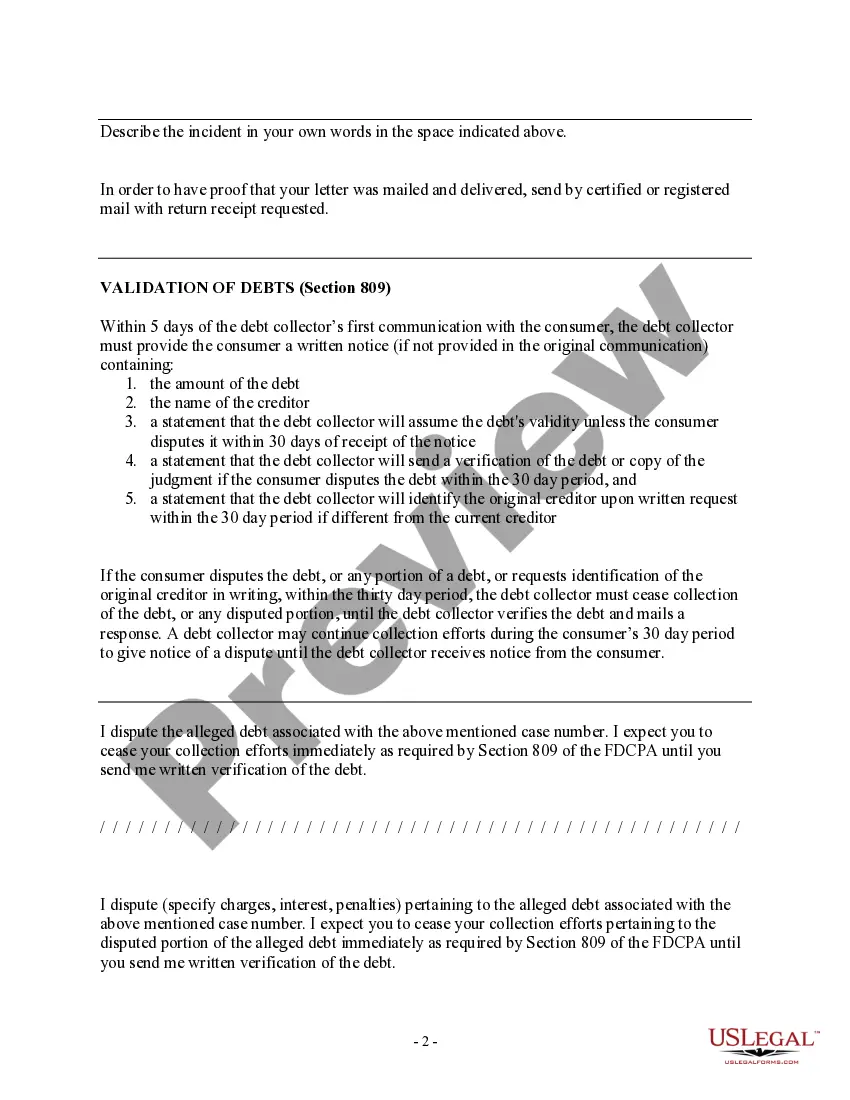

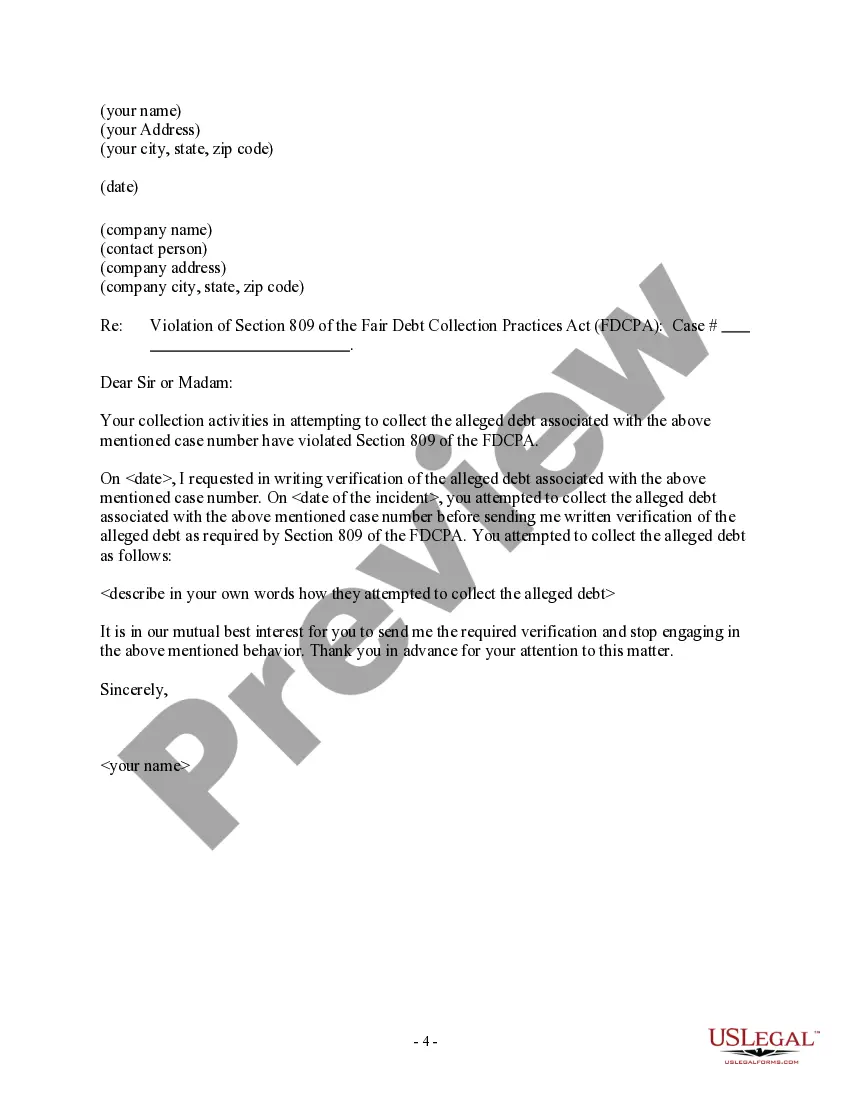

Use this form to help you respond to a debt collector's validation letter. You can respond by disputing the debt or any portion of it, asking fthe debt collector to verify the amount or validity of the debt, or request the name and contact information of the original creditor.

If you respond in writing within the 30 day period, the debt collector must stop attempting to collect the debt, or any disputed portion, until they verify the debt and mail you a response.

This form also also includes follow-up letters in the even the debt collector does not respond or continues attmpting to collect the debt after you requested verification. Middlesex Massachusetts is a county located in the state of Massachusetts, United States. It is one of the 14 counties in the state and is situated in the eastern part of Massachusetts. Middlesex County is known for its rich history, diverse population, and vibrant communities. In relation to debt collection, if you have received a validation letter from a debt collector regarding a debt in Middlesex County, Massachusetts, you have the right to request verification of the debt. This letter serves as a response to the debt collector's validation letter and seeks to obtain information that proves the validity of the debt they are attempting to collect. When drafting a letter to a debt collector seeking verification of a debt, it's important to include specific information such as: 1. Your contact details: Provide your full name, address, and phone number clearly at the beginning of the letter. 2. Reference number: If applicable, include any reference number or account number mentioned in the validation letter received from the debt collector. This will help in identifying the specific debt they are referring to. 3. Request for validation: Clearly state that you are seeking verification of the debt that the debt collector has claimed you owe. Mention that this request is made in accordance with the Fair Debt Collection Practices Act (FD CPA). 4. Detailed information: Ask the debt collector to provide specific details regarding the debt, such as the original creditor's name, the amount owed, the date of the last payment made, and the date the debt was incurred. Request any supporting documentation or contracts related to the debt. 5. Dispute protection: Emphasize that you are exercising your rights under the FD CPA and that you demand the debt collector cease collection efforts until they have fully verified the debt. This ensures that you are protected against any potential violations of debt collection laws. 6. Deadline for response: Specify a reasonable deadline (typically 30 days) by which you expect the debt collector to provide the requested verification and documents. State that failure to provide such verification within the given time frame may result in further legal action. It is important to note that while this general framework applies to debt verification letters in Middlesex County, Massachusetts, the specific language and details may vary based on individual circumstances and the type of debt being disputed (e.g., credit card debt, medical bills, personal loans).

Middlesex Massachusetts is a county located in the state of Massachusetts, United States. It is one of the 14 counties in the state and is situated in the eastern part of Massachusetts. Middlesex County is known for its rich history, diverse population, and vibrant communities. In relation to debt collection, if you have received a validation letter from a debt collector regarding a debt in Middlesex County, Massachusetts, you have the right to request verification of the debt. This letter serves as a response to the debt collector's validation letter and seeks to obtain information that proves the validity of the debt they are attempting to collect. When drafting a letter to a debt collector seeking verification of a debt, it's important to include specific information such as: 1. Your contact details: Provide your full name, address, and phone number clearly at the beginning of the letter. 2. Reference number: If applicable, include any reference number or account number mentioned in the validation letter received from the debt collector. This will help in identifying the specific debt they are referring to. 3. Request for validation: Clearly state that you are seeking verification of the debt that the debt collector has claimed you owe. Mention that this request is made in accordance with the Fair Debt Collection Practices Act (FD CPA). 4. Detailed information: Ask the debt collector to provide specific details regarding the debt, such as the original creditor's name, the amount owed, the date of the last payment made, and the date the debt was incurred. Request any supporting documentation or contracts related to the debt. 5. Dispute protection: Emphasize that you are exercising your rights under the FD CPA and that you demand the debt collector cease collection efforts until they have fully verified the debt. This ensures that you are protected against any potential violations of debt collection laws. 6. Deadline for response: Specify a reasonable deadline (typically 30 days) by which you expect the debt collector to provide the requested verification and documents. State that failure to provide such verification within the given time frame may result in further legal action. It is important to note that while this general framework applies to debt verification letters in Middlesex County, Massachusetts, the specific language and details may vary based on individual circumstances and the type of debt being disputed (e.g., credit card debt, medical bills, personal loans).