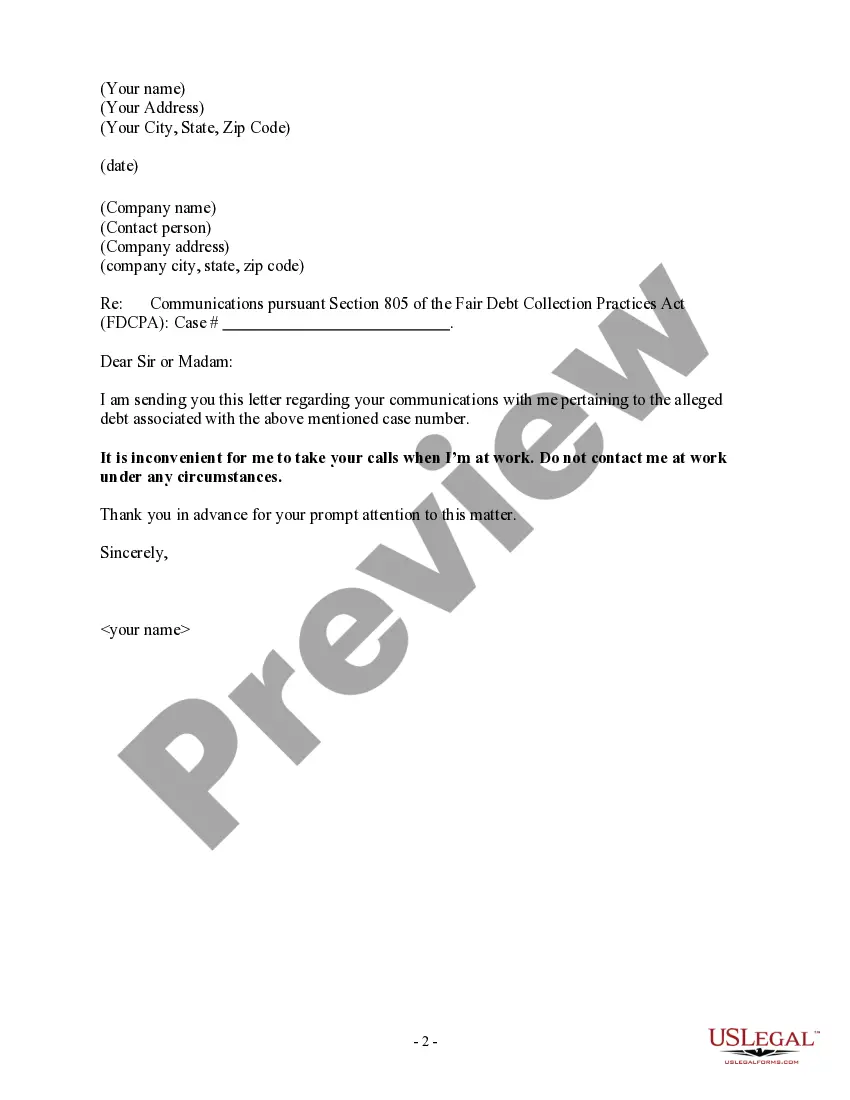

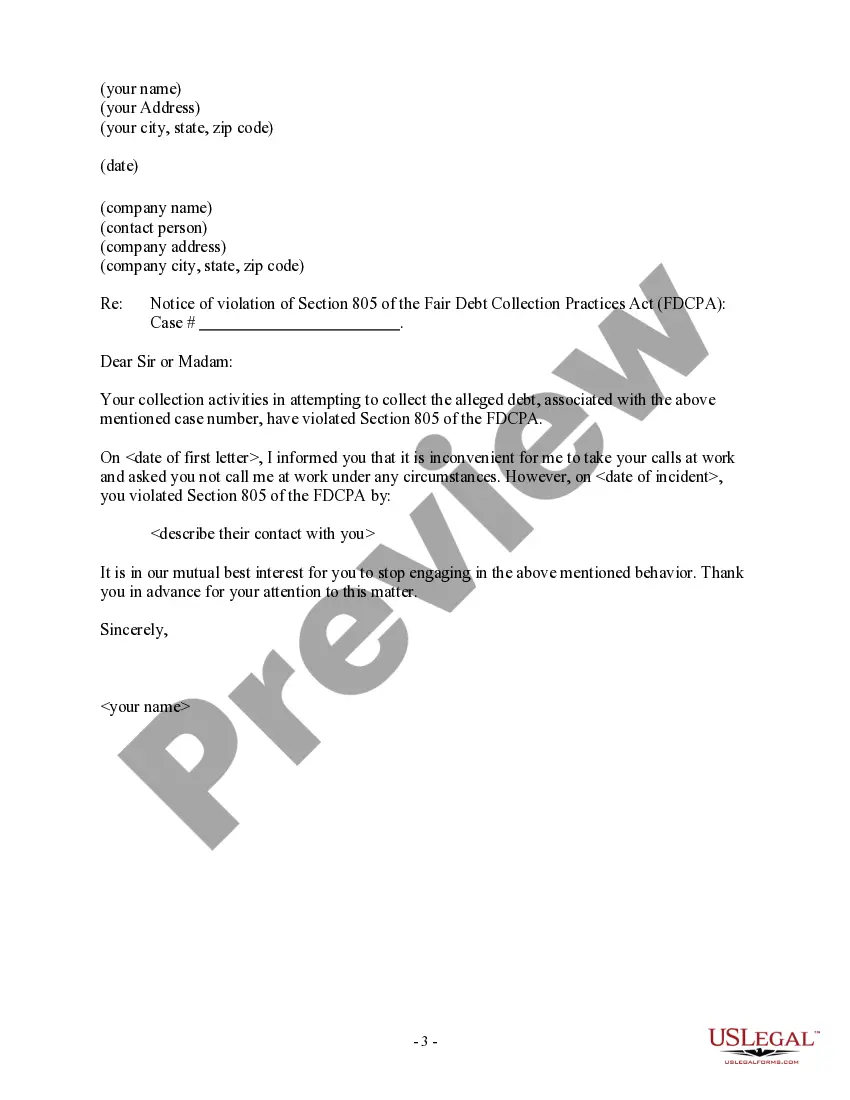

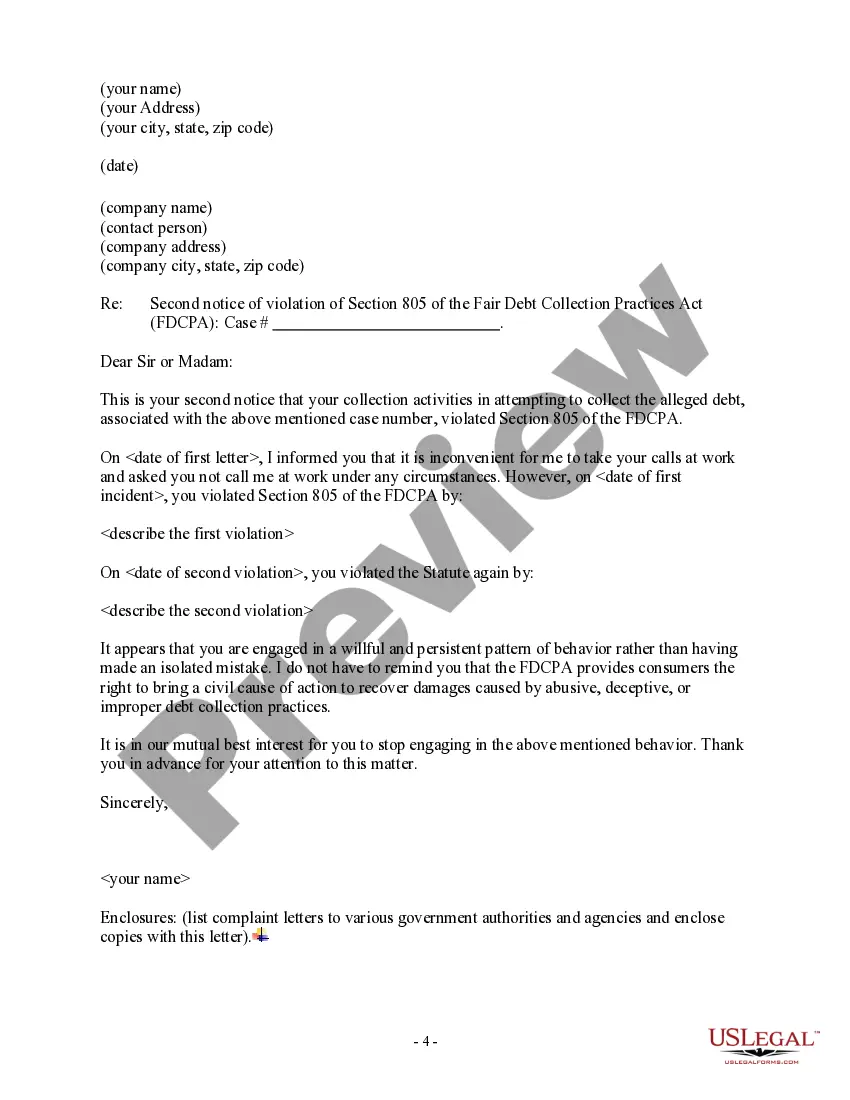

Harris Texas Notice of Violation of Fair Debt Act — Improper Contact at Work is a legal document issued to individuals or debt collectors who have violated the Fair Debt Collection Practices Act (FD CPA) by engaging in improper contact at the workplace. This notice serves as a formal warning and seeks to address the violation while protecting the rights of the consumer. In cases where a debt collector has made contact with the debtor at their place of employment, it is important to understand that the FD CPA establishes specific guidelines to ensure fair treatment and protect individuals from abusive or harassing practices. The Act clearly prohibits debt collectors from contacting a debtor at their workplace if they are aware that such communication is prohibited by the debtor's employer. The Harris Texas Notice of Violation of Fair Debt Act — Improper Contact at Work can be issued in several situations. Some different types of violations that may prompt the issuance of this notice include: 1. Repeated or excessive contact: Debt collectors must adhere to certain limitations regarding the number and timing of contacts they make with a debtor. If a debt collector has consistently contacted the debtor at their workplace, disregarding the Fair Debt Collection Practices Act limitations, a Harris Texas Notice of Violation can be issued. 2. Contacting the debtor's employer without permission: A debt collector is prohibited from disclosing any details about a consumer's debt to third parties, including the debtor's employer. If a debt collector contacts the employer to discuss the outstanding debt without the debtor's explicit permission, it constitutes a violation. 3. Inappropriate or abusive language: Debt collectors are obligated to maintain a professional tone during communication and should avoid using any abusive, threatening, or offensive language. If a debt collector is found to have used inappropriate language during contact with the debtor at their workplace, a violation has occurred. 4. Disclosure of debt details to colleagues: When contacting a debtor at their workplace, debt collectors must exercise caution to ensure confidentiality. If a debt collector discusses the consumer's debt details with their colleagues or any other third party, it is deemed a violation of the FD CPA. Receiving a Harris Texas Notice of Violation of Fair Debt Act — Improper Contact at Work serves as a formal warning to debt collectors that their actions have violated the FD CPA and may result in legal repercussions. It is essential for both debt collectors and debtors to be aware of their rights and responsibilities under the FD CPA to ensure fair debt collection practices and maintain a respectful relationship during the collection process.

Harris Texas Notice of Violation of Fair Debt Act — Improper Contact at Work is a legal document issued to individuals or debt collectors who have violated the Fair Debt Collection Practices Act (FD CPA) by engaging in improper contact at the workplace. This notice serves as a formal warning and seeks to address the violation while protecting the rights of the consumer. In cases where a debt collector has made contact with the debtor at their place of employment, it is important to understand that the FD CPA establishes specific guidelines to ensure fair treatment and protect individuals from abusive or harassing practices. The Act clearly prohibits debt collectors from contacting a debtor at their workplace if they are aware that such communication is prohibited by the debtor's employer. The Harris Texas Notice of Violation of Fair Debt Act — Improper Contact at Work can be issued in several situations. Some different types of violations that may prompt the issuance of this notice include: 1. Repeated or excessive contact: Debt collectors must adhere to certain limitations regarding the number and timing of contacts they make with a debtor. If a debt collector has consistently contacted the debtor at their workplace, disregarding the Fair Debt Collection Practices Act limitations, a Harris Texas Notice of Violation can be issued. 2. Contacting the debtor's employer without permission: A debt collector is prohibited from disclosing any details about a consumer's debt to third parties, including the debtor's employer. If a debt collector contacts the employer to discuss the outstanding debt without the debtor's explicit permission, it constitutes a violation. 3. Inappropriate or abusive language: Debt collectors are obligated to maintain a professional tone during communication and should avoid using any abusive, threatening, or offensive language. If a debt collector is found to have used inappropriate language during contact with the debtor at their workplace, a violation has occurred. 4. Disclosure of debt details to colleagues: When contacting a debtor at their workplace, debt collectors must exercise caution to ensure confidentiality. If a debt collector discusses the consumer's debt details with their colleagues or any other third party, it is deemed a violation of the FD CPA. Receiving a Harris Texas Notice of Violation of Fair Debt Act — Improper Contact at Work serves as a formal warning to debt collectors that their actions have violated the FD CPA and may result in legal repercussions. It is essential for both debt collectors and debtors to be aware of their rights and responsibilities under the FD CPA to ensure fair debt collection practices and maintain a respectful relationship during the collection process.