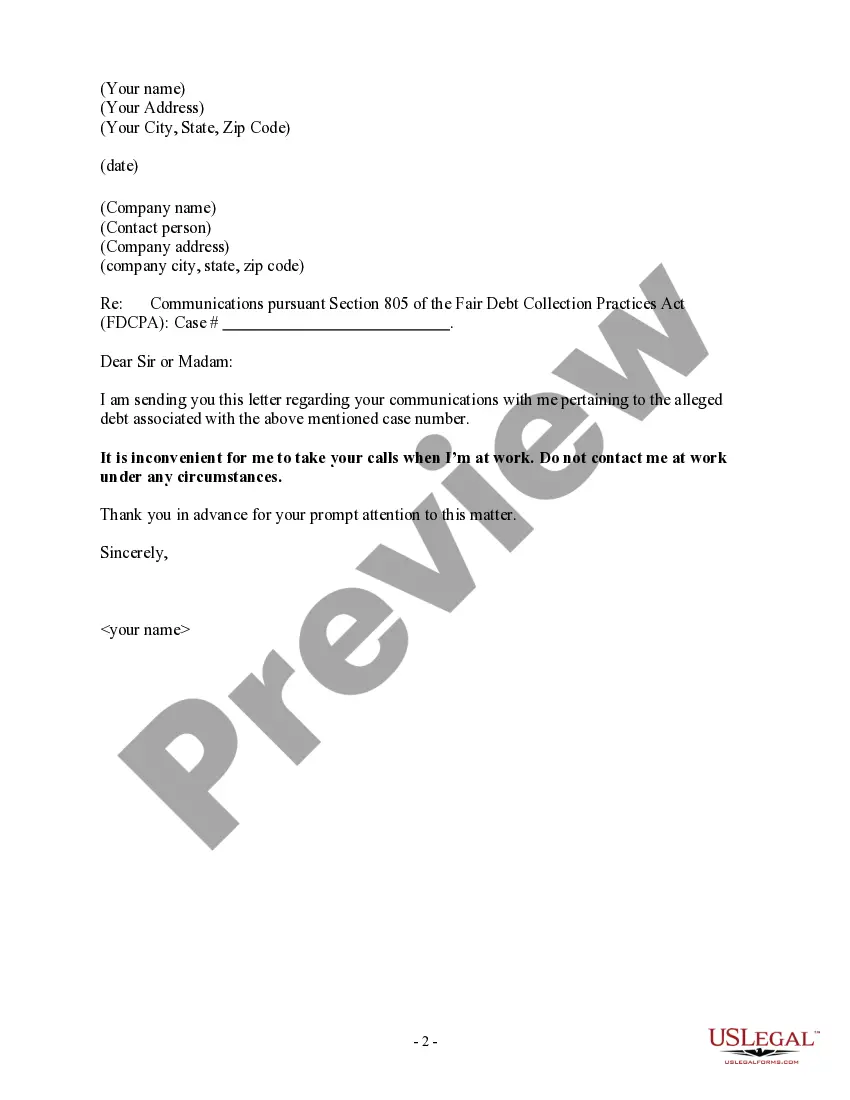

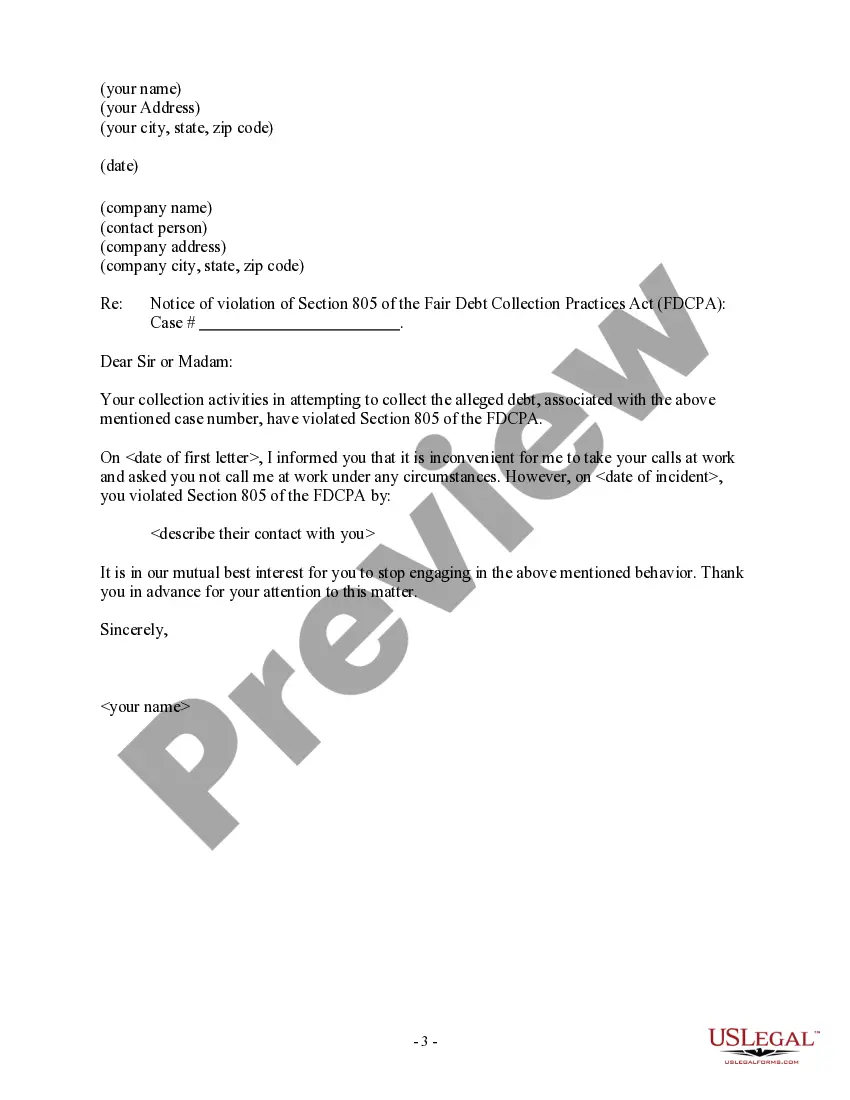

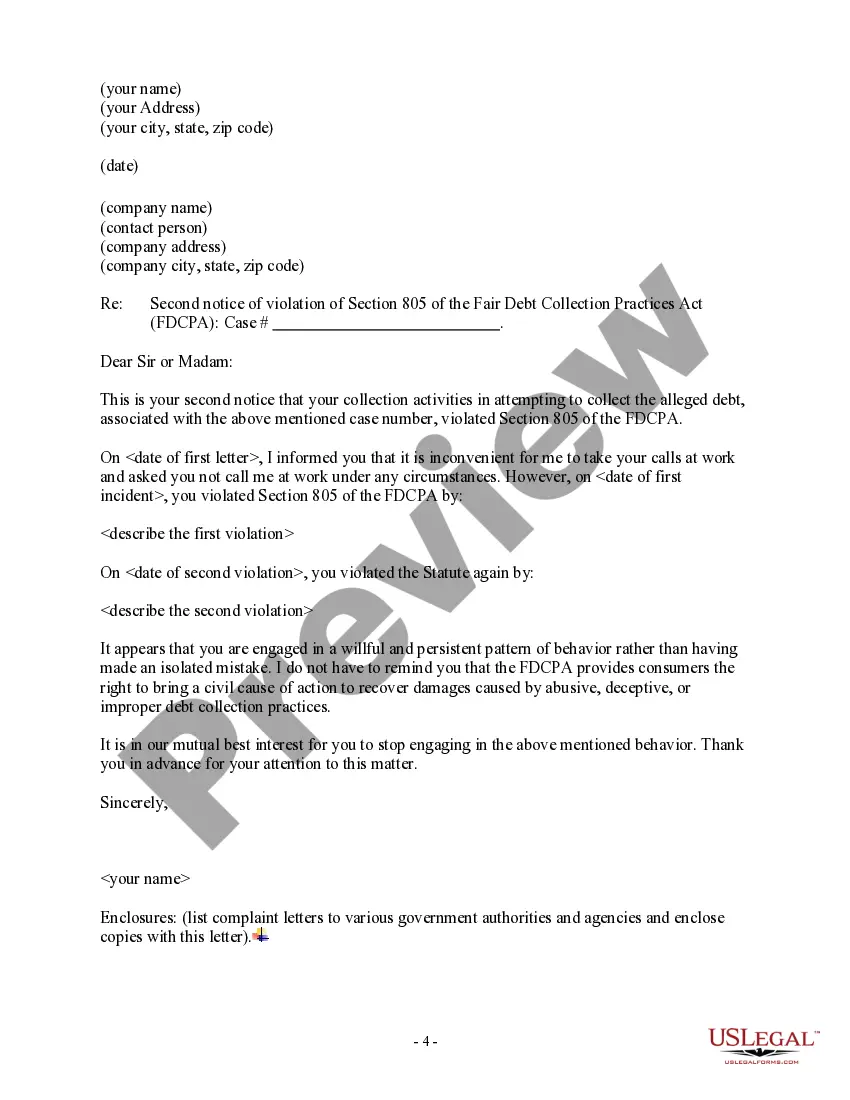

Collin Texas Notice of Violation of Fair Debt Act — Improper Contact at Work is a legal document that addresses instances where an individual's rights under the Fair Debt Collection Practices Act (FD CPA) have been violated by debt collectors. This violation specifically focuses on improper contact made by debt collectors to the individual's workplace. The FD CPA is a federal law that aims to protect consumers from unfair, deceptive, and abusive debt collection practices. This law outlines various guidelines that debt collectors must follow when attempting to collect debts from individuals. In the case of improper contact at work, debt collectors are prohibited from contacting individuals at their places of employment if they have reason to believe that the employer prohibits such communication or if the individual has informed them in writing that they are unable or unwilling to receive calls at work. Collin Texas Notice of Violation of Fair Debt Act — Improper Contact at Work serves as a formal notice to debt collectors informing them of their violation of the FD CPA and demanding that they cease all improper contact at the individual's workplace. It is important to follow the proper legal procedures to address these types of violations. Some types of Collin Texas Notice of Violation of Fair Debt Act — Improper Contact at Work may include: 1. Initial Notice: This is the first notice sent to the debt collector, informing them of the violation and demanding an immediate cease of all improper contact at the workplace. It may also mention potential legal action if the violation persists. 2. Follow-up Notice: If the debt collector continues to make improper contact after receiving the initial notice, a follow-up notice can be sent to escalate the issue. This notice may include additional details of the violations and reiterate the demand for immediate cessation of contact. 3. Notice of Intent to Sue: In some cases, if the debt collector does not respond or continues to violate the FD CPA even after receiving previous notices, a Notice of Intent to Sue can be sent. This notice informs the debt collector that legal action will be taken if the violation persists. It is important to consult with a legal professional experienced in debt collection laws to ensure that proper procedures are followed and to seek appropriate remedies for the violation.

Collin Texas Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Collin Texas Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Collin Notice of Violation of Fair Debt Act - Improper Contact at Work is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Collin Notice of Violation of Fair Debt Act - Improper Contact at Work. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Notice of Violation of Fair Debt Act - Improper Contact at Work in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!