Kings New York Payout Agreement refers to a legal contractual arrangement between two parties, wherein one party (the payer) agrees to make a designated payment to the other party (the payee) in accordance with specific terms and conditions. This agreement is typically associated with financial settlements, compensation packages, or structured payout plans. The Kings New York Payout Agreement can encompass various forms, tailored to the specific needs and preferences of the involved parties. Here are some common types: 1. Personal Injury Payout Agreement: This type of agreement is frequently used in personal injury cases, where an injured individual agrees to receive compensation from another party (such as the responsible party's insurance company) in scheduled payouts instead of a lump sum. 2. Lottery Payout Agreement: When a lottery winner chooses to receive their winnings over a specified period rather than a one-time lump sum, they enter into a Kings New York Payout Agreement. This arrangement ensures regular payouts, providing financial stability over time. 3. Structured Settlement Payout Agreement: In certain legal cases (like medical malpractice or wrongful death), a Kings New York Payout Agreement may be reached between the plaintiff and defendant. It outlines periodic payments to the victim or their beneficiary, serving as a financial safety net. 4. Employment Settlement Payout Agreement: When individuals reach a settlement in an employment dispute (such as wrongful termination or discrimination), a Kings New York Payout Agreement might be established. It regulates the terms of payment, ensuring the agreed-upon compensation is disbursed over an agreed timeline. 5. Mortgage Payout Agreement: In real estate transactions, the Kings New York Payout Agreement might be used to specify how the seller will receive the payment. It might include provisions for installment payments or delayed payouts, allowing flexibility in financial arrangements. Overall, Kings New York Payout Agreements offer a structured approach to financial transactions by defining payment terms, schedules, and amounts. These agreements provide security and peace of mind for both parties involved, ensuring that obligations are met consistently and fairly over time.

Kings New York Payout Agreement

Description

How to fill out Kings New York Payout Agreement?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Kings Payout Agreement, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the recent version of the Kings Payout Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Kings Payout Agreement:

- Glance through the page and verify there is a sample for your region.

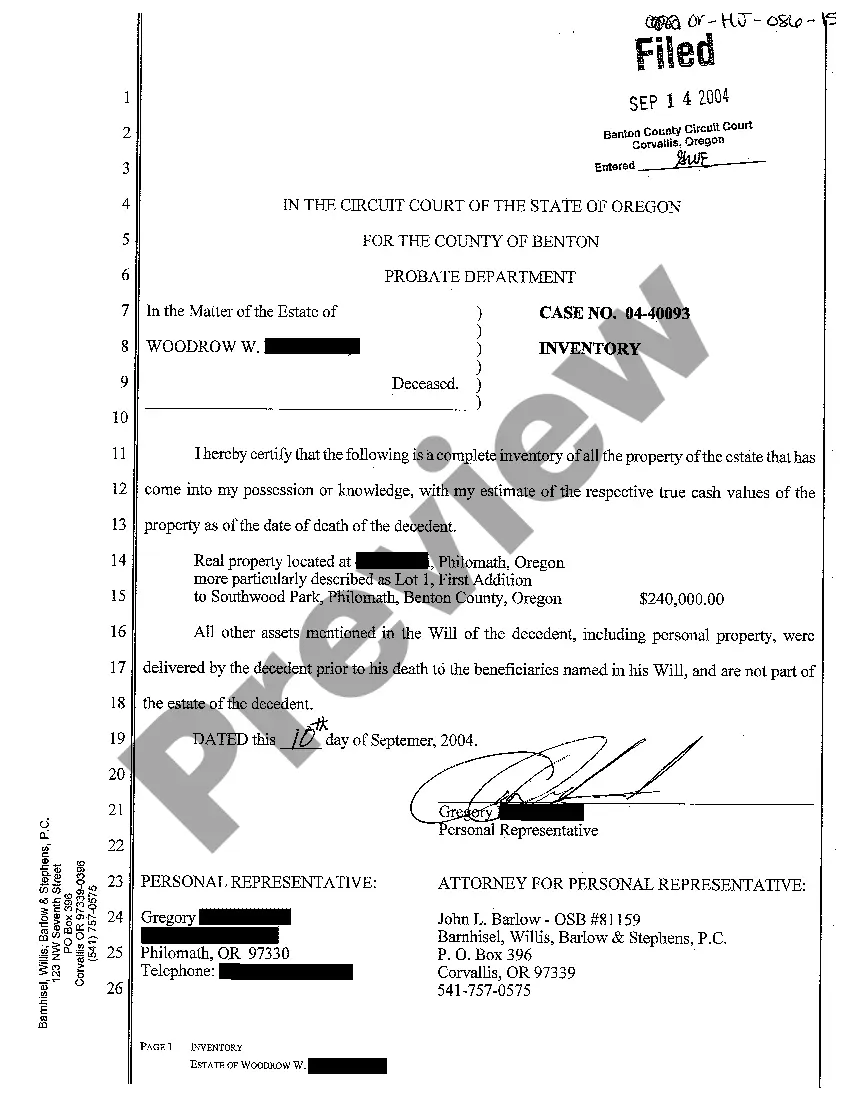

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Kings Payout Agreement and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!