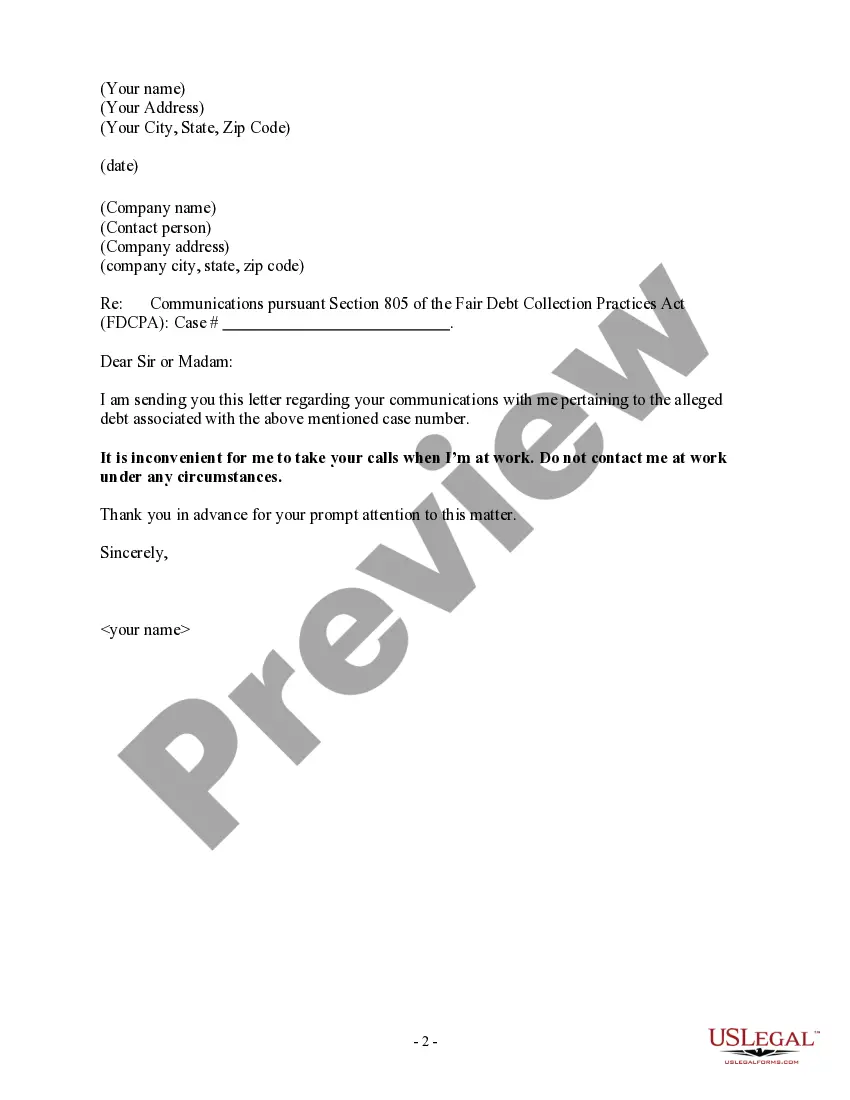

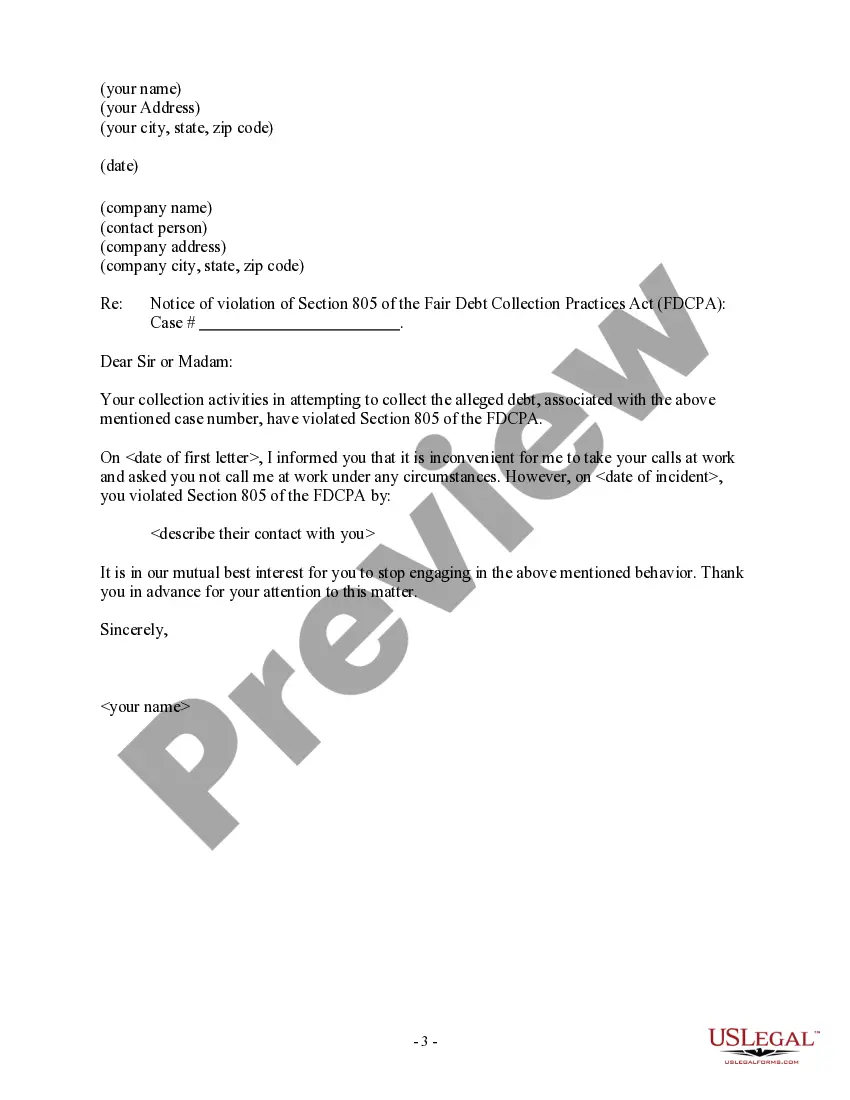

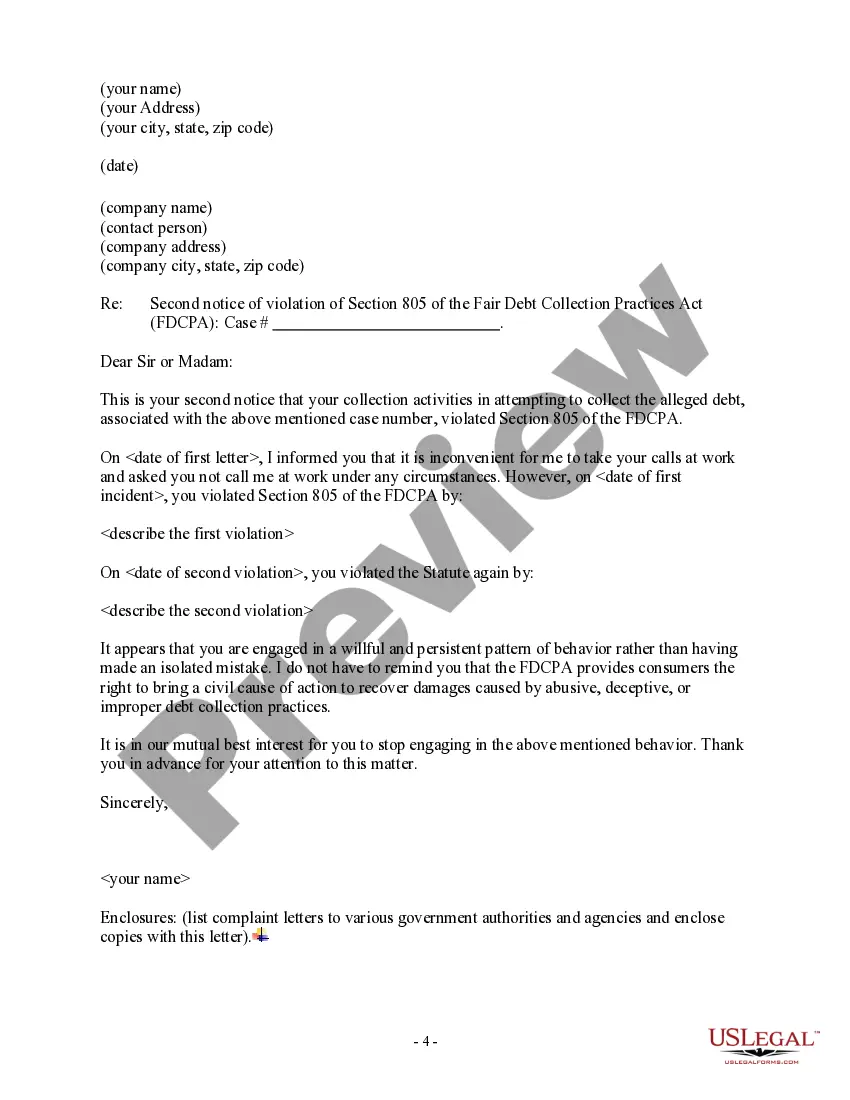

Phoenix Arizona Notice of Violation of Fair Debt Act — Improper Contact at Work is a legal document that serves as a notification to an individual in Phoenix, Arizona when a debt collector has violated the Fair Debt Act by making improper contact at their workplace. This violation occurs when a debt collector contacts an individual at their place of work, either by phone or in person, in an inappropriate or harassing manner. The purpose of this notice is to inform the debtor of their rights and to bring the debt collector's wrongful behavior to their attention. It aims to make the debtor aware that they are protected by the Fair Debt Act and that they have the right to take legal action against the debt collector for their improper contact. There are various types of Phoenix Arizona Notice of Violation of Fair Debt Act — Improper Contact at Work, depending on the specific circumstances of the violation. Some common types may include: 1. Harassing Phone Calls: This notice is used when the debt collector repeatedly calls the individual's workplace, causing undue stress and harassment. 2. In-Person Visits: This notice is applicable when a debt collector visits an individual's workplace without their consent or after being explicitly instructed not to do so. 3. Disclosure of Debt: This notice is used when the debt collector reveals private debt-related information to the individual's coworkers, superiors, or other unauthorized parties while contacting them at work. 4. Threats or Intimidation: This notice is relevant when a debt collector uses aggressive language, threats, or intimidation tactics while communicating with the individual at their place of work. 5. Continuous Disruptions: This notice is applicable when a debt collector frequently contacts an individual at their workplace, disrupting their ability to perform their job duties or causing distress. It is important for individuals who receive a Phoenix Arizona Notice of Violation of Fair Debt Act — Improper Contact at Work to seek legal advice promptly. They should gather any evidence of the improper contact and consult with an attorney experienced in consumer protection laws to understand their rights and potential course of action. Taking legal action against the debt collector may result in the debt collector being held accountable for their actions, facing penalties, and potentially ceasing future improper contact at the individual's workplace.

Phoenix Arizona Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Phoenix Arizona Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Phoenix Notice of Violation of Fair Debt Act - Improper Contact at Work, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Phoenix Notice of Violation of Fair Debt Act - Improper Contact at Work from the My Forms tab.

For new users, it's necessary to make some more steps to get the Phoenix Notice of Violation of Fair Debt Act - Improper Contact at Work:

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Debt collectors cannot call you at unusual or inconvenient times or places. Generally, they may call between 8 a.m. and 9 p.m., but you may ask them to call at other times if those hours are inconvenient for you.

Harassment and Call Restrictions Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

Debt collectors are allowed to contact your family, friends, neighbours, employer(s), and the like, but only to attempt to get your phone number and address, or to confirm your employment. In doing so, they cannot discuss your debt with these people, and once they've made contact, they cannot call them again.

Fortunately, there are legal actions you can take to stop this harassment: Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

If a creditor waits too long to take court action, the debt will become 'unenforceable' or statute barred. This means the debt still exists but the law (statute) can be used to prevent (bar) the creditor from getting a court judgment or order to recover it.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

Debt collectors are only allowed to contact debtors within reasonable hours. According to the Debt Collection Guideline, phone calls to debtors are allowed from Monday through Friday, between in the morning and up until 9 in the evening.

The definition of debt collector harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment also could come in the form of emails, texts, social media, direct mail or talking to friends or neighbors about your debt.

Top 7 Debt Collector Scare Tactics Excessive Amount of Calls.Threatening Wage Garnishment.Stating You Have a Deadline.Collecting Old Debts.Pushing You to Pay Your Debt to ?Improve Your Credit Score?Stating They ?Do Not Need to Prove Your Debt Exists?Sharing Your Debt With Family and Friends.

Put simply ? yes, if you owe money, collection agencies are allowed to call you at work. There are two primary reasons why a collection agency might contact your workplace or employer. Firstly, they may want to frighten or intimidate you.