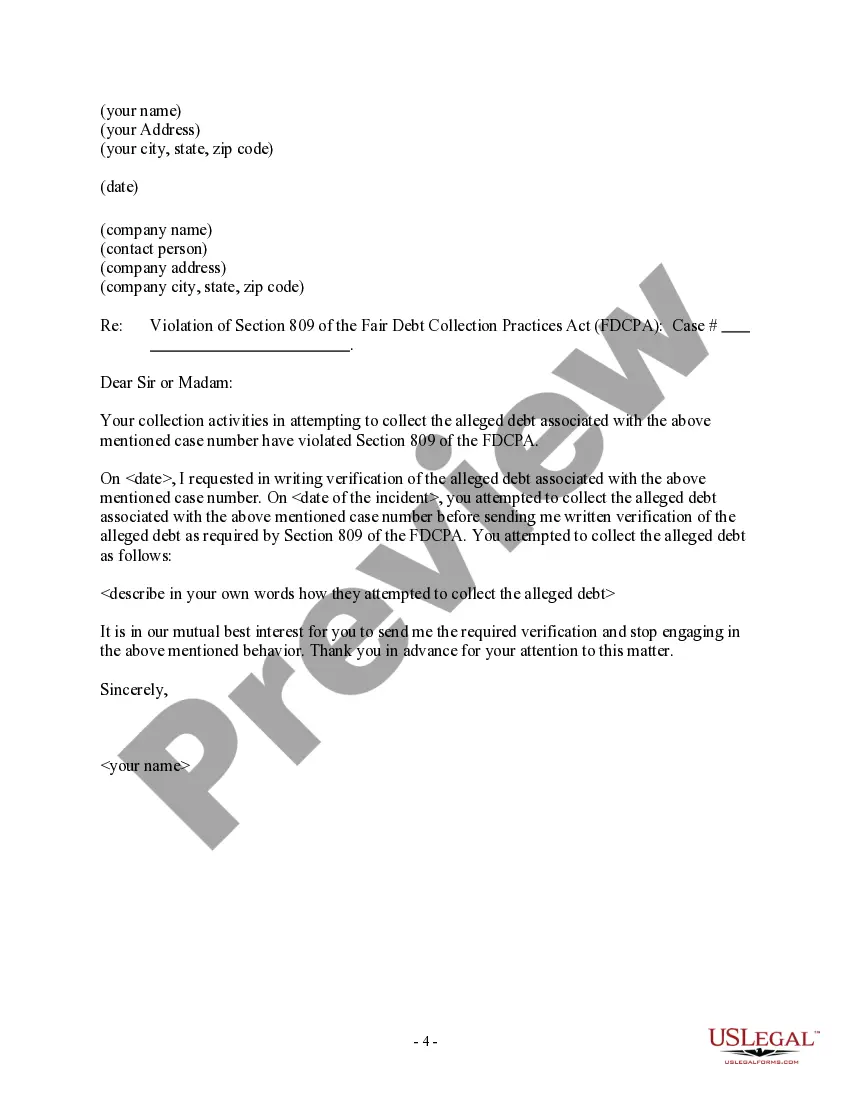

This form also also includes follow-up letters in the even the debt collector does not respond or continues attmpting to collect the debt after you requested verification. A detailed description of what is a Collin Texas Letter to debt collector seeking verification of a debt in response to their validation letter: A Collin Texas Letter, also known as a debt validation letter, is a formal written request sent by individuals to debt collectors in response to the validation letter received from the collector. This letter is specifically designed to seek verification of a debt that the collector claims is owed by the individual. When individuals receive a validation letter from a debt collector, which is a written notice informing them about an alleged debt and their rights, they have the option to respond with a Collin Texas Letter. This letter serves as a mechanism to request the collector to provide specific information and evidence to validate the debt they are pursuing. The Collin Texas Letter seeks to protect the rights of individuals by demanding that the debt collector substantiate the validity of the debt. It also aims to ensure that the collector has the legal right to collect the debt and has accurate information regarding the alleged debt. In the Collin Texas Letter, individuals may include relevant information such as the collector's name and address, account details, and the specific request for verification of the debt. The letter should clearly outline the reasons for disputing the debt and demand that the collector provide adequate documentation and evidence supporting the validity of the debt. Individuals may also choose to mention any applicable consumer protection laws that safeguard their rights, such as the Fair Debt Collection Practices Act (FD CPA) or the Fair Credit Reporting Act (FCRA). Mentioning these laws can help emphasize the seriousness of the request and put pressure on the debt collector to provide the necessary validation. Different types of Collin Texas Letters seeking verification of a debt may be categorized based on specific situations or circumstances. Some possible variations may include: 1. Collin Texas Letter for inaccuracies in debt reporting: This type of letter is used when the individual believes that there are inaccuracies or errors in how the debt is reported or recorded in their credit report. It seeks verification of the debt, along with evidence that it was reported accurately. 2. Collin Texas Letter for expired debts or statute of limitations: This variation is applicable when the alleged debt has passed the statute of limitations, making it unenforceable or noncollectable. The letter requests verification of the debt's validity and the calculation of the expiration date. 3. Collin Texas Letter for identity theft or mistaken identity: If the individual believes that the debt collector has contacted them regarding a debt that is a result of identity theft or mistaken identity, this type of letter seeks verification while providing relevant details to prove the error. It is essential to tailor the Collin Texas Letter to the specific situation and follow any applicable laws or regulations when seeking verification of a debt. Consulting with a legal professional or credit counseling agency can also provide valuable guidance and support in drafting the letter effectively.

A detailed description of what is a Collin Texas Letter to debt collector seeking verification of a debt in response to their validation letter: A Collin Texas Letter, also known as a debt validation letter, is a formal written request sent by individuals to debt collectors in response to the validation letter received from the collector. This letter is specifically designed to seek verification of a debt that the collector claims is owed by the individual. When individuals receive a validation letter from a debt collector, which is a written notice informing them about an alleged debt and their rights, they have the option to respond with a Collin Texas Letter. This letter serves as a mechanism to request the collector to provide specific information and evidence to validate the debt they are pursuing. The Collin Texas Letter seeks to protect the rights of individuals by demanding that the debt collector substantiate the validity of the debt. It also aims to ensure that the collector has the legal right to collect the debt and has accurate information regarding the alleged debt. In the Collin Texas Letter, individuals may include relevant information such as the collector's name and address, account details, and the specific request for verification of the debt. The letter should clearly outline the reasons for disputing the debt and demand that the collector provide adequate documentation and evidence supporting the validity of the debt. Individuals may also choose to mention any applicable consumer protection laws that safeguard their rights, such as the Fair Debt Collection Practices Act (FD CPA) or the Fair Credit Reporting Act (FCRA). Mentioning these laws can help emphasize the seriousness of the request and put pressure on the debt collector to provide the necessary validation. Different types of Collin Texas Letters seeking verification of a debt may be categorized based on specific situations or circumstances. Some possible variations may include: 1. Collin Texas Letter for inaccuracies in debt reporting: This type of letter is used when the individual believes that there are inaccuracies or errors in how the debt is reported or recorded in their credit report. It seeks verification of the debt, along with evidence that it was reported accurately. 2. Collin Texas Letter for expired debts or statute of limitations: This variation is applicable when the alleged debt has passed the statute of limitations, making it unenforceable or noncollectable. The letter requests verification of the debt's validity and the calculation of the expiration date. 3. Collin Texas Letter for identity theft or mistaken identity: If the individual believes that the debt collector has contacted them regarding a debt that is a result of identity theft or mistaken identity, this type of letter seeks verification while providing relevant details to prove the error. It is essential to tailor the Collin Texas Letter to the specific situation and follow any applicable laws or regulations when seeking verification of a debt. Consulting with a legal professional or credit counseling agency can also provide valuable guidance and support in drafting the letter effectively.