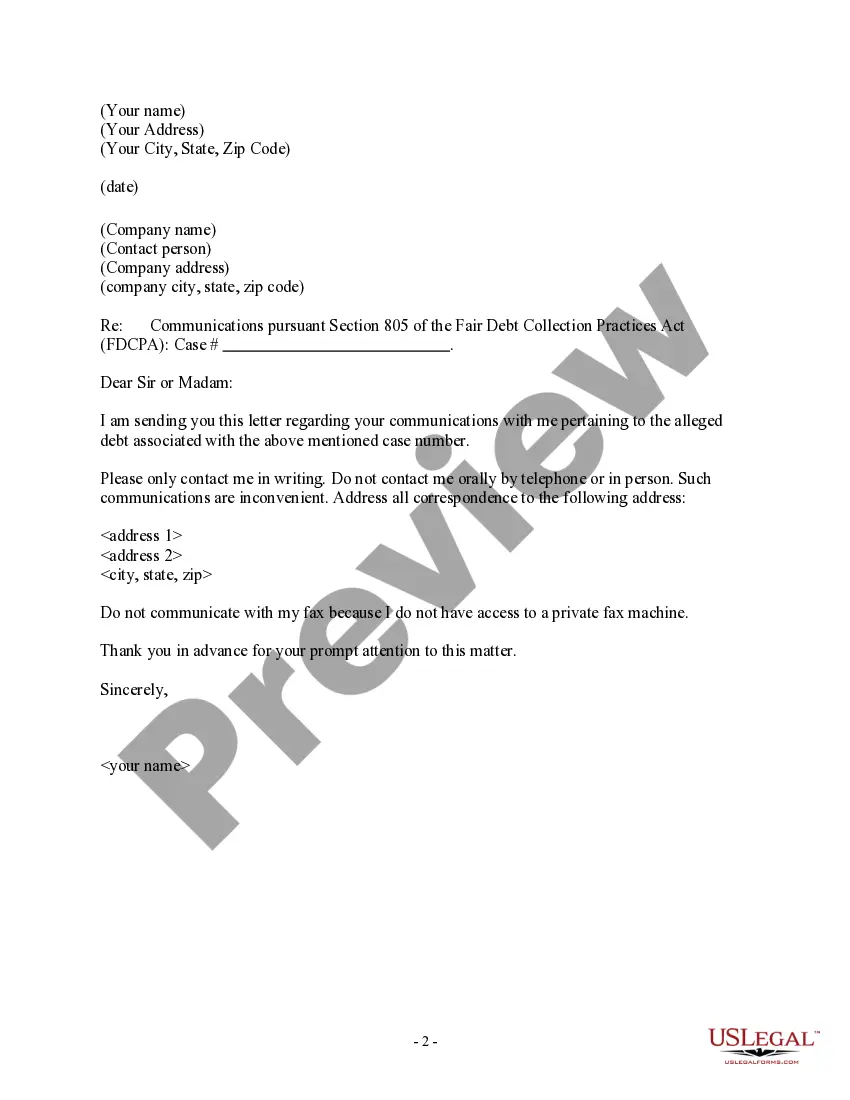

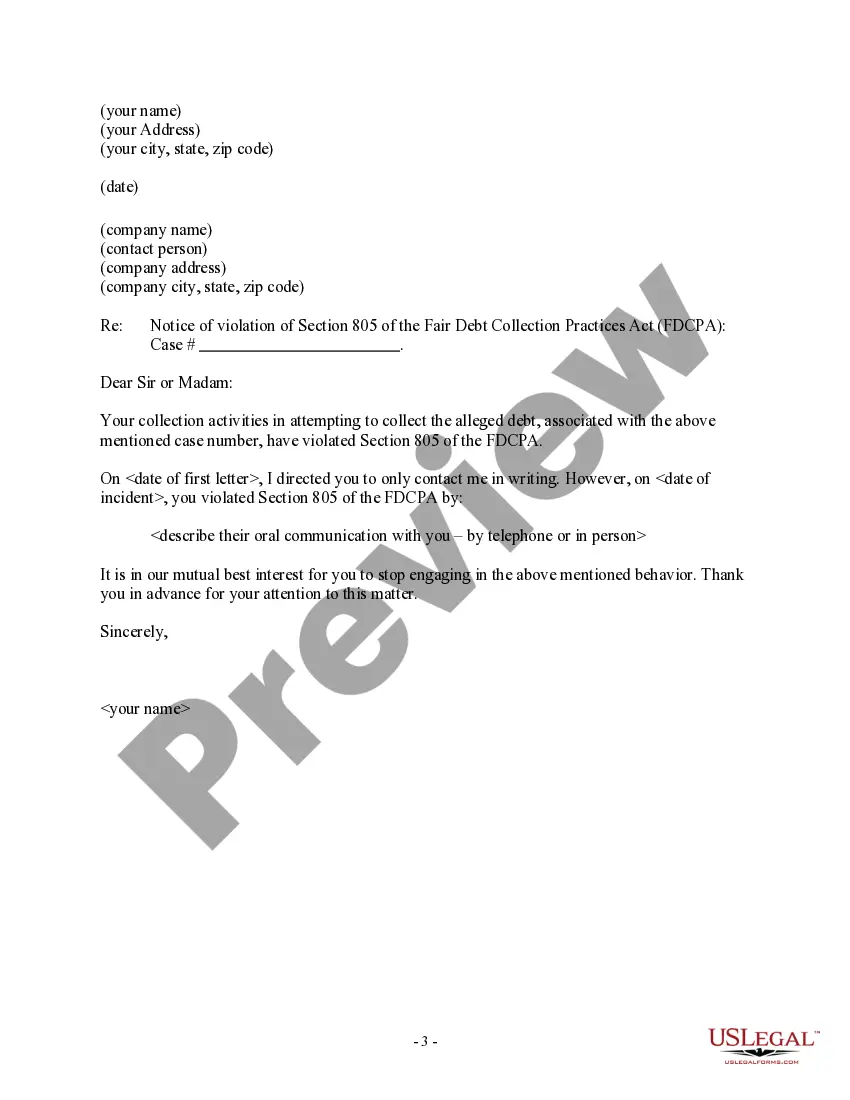

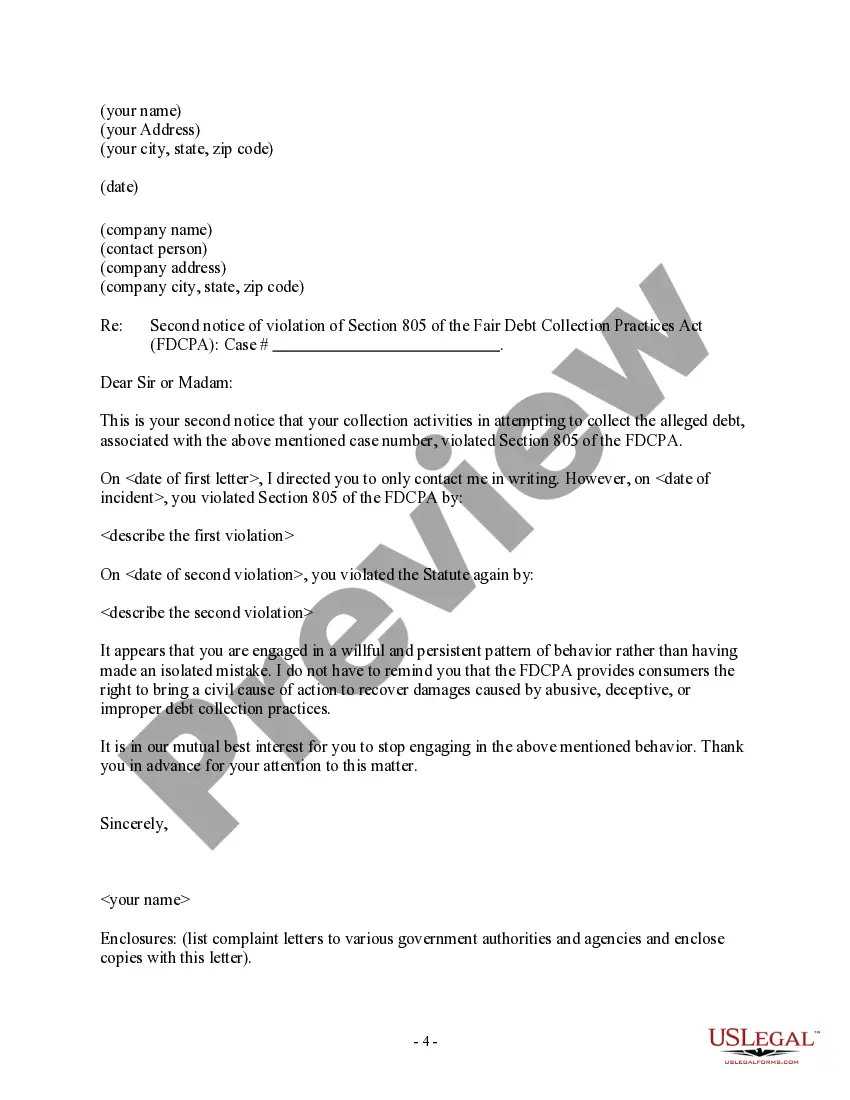

San Antonio Texas Letter to Debt Collector — Only Contact Me In Writing As a resident of San Antonio, Texas, it is important to understand your rights when dealing with debt collectors. In this detailed description, we will discuss the purpose and guidelines of a San Antonio Texas Letter to Debt Collector, emphasizing the importance of requesting written communications only. This letter serves as a valuable tool to protect yourself from aggressive or harassing communication tactics by debt collectors. In San Antonio, as in the rest of the United States, debt collectors are regulated by the Fair Debt Collection Practices Act (FD CPA). This legislation aims to promote fair, ethical, and respectful practices in debt collection. As a consumer, you have the right to control how and when a debt collector contacts you, and a San Antonio Texas Letter to Debt Collector — Only Contact Me In Writing can help you exercise this right. When writing this letter, it is crucial to include all the essential information. Start by addressing the debt collector by name and providing your own contact information, including your full legal name, current address, and phone number. Clearly state in the letter that you are invoking your rights under the FD CPA and the Texas Finance Code, specifically requesting that the debt collector communicates with you only in writing. By specifying this preference, you ensure that all future communication will be documented, allowing for easy reference and potential dispute resolution. It is advisable to include a warning that any further contact attempts through phone calls or other means will be considered a violation of the FD CPA and may result in legal action being taken against the debt collector. Additionally, highlight the importance of providing accurate and timely responses to your inquiries. Request that all correspondence includes detailed information about the debt, such as the original creditor, the amount owed, and any supporting documentation. This ensures transparency and allows you to review the validity of the debt and challenge any errors or discrepancies if necessary. Furthermore, it is essential to be aware of different variations of a San Antonio Texas Letter to Debt Collector — Only Contact Me In Writing. These may include: 1. San Antonio Texas Letter to Debt Collector — Cease and Desist: This letter takes the request for written communication a step further and requests the debt collector to completely cease all contact attempts, excluding essential legal notifications. 2. San Antonio Texas Letter to Debt Collector — Verification Request: This particular variation focuses on challenging the debt's validity and requests detailed verification from the debt collector. It asks for specific information regarding the debt to ensure accuracy and legitimacy. By utilizing a San Antonio Texas Letter to Debt Collector, you are asserting your legal rights and setting clear boundaries with debt collectors. By requesting written communication, you maintain control and ensure a transparent process while safeguarding yourself from potential harassment. Remember, it is always advisable to consult with a legal professional or credit counseling agency to understand specific regulations and laws applicable to San Antonio, Texas, when dealing with debt collectors.

San Antonio Texas Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out San Antonio Texas Letter To Debt Collector - Only Contact Me In Writing?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from the ground up, including San Antonio Letter to Debt Collector - Only Contact Me In Writing, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how you can locate and download San Antonio Letter to Debt Collector - Only Contact Me In Writing.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Check the related document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy San Antonio Letter to Debt Collector - Only Contact Me In Writing.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Antonio Letter to Debt Collector - Only Contact Me In Writing, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you have to deal with an exceptionally complicated case, we recommend getting a lawyer to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

The Texas Debt Collection Act also sets a statute of limitations for collecting debts. In Texas, debt collectors only have four years to collect a debt, and that limited timeframe means that debt collectors cannot pursue legal action against a debtor if a debt is more than four years old.

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Debt cases filed in a Texas JP/Justice Court have a deadline of 14 days after the summons is served. If you were served with a summons, but do not file an answer before the deadline, the judge will issue a default judgment against you.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

If you get a summons notifying you that a debt collector is suing you, do not ignore itif you do, the collector may be able to get a default judgment against you (that is, the court enters judgment in the collector's favor because you didn't respond to defend yourself).

If you ignore the letters there is a chance the debt collector won't go to court. This probably depends on how certain the debt collector is that you are the debtor. But in many cases they will go to court if you don't respond to them.