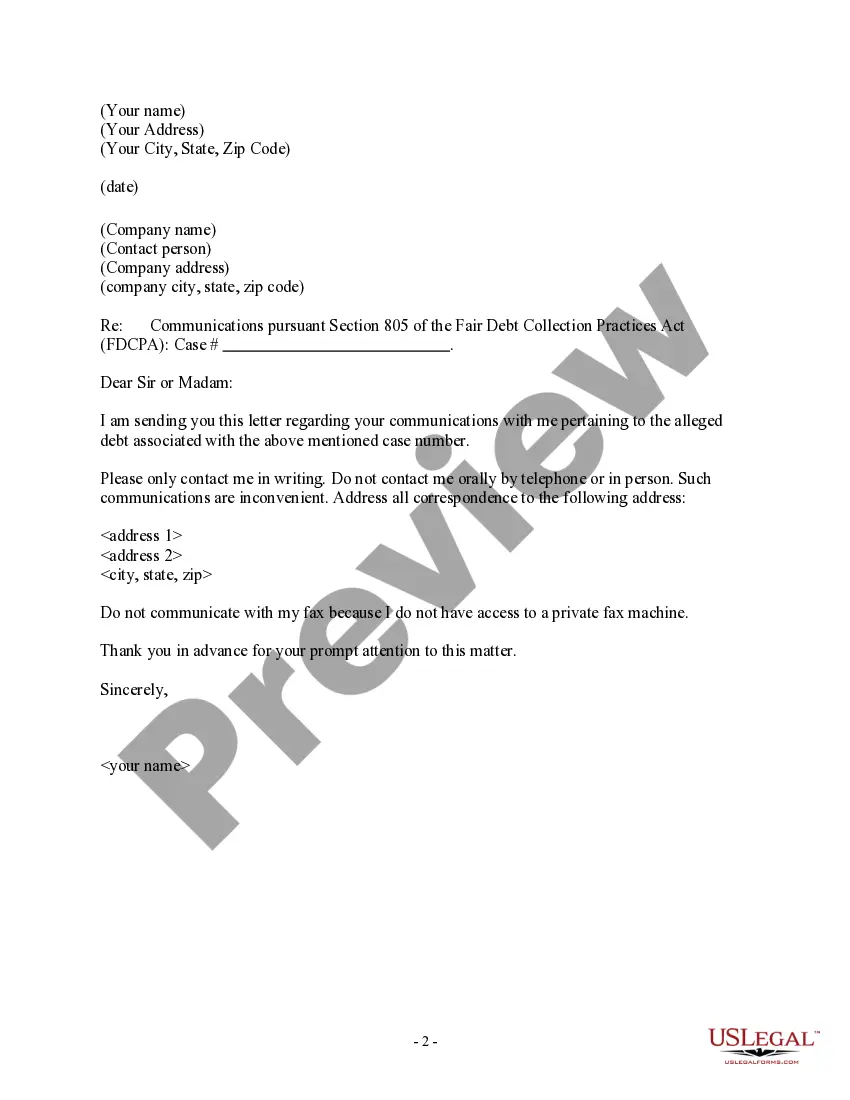

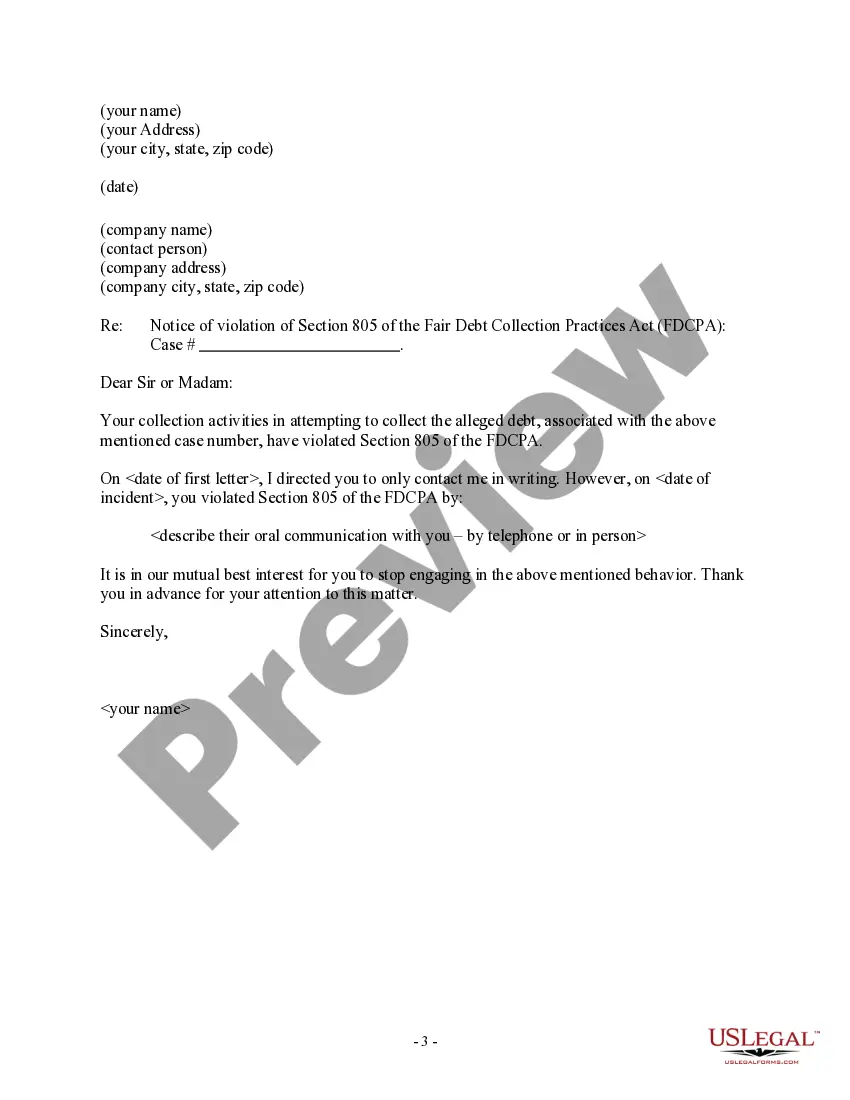

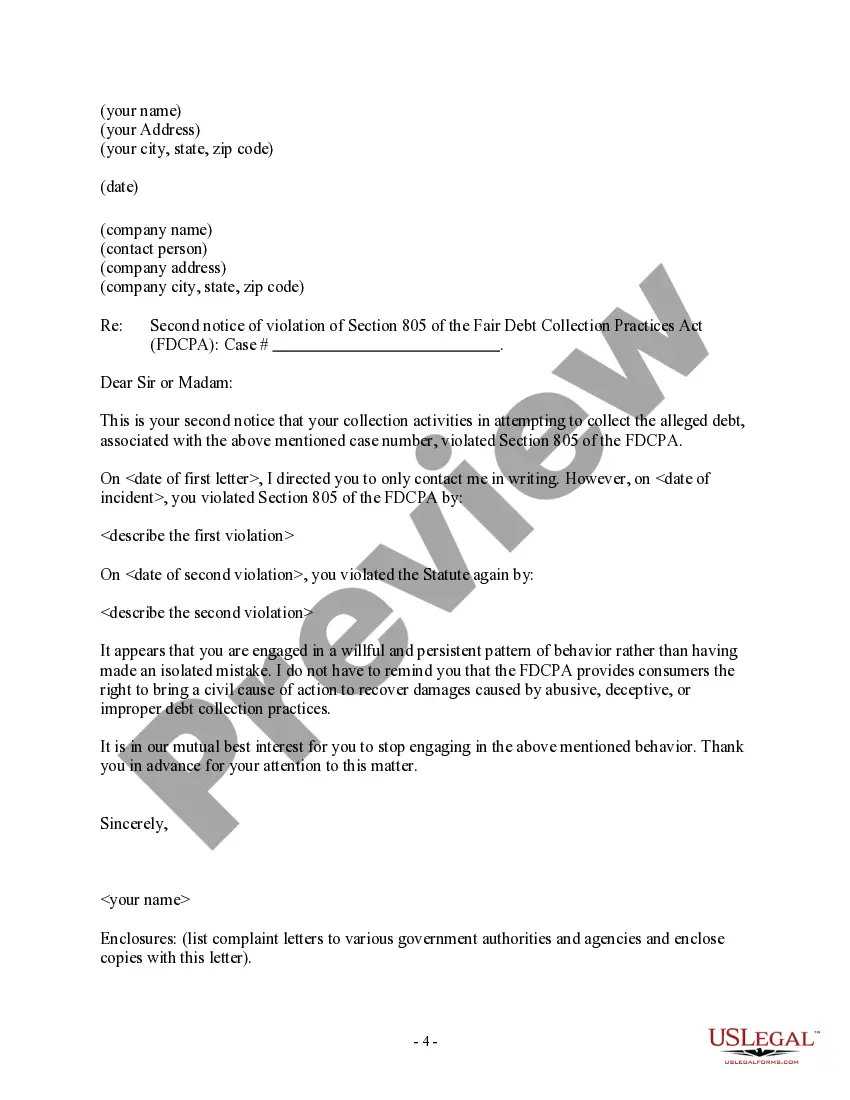

Miami-Dade, Florida — A Detailed Description Miami-Dade, Florida is a vibrant and bustling county located in the southeastern part of the state. It is home to Miami, one of the most popular tourist destinations in the world, known for its beautiful beaches, vibrant nightlife, and diverse cultural scene. As a resident of Miami-Dade, you may come across situations where you need to communicate with debt collectors. In such cases, it is important to understand your rights as a consumer and take necessary steps to protect yourself. One such step is to send a "Letter to Debt Collector — Only Contact Me In Writing" to ensure clear and documented communication. This type of letter serves as a request to debt collectors stating that they can only contact you through written correspondence and should refrain from contacting you via phone calls or other means. By doing so, you can have better control over the communication process, have a record of all correspondence, and avoid any potential harassment or misleading information. There are different variations of Miami-Dade, Florida "Letter to Debt Collector — Only Contact Me In Writing" that can be tailored to specific situations. Some of these variations may include: 1. General Request: This type of letter can be used when you want to establish a preference for written communication with debt collectors in general, without specifying any particular debts. 2. Debt-Specific Request: If you have multiple debts or accounts being pursued by different collectors, you may opt to send separate letters for each debt, specifying the creditor or collector's name, account number, and the exact amount owed. 3. Cease and Desist: In some cases, you may want to go beyond a simple request for written communication and require the debt collector to stop any further contact altogether. This type of letter is known as a "Cease and Desist" letter. Remember to include essential information in your letter, such as your full name, address, and contact details. State clearly that you only wish to be contacted in writing and provide a valid mailing address for the debt collector to send any necessary correspondence. By sending a "Letter to Debt Collector — Only Contact Me In Writing," you can exercise your rights as a consumer and protect yourself from unwanted phone calls or potential violations of the Fair Debt Collection Practices Act (FD CPA). It is always advisable to consult with an attorney or seek legal advice before proceeding with any specific course of action regarding debt collection.

Miami-Dade Florida Letter to Debt Collector - Only Contact Me In Writing

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-DCPA-27

Format:

Word;

Rich Text

Instant download

Description

Use this form to require a debt collector to only contact you in writing.

Miami-Dade, Florida — A Detailed Description Miami-Dade, Florida is a vibrant and bustling county located in the southeastern part of the state. It is home to Miami, one of the most popular tourist destinations in the world, known for its beautiful beaches, vibrant nightlife, and diverse cultural scene. As a resident of Miami-Dade, you may come across situations where you need to communicate with debt collectors. In such cases, it is important to understand your rights as a consumer and take necessary steps to protect yourself. One such step is to send a "Letter to Debt Collector — Only Contact Me In Writing" to ensure clear and documented communication. This type of letter serves as a request to debt collectors stating that they can only contact you through written correspondence and should refrain from contacting you via phone calls or other means. By doing so, you can have better control over the communication process, have a record of all correspondence, and avoid any potential harassment or misleading information. There are different variations of Miami-Dade, Florida "Letter to Debt Collector — Only Contact Me In Writing" that can be tailored to specific situations. Some of these variations may include: 1. General Request: This type of letter can be used when you want to establish a preference for written communication with debt collectors in general, without specifying any particular debts. 2. Debt-Specific Request: If you have multiple debts or accounts being pursued by different collectors, you may opt to send separate letters for each debt, specifying the creditor or collector's name, account number, and the exact amount owed. 3. Cease and Desist: In some cases, you may want to go beyond a simple request for written communication and require the debt collector to stop any further contact altogether. This type of letter is known as a "Cease and Desist" letter. Remember to include essential information in your letter, such as your full name, address, and contact details. State clearly that you only wish to be contacted in writing and provide a valid mailing address for the debt collector to send any necessary correspondence. By sending a "Letter to Debt Collector — Only Contact Me In Writing," you can exercise your rights as a consumer and protect yourself from unwanted phone calls or potential violations of the Fair Debt Collection Practices Act (FD CPA). It is always advisable to consult with an attorney or seek legal advice before proceeding with any specific course of action regarding debt collection.

Free preview